An article by

Andreas Wegmann

Published on

01/10/2020

Updated on

01/11/2023

Reading time

3 min

Table of content

Anyone interested in payment transactions in the European Union will quickly come across the terms SEPA vs TARGET2. The relationships are explained here.

SEPA vs TARGET2: Single European Payment Area (SEPA)

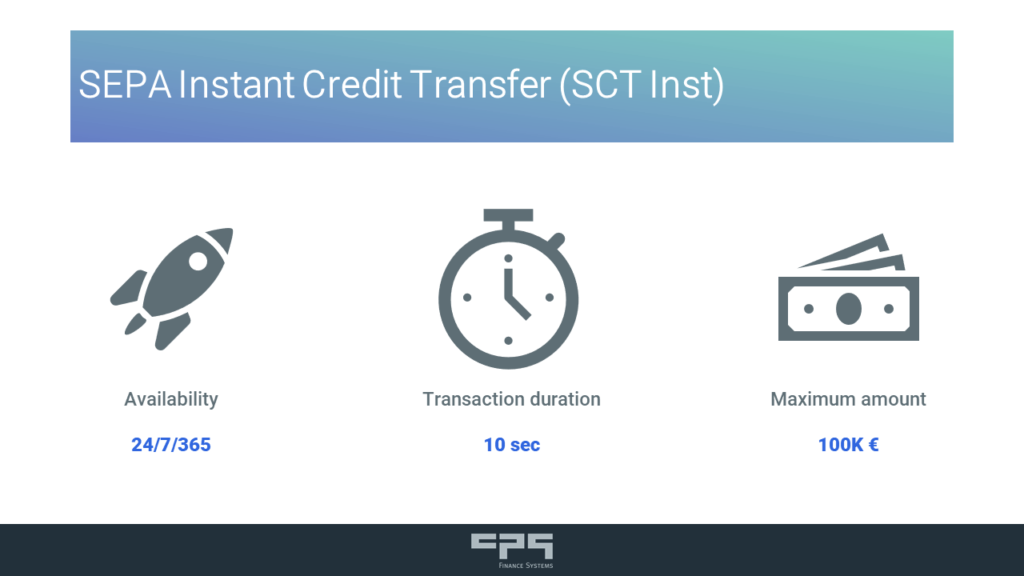

SEPA primarily describes a legal framework for the uniform handling of euro payments, even across national borders. This uniform approach strengthens the entire economic area. The technical services and standards are constantly changing and are constantly being adapted for reasons of efficiency or security.

The European Central Bank (ECB) and the European Payments Council (EPC) determines the practical handling of payments. ECB operates the Eurosystem and the national central banks are each part of this system.

SEPA vs TARGET2: SEPA payment? TARGET2 payment?

The term “SEPA payment” is often used in connection with payments. In general, it is understood to mean a payment that has been made entirely in the Eurosystem. The sending bank and the receiving bank are direct or indirect participants in the Eurosystem.

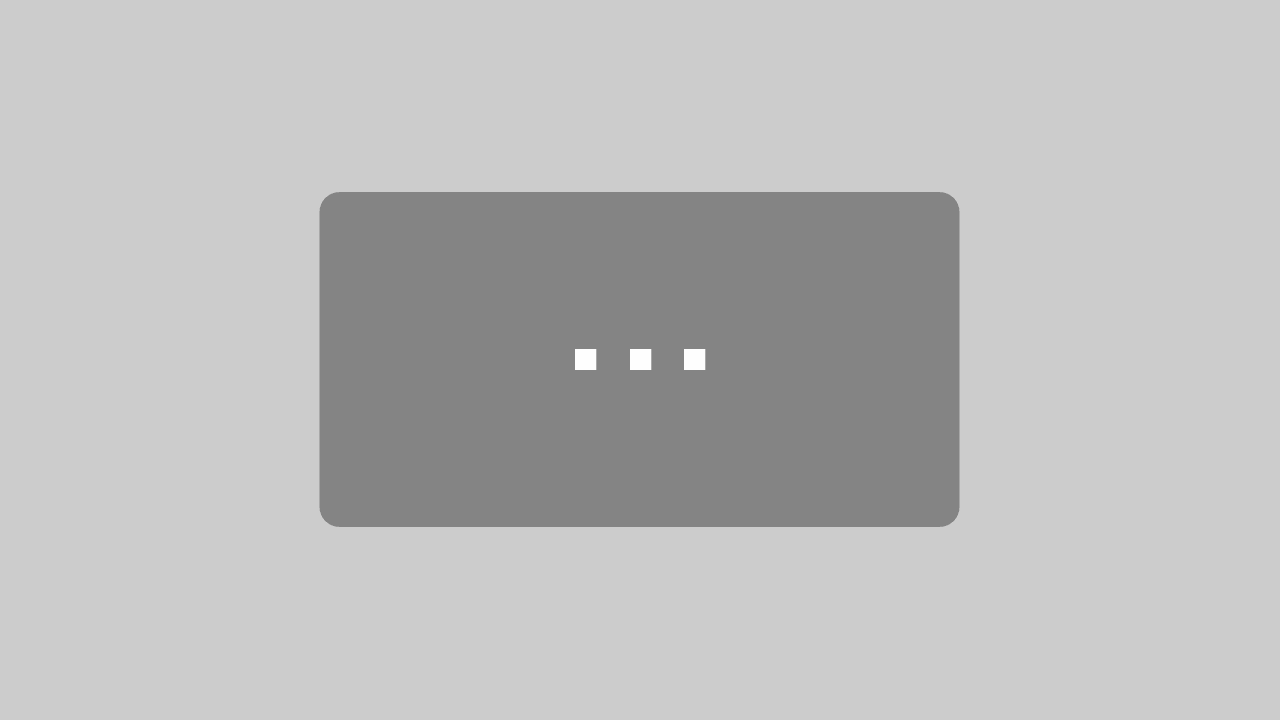

Much more often, “SEPA payment” specifically means a “SEPA Credit Transfer” (SCT) with its own SEPA SCT formats. This is a bank transfer in the retail payments service. To understand the difference between an SCT and a TARGET2 transaction, one has to know the different services in the Eurosystem.

SEPA vs TARGET2: the Eurosystem

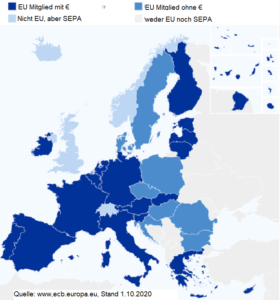

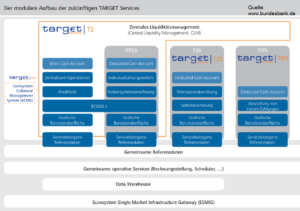

Euro payments between SEPA participants are processed via the Eurosystem. The national central banks make the market infrastructure available to the banks in their country. There are different services for large value payments (TARGET2), securities transactions (TARGET2-Securities) and SEPA instant payments (following article explains TIPS transaction flows). Beside of that the German Bundesbank (BBk) provides a service for retail payments (RPS; in German: elektronischer Massenzahlungsverkehr EMZ) .

TARGET2 is therefore part of the Eurosystem’s market infrastructure. Typically, individual payments are processed here, which should reach the recipient on the same day. The costs for clearing are tiered depending on the volume. Pricing starts at 0.80 euros per transaction at this service. The RPS is the much cheaper option. The costs at the RPS are calculated per bulk file (up to 100,000 transactions per bulk) at 0.0025 euros. An SCT can therefore be carried out almost free of charge. Modern payment systems such as CPG.classic allow the efficient and transparent use of all of these services. and their flexible handling via smart payment routes.

In addition to the costs, the operating times of the BBk services must also be taken into account, because only TIPS is a 24/7/365 service.

With the TARGET2 Big Bang in November 2022 (planning status Sep 2020), the core elements of the system will be consolidated and converted to ISO 20022. The account structure for the banks will also be simplified and the monopoly for access will be dissolved. The BBk provides information on the status of the TARGET2 / T2S consolidation, as does the European Central Bank.

Alternatives to the Eurosystem?

The Eurosystem is not the only clearing system that is SEPA compliant. The current list is published at the EPC.

Share