An article by

Andreas Wegmann

Published on

09/03/2021

Updated on

13/01/2022

Reading time

3 min

A so-called clearing and settlement mechanism (CSM) is used to transfer funds between banks. There are around 150 such CSMs worldwide. The benefits and functionality are briefly explained in this article.

What is money?

To understand the role of a CSM, one must first think fundamentally about money. The most important quality of money is its limited availability. If money or a currency were available indefinitely, it would be worthless. Nowadays, money is rarely an embossed piece of gold with its own material value, rather a printed piece of paper. In times of cashless payment transactions, money is mostly so-called fiat money, i.e. imaginary.

Each independent state has its own money, its currency. As a rule, the respective national bank has the task of conducting currency policy. This is essentially the control of the money supply, i.e. the National Bank must in particular prevent money from being “created” at random in banks. The banks of a country “receive” money from the national bank and have to deposit collateral for it. How the bank uses the money for its part must be proven, i.e. it must be clear, for example, which account holder owns how much money.

Moving money

It is of course easy to move fiat money within a financial institution: something is credited to one account and something is deducted from another. Banks can of course also move money among each other. In the simplest case, mutual accounts are opened and transfers are made. Only when these two banks have reported the balance of their transactions to the National Bank was the money finally moved.

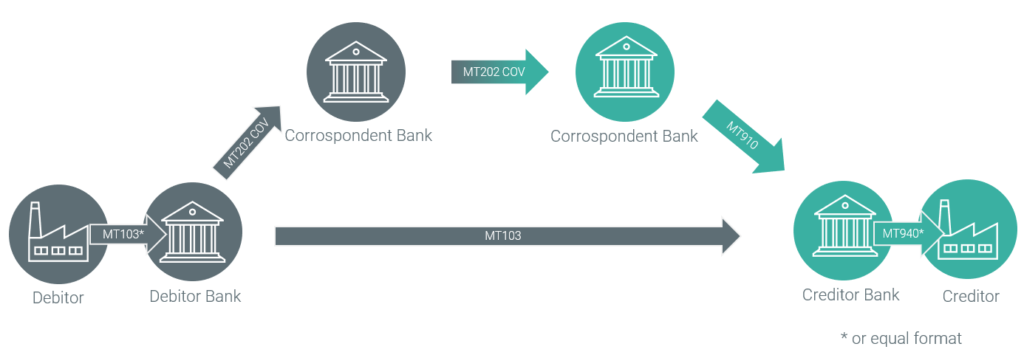

Correspondent banking system

Around 200 banks worldwide are actively engaged in the so-called correspondent banking business, i.e. they transfer money for other banks. In many cases, these banks also offer a currency exchange. Especially in remote countries with no developed financial system, this is the only way to send money. Long chains of financial institutions can be necessary before the money arrives at the recipient.

When banks “correspond” in this way, they have mutual accounts. In order to exchange the related financial messages as efficiently as possible (see illustration), European banks founded SWIFT in 1973. Messages are transmitted in its own network, with special protocols (SWIFT messaging services) and formats (SWIFT message types).

Clearing and Settlement Mechanism (CSM)

With around 30,000 banks worldwide, processing payments only through correspondent banks is not efficient. In addition, since the Lehman crisis it has been proven how quickly this system can come to a standstill if a participant fails.

In order to do justice to both problems, so-called CSMs were created. Here banks team up to a central account system and can make transactions with one another within the system. A CSM typically works on a credit basis, i.e. one participant cannot pull the others into the abyss.

Difference between Clearing and Settlement

A money movement usually takes place in two steps:

- Clearing – the receiving bank or CSM accepts the transaction and thus virtually guarantees processing

- Settlement – the money actually comes into the recipient’s area of disposal, i.e. he can continue to use it himself.

In terms of real online processing, both steps would take place at the same time, but this is still the exception in the financial world.

Clearing and Settlement Mechanism and “Real Time Gross Settlement” (RTGS)

The more modern CSM systems work according to the RTGS principle, ie “Real Time” and “Gross Settlement”. Often banks have an almost balanced flow of payments with other banks, i.e. “about as much comes in as goes out”. In order to preserve your own liquidity, an attempt is made to trigger your own outgoing payments as late as possible. In order to avoid participants gaining one-sided advantages, there are different measures at the CSMs. In the EU’s CSM, the TARGET2 system, payments are made as quickly as possible. If, however, there is no cover, the system waits until payments have been received. In this respect, the term “Real Time” in CSM systems is to be seen relatively.

The term “Gross Settlement” means that sales are settled without any deduction of fees. Fees are therefore calculated separately.

Clearing and Settlement Mechanism and Blockchain (Distributed Ledger Technology – DLT)

There are various initiatives around the world to introduce so-called cryptocurrency parallel to one’s own currency. As soon as a state tokenizes its currency, the transfer of this crypto currency is more like cash than fiat money. The DLT system replaces the central database of the National Bank. The money supply is no longer controlled by the banks, but is more or less a property of the currency itself. A crypto currency does not need an account in the traditional sense. The role of a bank becomes fundamentally different in the context of a cryptocurrency. Even a CSM would only have a right to exist for currency exchange. Clearing and settlement merge into one step with a cryptocurrency.

Share