Published on

23/12/2020

Updated on

01/11/2023

Reading time

4 min

Table of content

SEPA Instant Payments: Summary of the status quo in December 2020

Using public data from the ECB and EBA Clearing, we analyze the situation with the adaptation of SEPA Instant Payments by banks and financial institutions (identified by their BIC or BIC bank code) in the SEPA area. The following article covers the following topics in detail:

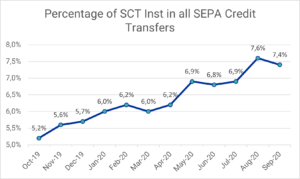

- TIPS shows an increasing trend in the percentage of SCT Inst transactions of all SCT transactions, currently this is 7.4%.

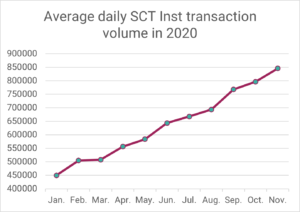

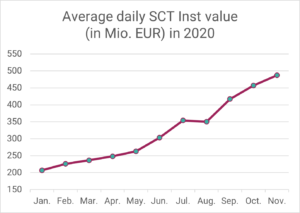

- In 2020, RT1 recorded approximately a doubling of the SCT Inst transaction volume and the SCT Inst amount volume, currently an average of approximatley 900 thousand daily transactions with a value of almost EUR 500 million.

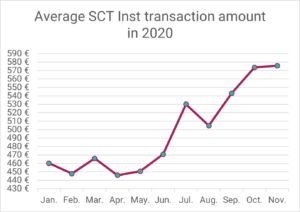

- The increase of the SCT Inst amount limit to 100,000 EUR is shown in the transaction statistics of RT1 with an average amount of currently approx. 576 EUR.

- The number of TIPS and RT1 participants (measured in BIC bank codes) is growing slowly but steadily.

- The decisions of the ECB of July 2020 regarding participation in TIPS were formulated in concrete requirements of the Bundesbank and the ECB.

SEPA Instant Payments: Shortly explained

We briefly describe the instant payments process in the article SEPA Instant Credit Transfer: Transfers up to € 100K in 10 seconds.

What data do we analyze?

Here we analyze the status quo of instant payments with the help of public data from May to December 2020 of the European Central Bank (ECB) and EBA Clearing (EBA stands for Euro Banking Association), which are published monthly by these institutions. We specifically evaluate which financial institutions participate in instant payments via which bank identifier code (BIC) or which BIC bank code.

Why the reference to these sources? The ECB and EBA Clearing both offer clearing and settlement mechanisms (CSM) for SEPA Instant Payments and therefore report regularly on their participating institutions. The ECB offers the Target Instant Payment Settlement (TIPS) service for instant payments, while EBA Clearing offers the RT1 service.

SEPA Instant Payments: Statistics from ECB and EBA Clearing

Statistics from ECB

The following figure shows the percentage of SCT Inst transfers in all SCT transfers processed via TIPS in the months of October 2019 to September 2020. An increasing trend can be clearly seen here, even if the current percentage of 7.4% is still small.

Instant Payments via TIPS: Percentage of SCT Inst transfers of all SCT transfers (source: EZB)

Statistics from EBA Clearing

The following figure shows the average daily SCT Inst transaction volume processed via RT1 in 2020. A steadily increasing trend can be clearly seen here, the volume has almost doubled in the last 11 months.

Instant Payments via R1: Average daily SCT Inst transaction volume in 2020 (source: EBA Clearing)

The following figure shows the average daily SCT Inst volume in million EUR processed via RT1 in 2020. An increasing trend can be clearly seen here, the volume has more than doubled in the last 11 months.

Instant Payments via R1: Average daily SCT Inst volume in EUR million in 2020 (source: EBA Clearing)

As the following figure shows, since July 2020, when the SCT Inst amount limit was increased from EUR 15,000 to EUR 100,000, a significant increase in the average transfer amount can also be observed.

Instant Payments via R1: Average transfer amount in 2020 (source: EBA Clearing)

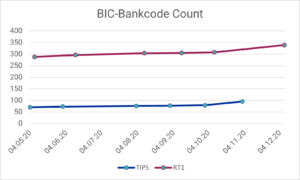

Number of BIC bank code participants in TIPS or RT1

The following figure shows the number of BIC bank codes participating in TIPS or RT1 in the period from May to December 2020. A slowly increasing trend can be seen here, even if the increase in the SCT Inst transaction volume (see above) is probably due to the adaptation of SCT Inst transactions within the participating banks can be explained than by more SCT participants per se.

Instant Payments: Number of BIC bank codes connected to TIPS or RT1 (source: EZB, EBA Clearing)

SEPA Instant Payments: Other relevant news

- The Deutsche Bundesbank informs in circular no 70/2020 (in German) as a result of the ECB Council decision of July 2020 that SCT Inst process participants who can be reached in TARGET2 must also be available in TIPS from November 2021. The Deutsche Bundesbank requires feedback from all institutions affected by the availability obligation by December 15, 2020 at the latest!

- The European Central Bank deals with this in the following publication: How to make instant payments the new normal in Europe?

Outlook

This article is part of a series on SEPA Instant Payments and builds on these articles:

- Instant Payment: News and insights from October 2020

- SCT Instant Payment: participation analysis within SEPA area (August 2020)

- SEPA Instant Credit Transfer Register of Participants: a data analysis (June 2020)

In the following analyzes, we will observe the monthly changes and further deepen the evaluation of the spread of SEPA Instant Payments in the SEPA area.

Contact

Among other things, we offer a software solution CPG.instant for processing SCT Inst. If you have any questions, suggestions or interests about payment transactions, instant payments and software solutions, please contact us:

- By phone: +49 (0) 89 6809700

- Email: infocpg@cpg.de

Share