An article by

Andreas Wegmann

Published on

01/04/2021

Updated on

01/11/2023

Reading time

3 min

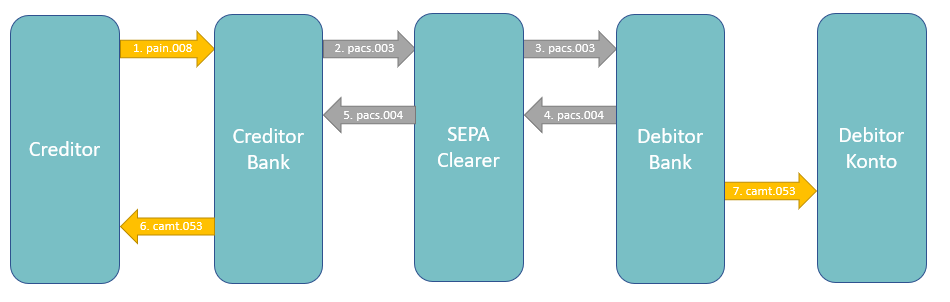

In Germany, SEPA SDD (direct debits – “Lastschrift”) are particularly popular for recurring payments. Since the term “direct debit” has a completely different meaning in the world of credit cards than in SEPA, there is a risk of misunderstandings. Formats and transaction flow used here relate purely to SEPA SDD. Special features of B2B direct debit are not considered here. The basis of all the processes presented is the Deutsche Bundesbank‘s SEPA Clearer (March 2021).

SEPA SDD: Direct Debit

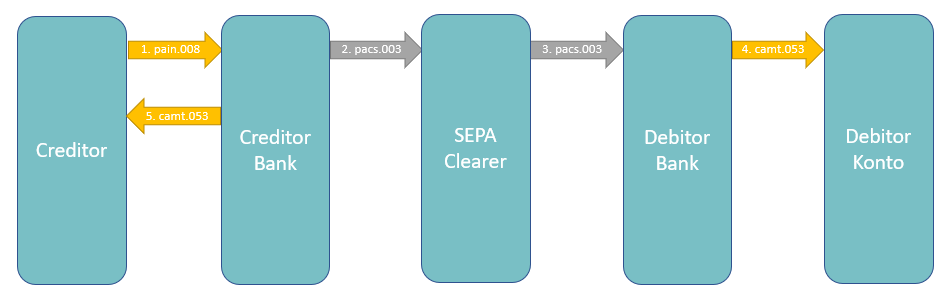

The creditor must submit the direct debit to his bank at least one and a maximum of 14 days before the due date as pain.008 (or in an individually agreed format). The bank submits the transaction as pacs.003 and, as always with the SEPA Clearer, there is no confirmation apart from the EBICS transmission protocol.

R-Transactions

A direct debit can be rejected or reversed. SEPA differentiates here whether this happens before or after the execution and who is the initator. A distinction is made between four cases:

- Reject: the debtor’s bank immediately refuses to transaction

- Cancellation: the vendor recalls the direct debit before it is executed

- Reversal: the vendor reimburses an executed direct debit

- Refund: the debtor declines an executed SDD

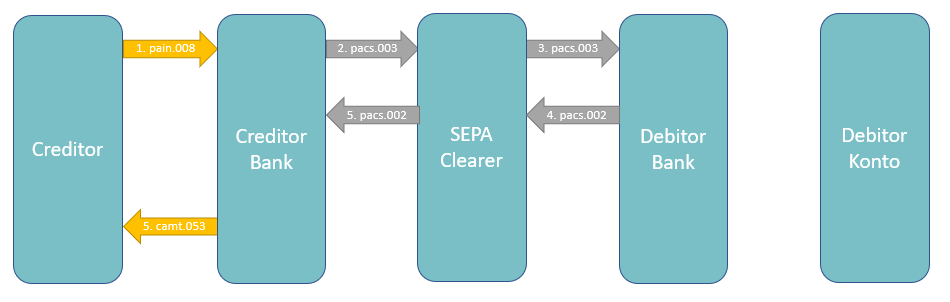

SEPA SDD: Reject

If the recipient’s bank declines the transaction, e.g. because the account does not have enough limit, this is sent as a pacs.002 message. This type of rejection occurs before the due date.

Apart from the message formats, most banks in Germany charge a return fee in the event of such a so-called “bursting of the direct debit”. The debtor bank receives an average of € 3.50 per return debit from the creditor bank. The creditor bank usually passes this fee on to the creditor.

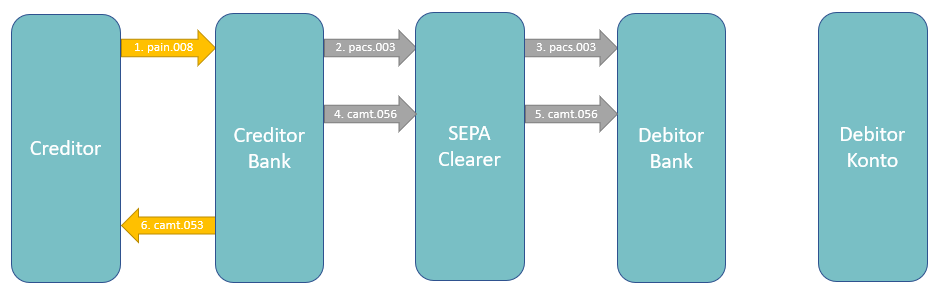

SEPA SDD: Cancellation

The creditor or his bank can cancel a direct debit before it is executed. There is no separate format for this process in customer / bank communication, but a bank can determine how this business case is carried out. The cancellation is then carried out via camt.056 ISO 20022 message.

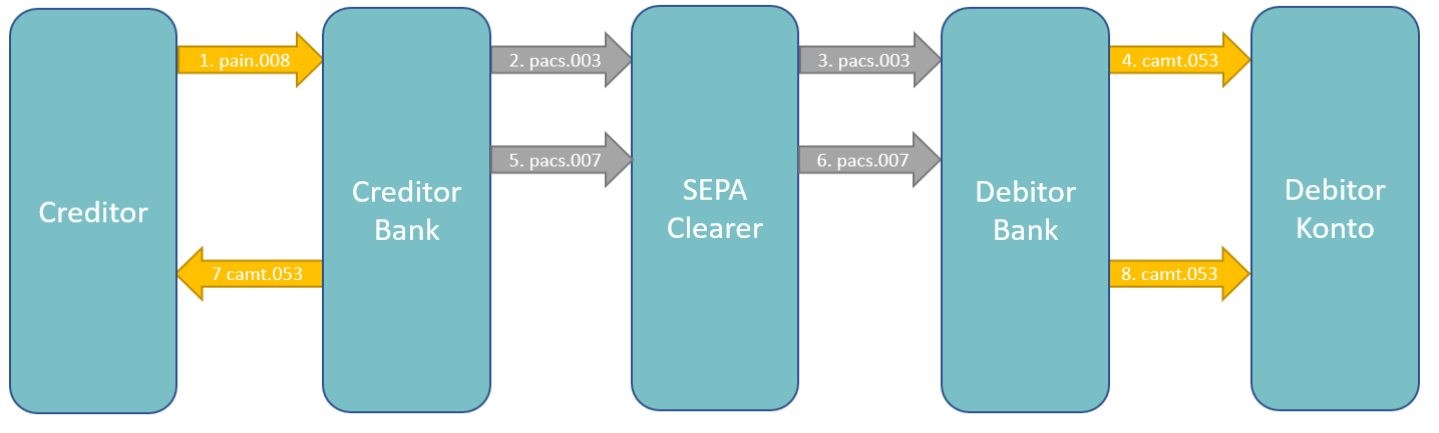

SDD Reversal

If a SDD has already been carried out it can be refunded by the creditor using pacs.007. The process refers to a previous pacs.003.

Important: a reversal cannot be undone and can overlap with a refund!

SDD Refund

The customer can object to a direct debit. He let his bank get the collected money back, e.g. because he thinks it is unjustified. The associated format is pacs.004.

If the direct debit has a valid mandate, the deadline for this is eight weeks after the due date. If there is no direct debit mandate, the deadline is extended to 13 months.

A return debit fee is usually charged for this business transaction as well.

Tests with the Deutsche Bundesbank

The SEPA participants of the Deutsche Bundesbank must be able to handle all of the SEPA SDD formats presented in tests. In a modern payment system such as CPG.classic, the handling of the less common formats can be simplified.

Share