An article by

Dr. Martin Berger

Published on

25/10/2020

Updated on

01/11/2023

Reading time

5 min

Table of content

Instant Payment: Summary of the status quo in October 2020

This article is part of a series on SEPA Instant Payment and continues on these articles: SCT Instant Payment: participation analysis within SEPA area (August 2020), SEPA Instant Credit Transfer Register of Participants: a data analysis (June 2020). We use public data from ECB and EBA Clearing to analyze how the adaptation is progressing for payment scheme by banks and financial institutions (identified by their BIC or BIC bank code) in the SEPA area. The following article covers the following topics in detail:

- After counting the participating BIC bank codes, a more reliable benchmark compared to the BIC itself, RT1 still has a lead over TIPS.

- 19% of the BIC bank codes of the SEPA SCL directory are instant payment capable, in order to be the “new normal” a lot more adaptation is required.

- The ECB and EU Commission have published some groundbreaking announcements for TIPS and SCT Inst in the last few weeks, which should significantly promote interoperability and adaptation. We highlight the essentials.

Instant Payment: Briefly explained

We briefly describe the instant payment process in the article SEPA Instant Credit Transfer: Payments up to 100K€ in 10 secs.

What data do we analyze?

We are analyzing the status quo of instant payment with the help of public databases from October 2020. These databases are regularly published by the European Central Bank (ECB) and the EBA Clearing (EBA stands for Euro Banking Association). We specifically evaluate which financial institutions participate in instant payment via which bank identifier code (BIC) or which BIC bank code. Why the reference to these sources? ECB and EBA Clearing both offer clearing and settlement mechanisms (CSM) for SEPA Instant Payment and therefore report regularly on their participating institutions. The ECB offers the Target Instant Payment Settlement (TIPS) service for instant payment, while EBA Clearing offers the RT1 service.

Instant Payment: Participation via TIPS vs. RT1 vs. TIPS + RT1

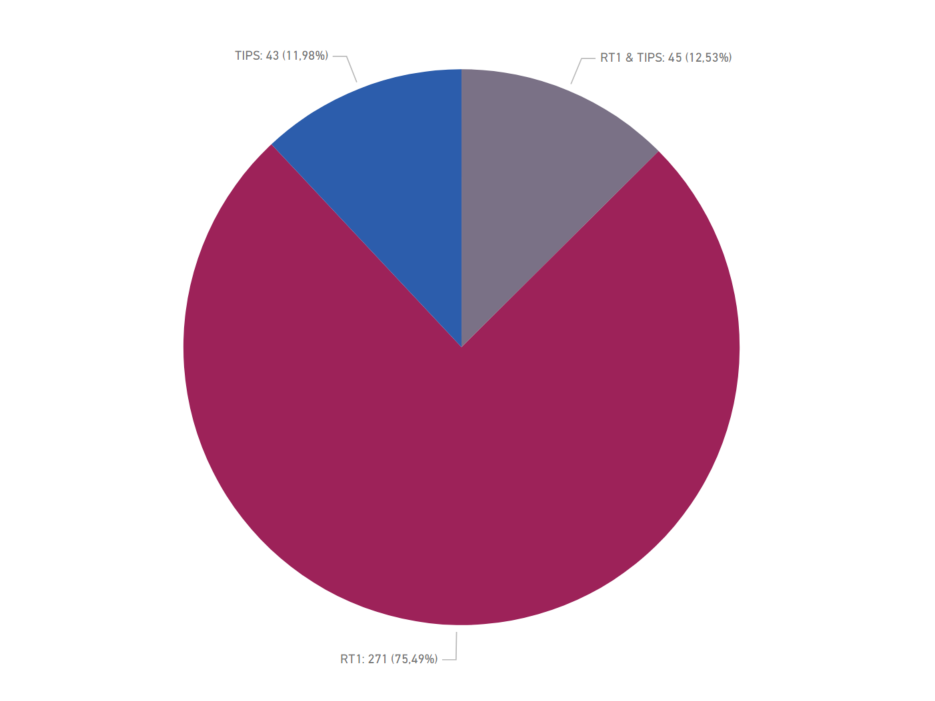

Based on the data from ECB from October 1st, 2020 and from EBA Clearing from October 9th, 2020, it is analyzed which SCT Inst participating BICs (Bank Identifier Codes) only connect TIPS, only RT1 or both. In the following we show counting according to BIC bank code (first 4 digits assigned to a BIC and a bank), i.e. determine which unique BIC bank codes are associated with which clearing and settlement.

Instant payment connection TIPS vs. RT1 vs. TIPS + RT1: Counting according to BIC bank code

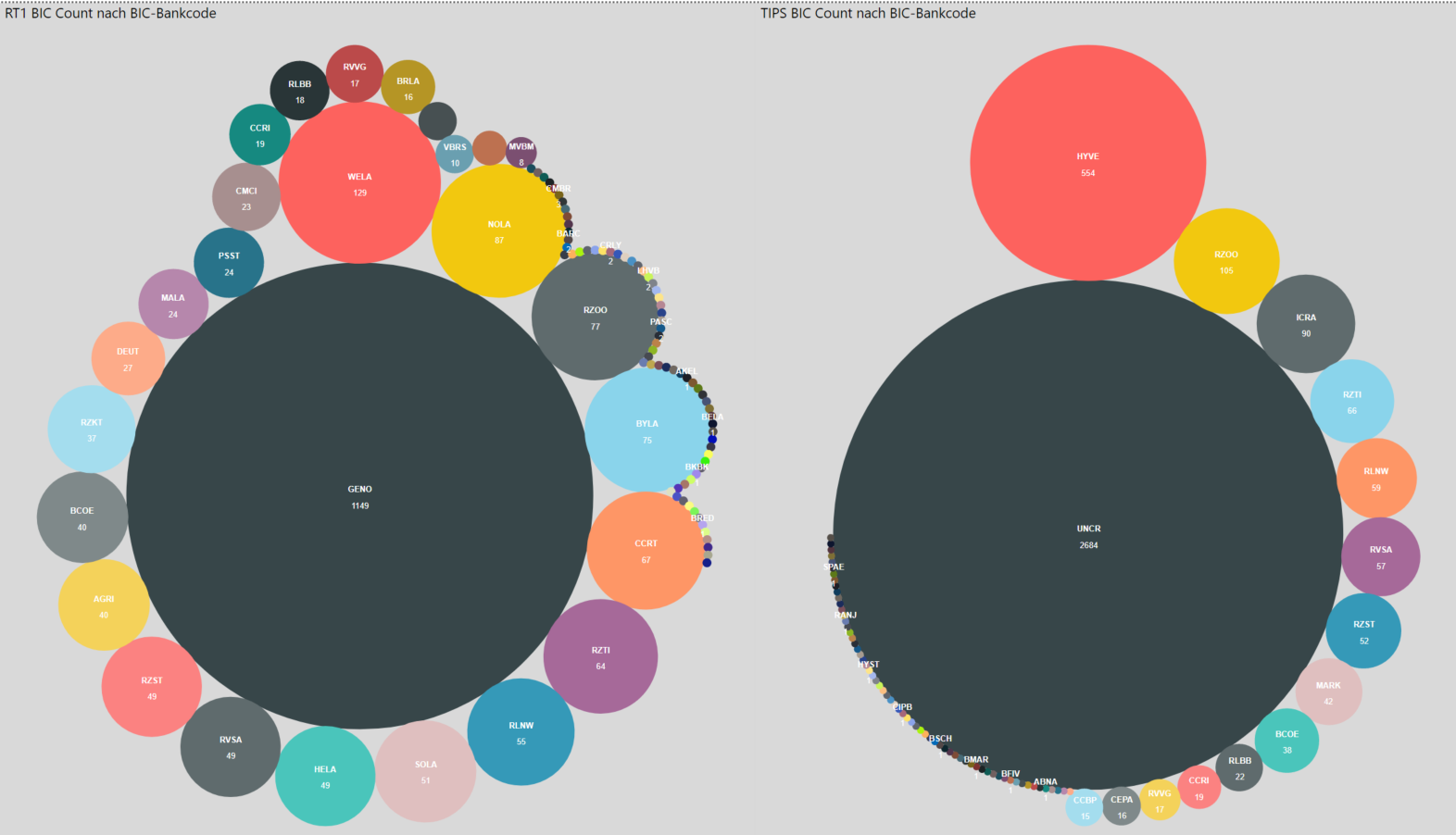

RT1 (left) or TIPS (right) BIC counting per BIC bank code illustrated as a bubble chart: Each bubble represents a BIC bank code, the size of which is expressed by the number of BICs listed in the bank. The BIC bank codes are sorted clockwise according to the number of BICs. With TIPS there are few very large bubbles, with RT1 significantly more medium-sized bubbles. When assessing the bubble size, however, it should be noted that the BICs listed by EBA Clearing data only list one BIC-8, provided that all branches (BIC-11) are connected via it!

It shows the following:

- According to this approach with regard to the BIC bank code, RT1 still shows a clear lead with regard to adaptation.

- Otherwise, there has been little change in the conditions of the TIPS / RT1 connection compared to August 2020.

- The majority of the SCT Inst participants continue to opt for one of the two services.

Instant Payment: Coverage of the BIC bank codes of the SEPA SCL directory

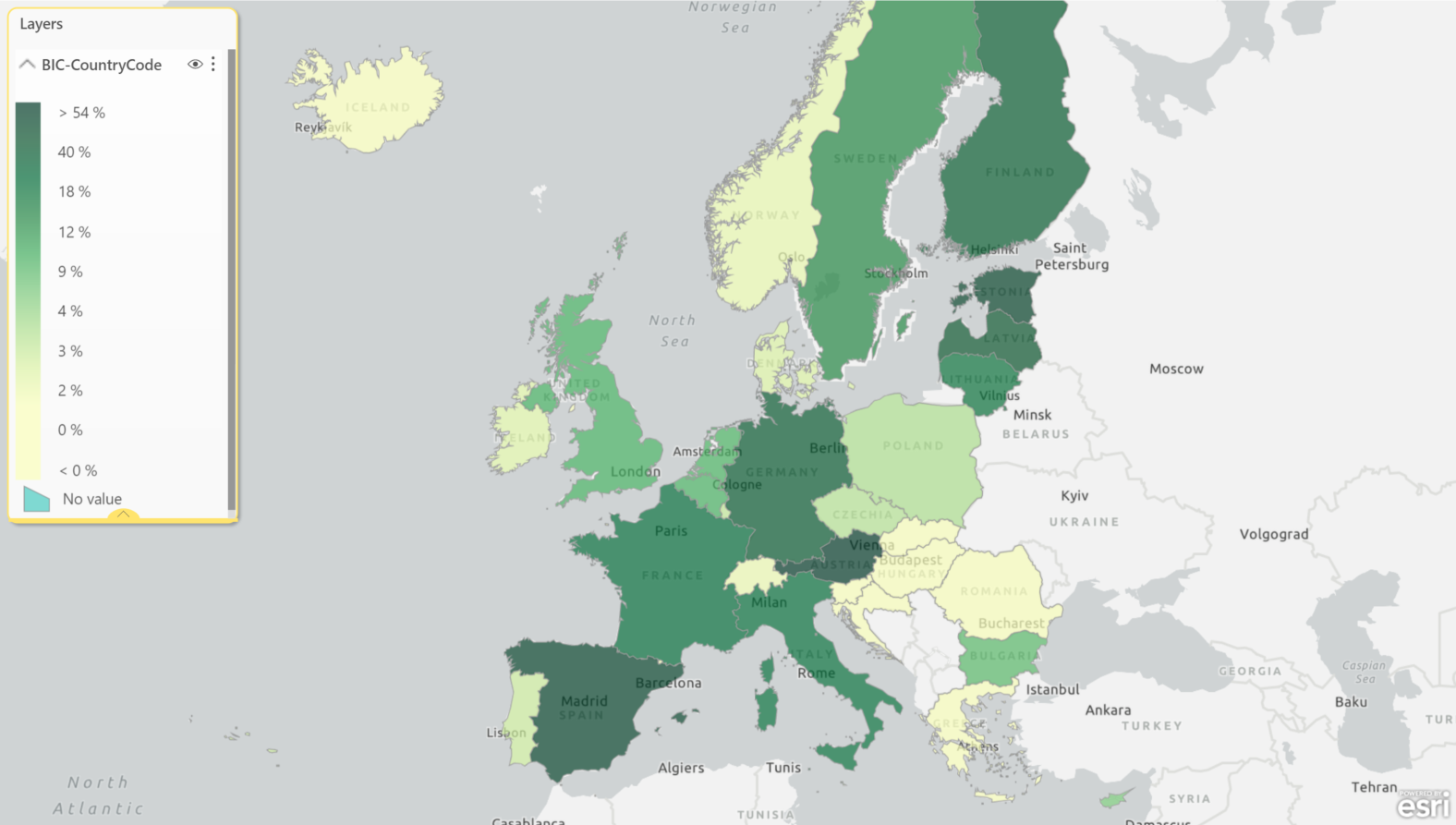

This map of the SEPA area shows what percentage of the BICs listed in the SCL directory participate in SCT Inst for each SEPA country.

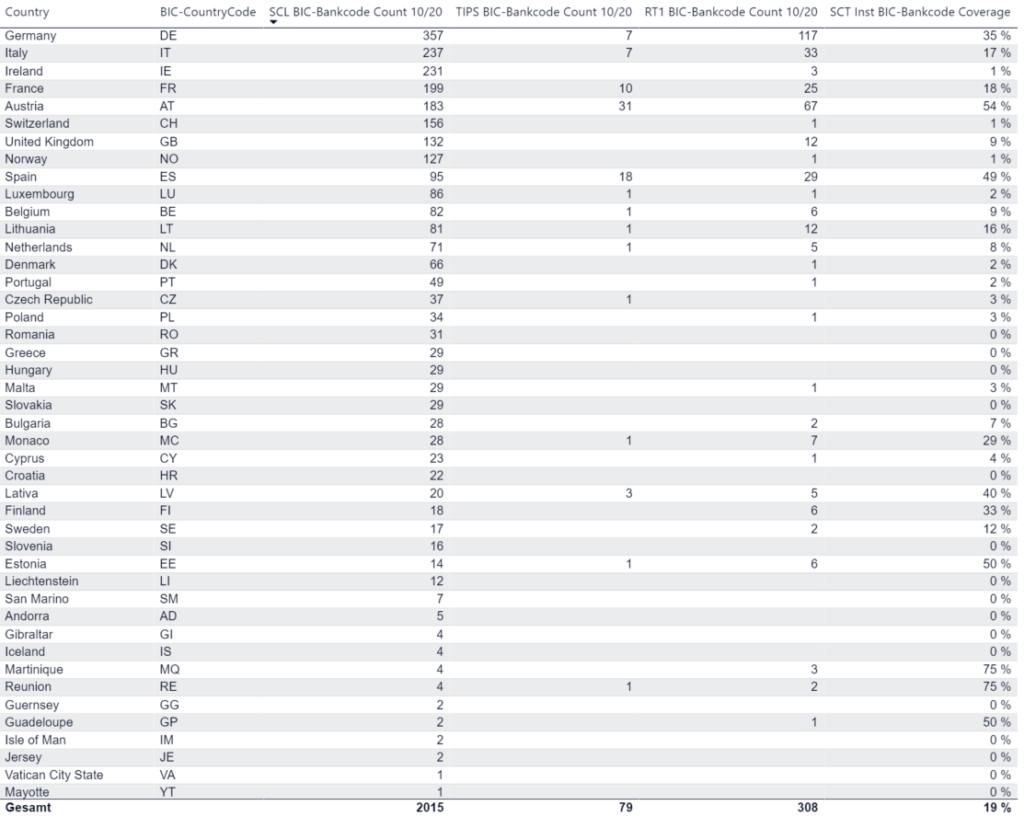

Based on the data from ECB from October 1st, 2020, from EBA Clearing from October 9th, 2020 and the Bundesbank’s SEPA SCL Directory, it is analyzed how the coverage of the BICs participating in SCT in the SEPA area is currently structured. The data on which the map is based are listed in the following table:

SCL directory listed BIC bank codes per SEPA country, their participation in TIPS or RT1 as well as the resulting percentage coverage of all SCL directory BIC bank codes of the SEPA countries.

This clearly shows that the SCL directory coverage by SCT Inst with 19% for the entire SEPA area can still be significantly expanded.

Instant Payment: More relevant news

- ECB news from October 6th, 2020, in which a project is announced that will advance the currency interoperability of Instant Payment:

- Together with the Swedish National Bank, the ECB is investigating cross-currency instant payments via TIPS.

- This should enable instant payments in Swedish kronor via TIPS until May 2022.

- On September 16, 2020, the Deutsche Bundesbank reported in their newsletter Zahlungsverkehr und Wertpapierabwicklung (in German) of the ECB Council resolution of July 24, 2020, which will have far-reaching effects on the use of TIPS and thus also on the interoperability between RT1 and TIPS:

- All payment service providers who can be reached in TARGET2 and who have signed the SCT Inst scheme must be reachable in TIPS.

- Automated Clearing Houses (ACHs), which offer instant payment, are to move their technical accounts from TARGET2 to TIPS.

- Implementation by the end of 2021 with the aim of better penetration of SCT Inst.

- Communication of EU commission from 24.9.2020 regarding Retail Payments Strategy for the EU:

“Key action:

In November 2020, i.e. at the expiration of the temporary exemption period set by the SEPA Regulation for meeting the adherence requirements of the SEPA Instant Credit Transfer (SCT Inst.) Scheme, the Commission will examine the number of payment service providers as well as the number of accounts able to send and receive SEPA instant credit transfers. The Commission will assess whether these numbers are satisfactory and, on that basis, decide whether it is appropriate to propose legislation requiring payment service providers’ adherence to the SCT Inst. Scheme by the end of 2021. Such a proposal, if decided, would lay down the criteria for determining which payment service providers should be subject to obligatory participation.”

As a result, over the next few weeks we can eagerly await whether – and for whom – a obligatory participation in the SCT Inst scheme can be expected by the end of 2021.

Outlook

In the following analyzes we will observe the monthly changes and further deepen the evaluation of the spread of instant payment in the SEPA area.

Contact

Among other things, we offer a software solution CPG.instant for processing SCT Inst. If you have any questions, suggestions or interests about payment transactions, instant payments and software solutions, please contact us:

- By phone: +49 (0) 89 6809700

- Email: infocpg@cpg.de

Share