An article by

Andreas Wegmann

Published on

24/09/2020

Updated on

01/11/2023

Reading time

2 min

Table of content

Anyone who deals with interbank payments in Europe will quickly come across the terms EBICS and SEPA. This article gives a brief overview of the relationships.

EBICS SEPA: Electronic Banking Internet Communication Standard (EBICS)

EBICS is a communication standard that has been specifically defined for the transfer of payments. EBICS is a DK development that has replaced the BCS-FTAM standard. The main motivation for this was the ability to communicate over the Internet and the possibility of electronic signatures. The specifications for EBICS are publicly available. A company may develop their own EBICS communication. From an economic point of view, it certainly makes more sense to use a supplier’s proven solutions.

There are two main areas of application for EBICS

- Communication from (corporate) customers to thier bank (customer-bank)

- Interbank payments – SEPA Clearer

1. EBICS customer-bank communication

The technically simple version of EBICS is the customer-bank connection. The customer (company) only needs an EBICS client. This client connects to the bank’s server whenever needed. This is used both for the transmission of PAIN messages (mostly PAIN.001 transfers or PAIN.008 direct debits) to the bank, as well as for collecting account statements (CAMT).

It is important to know that every bank in Germany can be reached via EBICS. In addition EBICS is also enjoying increasing popularity internationally.

2. Interbank payments – SEPA Clearer

The market infrastructure of the Bundesbank (BBk) can in principle be reached via SWIFTNet FileAct. A Swift Service Bureau is usually used for this and fees apply. Especially for handling bulk payment transactions (EMZ), the cheaper alternative is the connection via EBICS. With EBICS there are no transaction fees, only the infrastructure costs for the EBICS server apply.

The connection to the Bundesbank requires an EBICS server on both sides so that both sides can actively initiate the connection. Credits transfers, direct debits and card collections are transmitted in the respective PACS format.

From a German point of view, the connection to the SEPA Clearer is certainly important for banks, but the corresponding EBA clearing service, STEP2, can also be accessed via EBICS.

EBICS SEPA: Single European Payment Area (SEPA)

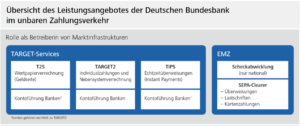

Firstly SEPA describes a legal framework and technical implementation is of secondary importance. Similar handling of euro payments strengthens the economic area and national borders become meaningless. The legally uniform handling of payments will stay, while the technical services and standards are constantly changing and expanding. The practical processing of payments takes place via the Eurosystem of the European Central Bank. As part of the Eurosystem, the national central banks operate the market infrastructure for processing national payments. Seperate services are part of system as shown in the following picture for the BBk:

There are many other clearing systems that are SEPA compliant. The current list is published at the EPC.

Misunderstandings in connection with SEPA are mostly based on insufficient selectivity in the use of the terms. “SEPA payment” often means an SDD (SEPA Direct Debit), SCT (SEPA Credit Transfer) or SCC (SEPA Card Clearing). These are message types (XML according to ISO 20022). In EBICS transactions are also encrypted and compressed.

In conclusion banks and corporates are advised to use software solutions that allow easy use of transmission paths and formats such as CPG.classic.

Share