Posts Tagged ‘SEPA Payments’

EPC November Release 2023

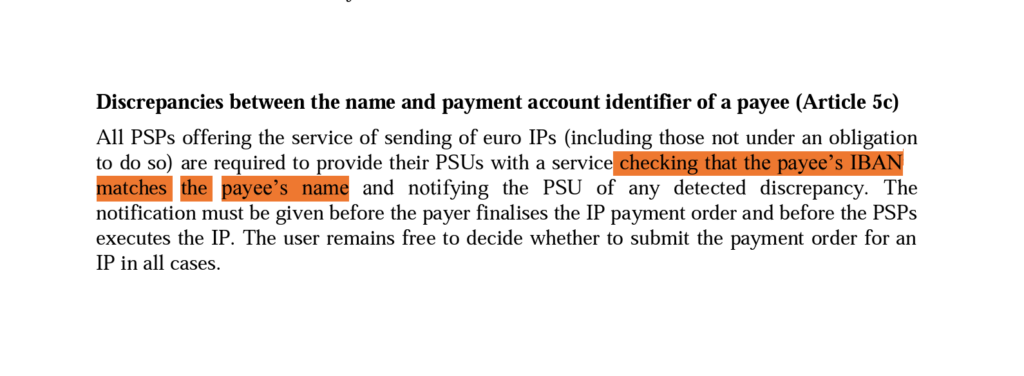

SEPA Name check

Anyone making a credit transfer (or direct debit) in the SEPA area enters the name of the recipient (or payer), but this is not matched by the bank. Simple transposed numbers are effectively prevented by the IBAN check digit. However, if fraudsters send a forged invoice to a victim, for example, the recipient’s name cannot…

Read MorePayment transaction statistics

“You can prove anything with statistics, even the opposite” is a quote from James Callaghan. There are also countless statistics in the field of “payment” and very few of them are actually helpful. The players in the industry like to “prove” their own (often supposed) market leadership or consulting companies publish international studies to prove…

Read MoreSEPA Request to Pay – Quo vadis?

The EPC Scheme Rulebook for SEPA Request to Pay (SRTP) has been available since June 2020 after many years of discussion in advance. There is now a second edition and the interbank infrastructure for processing is also in operation. The topic is much discussed because companies and retailers hope for lower fees in payment transactions…

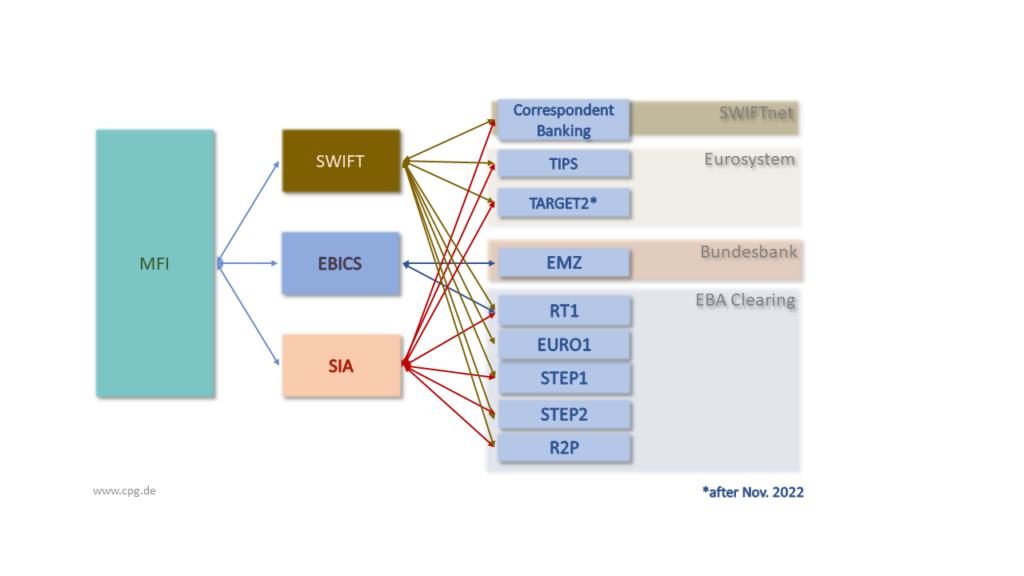

Read MoreTARGET2 SEPA SWIFT payments system

A modern payments system software for banks must be able to deal with many different internal and external systems. Both the regulation and the market requirements are becoming increasingly dynamic, so that flexibility is becoming more important. This article explains the most important functions and tasks for a “TARGET2 SEPA SWIFT payments system”. TARGET2 SEPA…

Read MoreSEPA TARGET SWIFT Software – how is the interaction?

A “SEPA TARGET SWIFT software” handles transactions in interbank payments. Anyone who is not active in this field usually only has a rough idea of what the words mean. This article gives a simplified overview. SEPA A good deal of misunderstanding is created by the fuzzy use of terms. This happens frequently with “SEPA” in…

Read MoreRequest to Pay MOTO

Request to Pay MOTO As already mentioned, R2P is not a payment method, but just a request. It needs to be combined with a SEPA payment. All possible combinations are very well suited for distance trading, so-called “MoTo Transactions” (Mail Order Telephone Order; also called “card not present” transactions in the credit card world). The…

Read MoreRequest to Pay Basics

Request to Pay: who is behind it? In June 2020, the European Payments Council published the so-called Rulebook for Request-to-Pay (SEPA RTP Scheme Rulebook 2020), thereby laying the foundations for Request to Pay. The European Union, together with the SEPA banks, wants to expand the Eurosystem (TARGET Services) to include a variant in payment transactions.…

Read MoreSEPA vs TARGET2: How are they related?

Anyone interested in payment transactions in the European Union will quickly come across the terms SEPA vs TARGET2. The relationships are explained here. SEPA vs TARGET2: Single European Payment Area (SEPA) SEPA primarily describes a legal framework for the uniform handling of euro payments, even across national borders. This uniform approach strengthens the entire economic…

Read MoreSEPA Payments: Hurdles & Solutions for Banks

The SEPA payments transactions in Germany are processed via the market infrastructure of the Deutsche Bundesbank (BBk). If banks strive to participate in SEPA, it is important to know this infrastructure very well in order not to suffer any cost disadvantages. Previous knowledge of clearing systems from “non-SEPA” payment transactions is often more of a…

Read More