An article by

Andreas Wegmann

Published on

30/09/2020

Updated on

01/11/2023

Reading time

2 min

Table of content

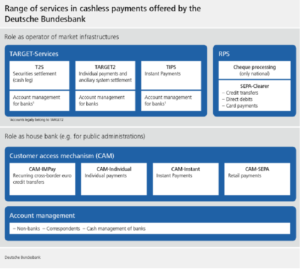

The SEPA payments transactions in Germany are processed via the market infrastructure of the Deutsche Bundesbank (BBk). If banks strive to participate in SEPA, it is important to know this infrastructure very well in order not to suffer any cost disadvantages. Previous knowledge of clearing systems from “non-SEPA” payment transactions is often more of a hindrance than helpful.

Typical hurdles

- orchestrating the three services for individual payments (TARGET2), bulk payments (RPS) and instant payments (TIPS)

- the implementation of communication via SWIFT and EBICS (SEPA)

- converting formats for internal and external systems

SEPA payments transactions: the market infrastructure of the Bundesbank (BBk)

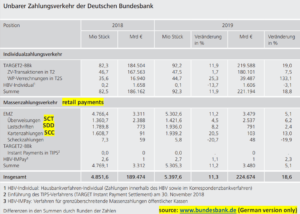

Large-value payments between banks are processed in the Eurosystem via TARGET2. This service is comparatively expensive, but fast. By far the largest share in German payment transactions takes place via electronic bulk payment transactions (retail payments service; RPS). The different usage becomes clear by looking at the statistics: SEPA payment transactions 2019

The difference in costs is much more decisive: around 80 cents (depending on the volume) are due for a TARGET2 transaction, while with the EMZ fee is only 0.25 cents per bulk file (up to 100,000 individual transactions). This service handles SEPA credit transfers (SCT), SEPA direct debits (SDD) and SEPA card clearing (SCC).

SEPA payments transactions: SWIFT and EBICS

It is also important to know the structures when communicating with the respective BBk service. TARGET2 payments are usually sent via a SWIFT service bureau, i.e. MT or MX messages are used here and high fees apply. The communication for retail payments is done exclusively by EBICS and there is no fee for it (apart from the possible license fee for the EBICS server). EBICS is primarily used for security and the protocol must be used in conjunction with the message type.

SEPA payments: converting formats

The internal systems of a bank often still work with legacy formats. Even if ISO 20022 forms the basis, different derivatives usually have to be recognized and corrected. Efficient format conversion is key to an efficient and flexible bank payment system.

SEPA participation: overcoming hurdles

A payment system should be independent of the internal and external systems of a bank, as this is the only way to clearly define the interfaces. There are a number of ready-made systems on the market such as CPG.classic. Modern software is independent of operating systems and can also be operated in cloud environments. The following aspects are also important:

- sophisticated converting tools in order to adapt to any upstream or downstream systems

- comprehensive review mechanisms in oder to minimize returns

- flexible payment routes so that new requirements do not trigger an IT project

A modular structure and a modern GUI can now be considered a prerequisite for a payments system, even if a fully automated operation is sought. Transparency of processes and procedures are the basis for the mobility and flexibility of an bank.

Share