An article by

Andreas Wegmann

Published on

27/12/2021

Updated on

01/11/2023

Reading time

3 min

Table of content

A “SEPA TARGET SWIFT software” handles transactions in interbank payments. Anyone who is not active in this field usually only has a rough idea of what the words mean. This article gives a simplified overview.

SEPA

A good deal of misunderstanding is created by the fuzzy use of terms. This happens frequently with “SEPA” in particular. SEPA is initially a legal entity between several states. In payment transactions, this usually means clearing in the Eurosystem. There are different national solutions for domestic payments (see article “How consistent is SEPA?“).

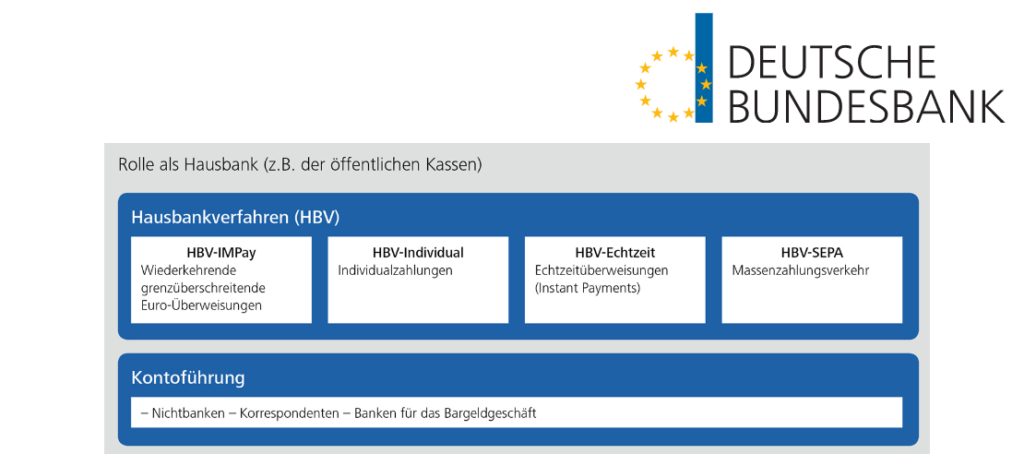

In Germany, the Bundesbanks offer their member banks the so-called “SEPA Clearer” (also “EMZ” for electronic mass payments) as a clearing service for their member banks. This service is often called “SEPA” for short in this country. The specialty is the accessibility via “EBICS”, a special communication standard for financial transactions. The bulk payment transactions are processed without priority in so-called bulk files, i.e. files with up to 100,000 individual transactions. Further information can be found in the article “EBICS SEPA: How does that work togehther?”.

TARGET

TARGET, or rather TARGET2, is the name of a clearing system for large amounts within the Eurosystem. Cross-border payments in the SEPA area are also processed here. As soon as the sender of a payment is not in the same (SEPA) country as the recipient, the transaction is forwarded by the national system to TARGET2. Another very important function of the TARGET2 system for a bank is the administration of the minimum reserve and the procurement of central bank money.

As with any relevant clearing system, the TARGET system is constantly being improved and expanded. Fundamental changes will be made in November 2022 as part of the T2 / T2S consolidation. More on this can be found in the article “TARGET2 Big Bang“.

SWIFT

The term SWIFT also often seems ambiguous. The name of the organization is often used synonymously for message formats or the correspondent banking system. If a SEPA bank wants to send a payment outside the euro currency area, this is usually done via a SWIFT service office.

The most common misconception is that SWIFT performs a clearing function. Although the SWIFT message formats and the SWIFTnet communication network are used to contact a clearing system, SWIFT does not operate the clearing itself. An overview of this topic can be found in the article “What is SWIFT?“.

Payment transactions for banks in Germany with SEPA TARGET SWIFT Software

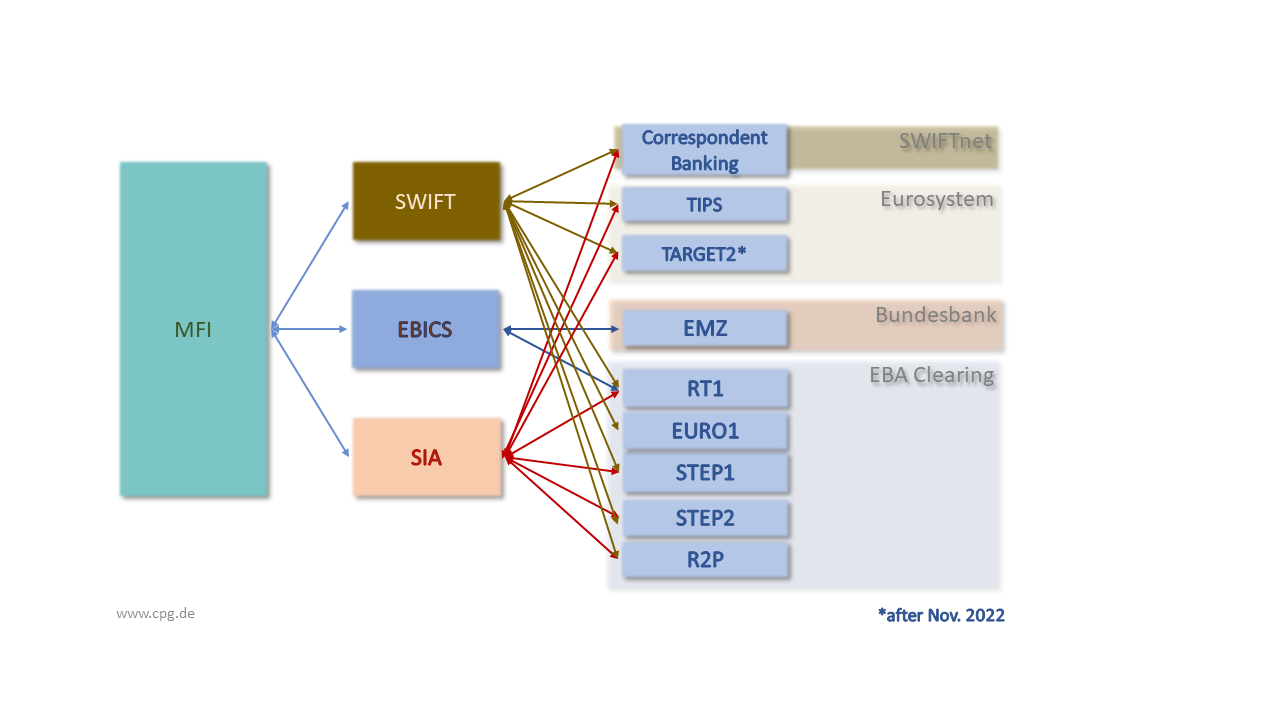

Every financial institution has a business policy that entails payment transactions in one form or another and large or small volumes. The demands on SEPA TARGET SWIFT software can therefore be very different. Dealing with TARGET, SWIFT and the SEPA Clearer is the average requirement for banks in Germany.

With the introduction of SEPA real-time payments, most banks are also connected to TIPS or RT1 as an online clearing system.

All of these services have at least their own dialect for the message formats. An example of this via the pacs.008 can be found in this entry: ISO20022 is not the same as ISO20022

The communication channels to the individual services can also be different. In addition to the SWIFT and EBICS channels mentioned, SIA is now also on the market as a provider for banks. Very security-conscious banks maintain several connections to functionally identical services in order to maximize reliability.

SEPA TARGET SWIFT software for banks

Dealing with different services and communication channels requires considerable effort for the maintenance of all these systems. Banks therefore strive to keep the structure as simple as possible. On the other hand, the market increasingly requires faster adjustments to customer requirements and regulatory requirements. Ideally, payment transaction software is used that, through simple configuration, manages the various communication channels and services with the associated message formats. New business models or business partners can then also be implemented more quickly in the payments system.

CPG.classic is a SEPA TARGET SWIFT software with a large number of technical functions for the payments department. A first impression and overview can be found in this YouTube video:

If you have any questions about CPG.classic, please use our contact form.

Share