Published on

13/01/2022

Updated on

01/11/2023

Reading time

3 min

Table of content

TIPS Participants: Updated participation rules for SEPA Instant Payments

An ECB decision of July 2020 that SEPA Instant participants who can also be reached in TARGET2 must also be available as TIPS participants from November 2021, caused quite a bit of attention in interbank payments, and let several financial institutions to reconsider or re-prioritize the participation to SEPA Instant Credit Transfer.

How to make instant payments the new normal in Europe? was the headline of the ECB’s announcement, in which its clear goal was that payment service providers (PSPs) and automated clearing houses (ACHs) offer a Europe-wide reach for instant payments. This is intended to support the EU’s broader goal of ensuring a successful roll-out of instant payments across Europe and ultimately giving European citizens and businesses the ability to make real-time electronic payments to and from any EU country both at the point of sale as well as online.

TIPS Participants: How did participation in TIPS develop between November 2020 and January 2022?

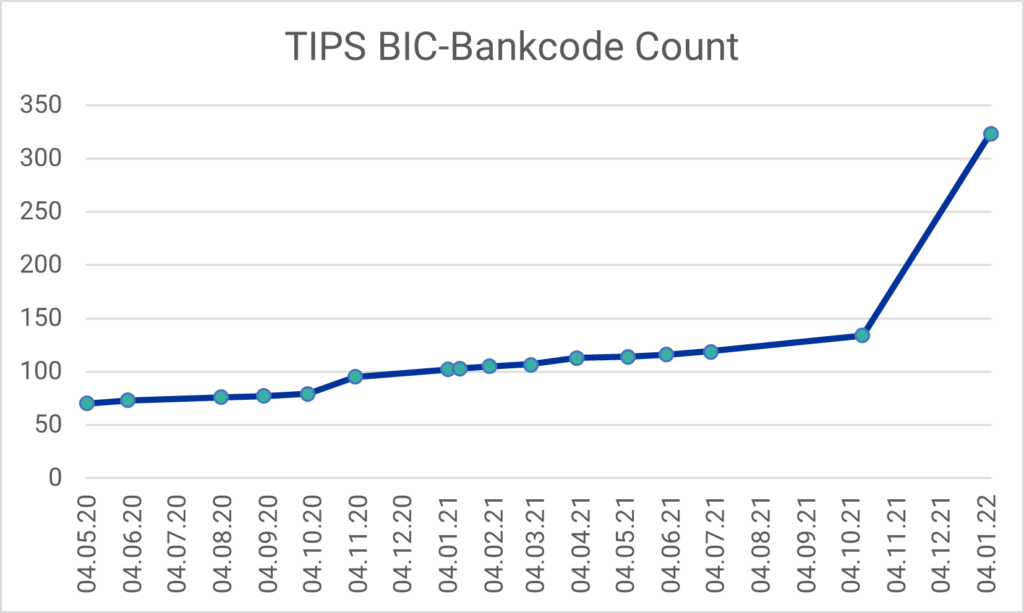

With the announcement in November 2020, the starting shot was given for some TARGET2 participants to implement a TIPS connection by November 2021. We have therefore observed closely since November 2020 how TIPS participation is developing based on the number of participating BIC bank codes:

- 02/11/2020: 95 TIPS-participating BIC bank codes (see SEPA Instant Payments: News and insights from December 2020)

- 04/01/2021: 102 TIPS-participating BIC bank codes

- 12/01/2021: 103 TIPS-participating BIC bank codess

- 01/02/2021: 105 TIPS-participating BIC bank codes (see Instant Payment System: News and insights from February 2021)

- 01/03/2021: 107 TIPS-participating BIC bank codes

Unfortunately, we now know exponential growth differently…

- 01/04/2021: 113 TIPS-participating BIC bank codes (see SEPA Credit Transfer Instant: Analysis of the adaptation in April 2021)

- 06/05/2021: 114 TIPS-participating BIC bank codes

- 01/06/2021: 116 TIPS-participating BIC bank codes (see Instant SEPA Payments: Current figures from June 2021)

- 01/07/2021: 119 TIPS-participating BIC bank codes

Funny, some financial institutions didn’t hear the shot!?!

- 12/10/2021: 134 TIPS-participating BIC bank codes (see SEPA Instant: Status in October 2021)

Hmm, for a long time there was no participant publication from the ECB?

- 07/01/2022: 324 TIPS-participating BIC bank codes

Well, go!

Of course we deliver these numbers kolonne also as a graph that shows the development over time:

TIPS Participants: Development of the number of TIPS connected BIC bank codes in the period 2020-2022 (Data source: ECB – Facts and Figures)

Interim conclusion

- Also, ECB draws a first summary with its article New participants join TIPS.

- According to the requirement on time (but not a day too early as expected), significantly more financial institutions participate in TIPS.

- The ECB measure to “push” SEPA instant payments is beginning to have an effect.

- Sustained growth is to be expected here in the coming months. We will definitely watch it.

Additional information on TIPS and SEPA Instant

As a solution partner for interbank payment transactions for SEPA or SEPA Instant, we offer our CPG.classic product or a high-performance software solution CPG.instant for processing SCT Inst transfers, which allows banks to flexibly connect one or more core banking systems and clear payments via TIPS or RT1 among others.

If you have any questions, suggestions or are interested in the topic of payment transactions, instant payments in SEPA or our software products, please do not hesitate to contact us!

You can find further articles on this topic in our blog category SEPA instant payments.

Share