An article by

Andreas Wegmann

Published on

24/05/2023

Updated on

26/05/2023

Reading time

4 min

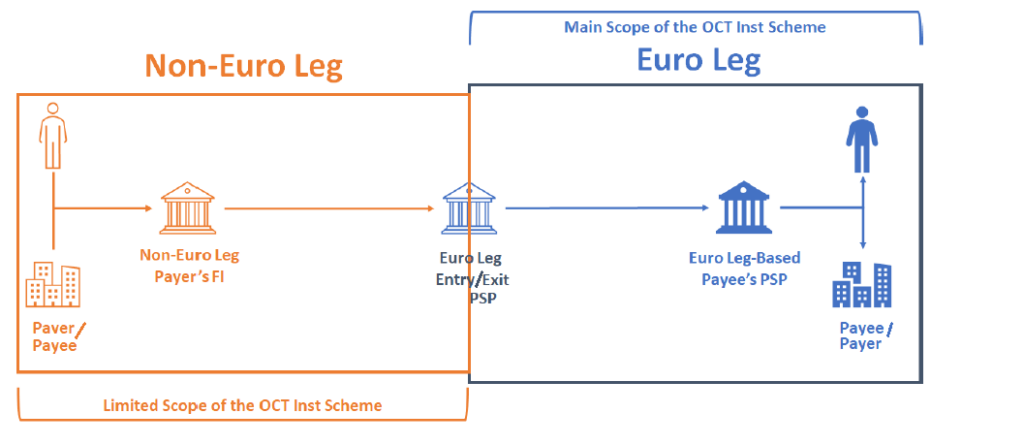

The euro and SEPA regulations are very beneficial for banks and businesses in participating countries because clear rules and reliable systems enable efficient payments processing. Now the EU is pushing SEPA’s multicurrency capability and that too in the form of 24/7/365 real-time payments: the EPC published the One-Leg Out Instant Credit Transfer (OCT Inst) Scheme Rulebook in March 2023 and the service will start at the end of November 2023. This article summarizes the most important things.

OCT Inst: What benefits should these scheme offer?

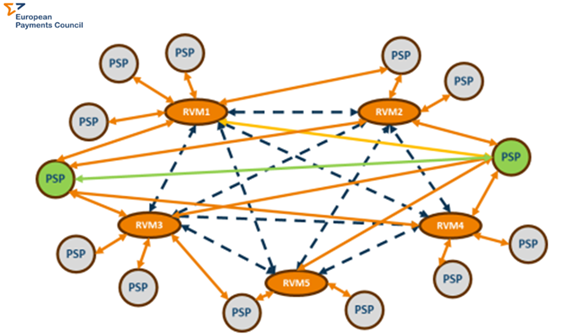

At first glance, the task seems to be simple, to connect the EU’s own real-time clearing with the corresponding systems in the non-euro area. Payment service providers (vulgo banks) can then send and receive payments of up to €100,000 in real time via the familiar paths (TIPS, RT1). EU countries without the euro and important trading partners with their own currency will get standardized access to the Eurosystem. This strengthens the euro as a currency, promotes the economy and also offers advantages to citizens in foreign transactions.

By presenting a scheme, the discussion can be started and the EPC is therefore in control. All other real-time clearing systems or banks outside the SEPA area can consider whether they want to participate in OCT Inst. Financial institutions that act as service providers for other banks are also explicitly allowed. So there is indirect and direct participation. The EPC has set aside the period from March to December 2023 (although operations start at the end of November!) for change requests, so hopefully all aspects can be examined.

What are the hurdles for OCT Inst?

At second glance, the devil is in the details, as other real-time payment systems are neither technically nor legally identical. In addition, there is the biggest hurdle: currency exchange. The dynamics of currency fluctuations are absorbed in trading by an exchange rate difference in buying and selling, and normally good money is made in foreign exchange trading. So it’s a matter of figuring out how to manage operations, liability, currency risk and revenue in a way that creates an attractive infrastructure for all parties involved.

Major international banks such as HSBC or Deutsche Bank, which see currency trading as an important business segment, are unlikely to like the One-Leg Out Instant Credit Transfer Initiative. They earn quite well as correspondent banks with the existing systems, albeit more in the wholesale area for large-value payments. Whether they participate in OTC Inst and align or supplement their business accordingly remains to be seen.

The neobanks like Revolut or Ripple will probably lose business and possibly engage in a price war. This is in the interest of the EU and its citizens.

What are the rules of the game at OCT Inst?

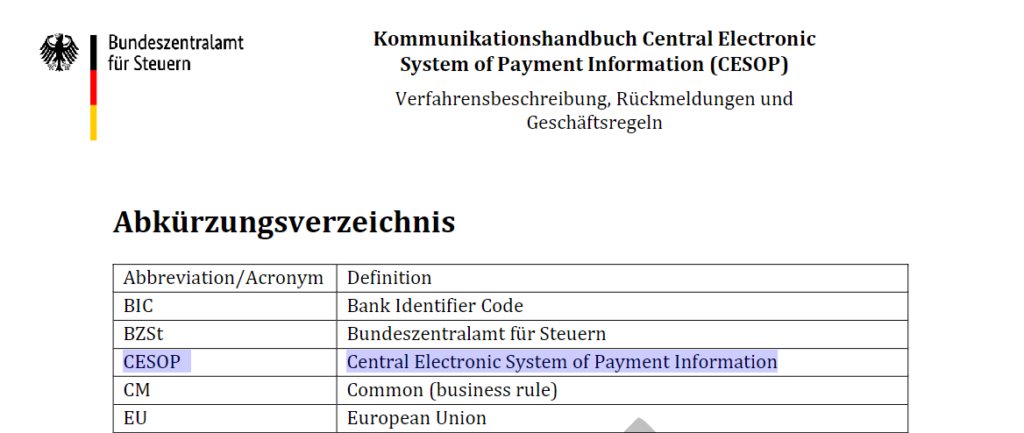

Anyone who wants to participate in OCT Inst must comply with the rules. In addition to absolute cost transparency and a tight time limit for processing, the ISO 20022 message format is mandatory. An end-to-end ID and remittance information use must also be available to the sender and recipient.

The EPC has little legal authority in foreign countries and therefore the bank, which acts as the gateway to the euro zone, is of particular importance. It must ensure that its affiliated financial institutions also operate in a compliant manner.

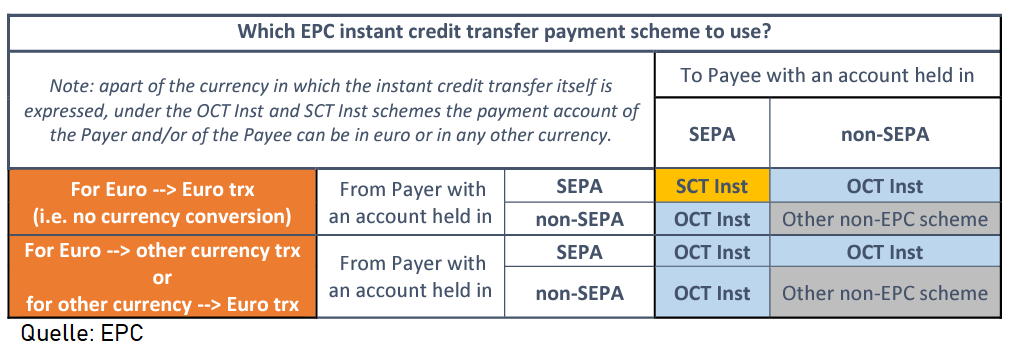

SCT Inst or OCT Inst?

One might get the idea that OCT Inst is an extension of the existing SEPA Instant Payments infrastructure. This is not the case. Both systems are independent services and PSPs are not forced to participate in the One-Leg Out Instant Credit Transfer Scheme.

An interesting aspect are payments via OCT Inst, which take place without currency exchange (i.e. Euro/Euro). This is to enable holders of euro accounts outside the SEPA area to make money transactions with account holders within the SEPA area. Within the euro zone OCT Inst shall not process €/€ transactions to avoid cannibalization among the euro clearing services.

In order to establish compatibility with SWIFT’s Cross Border Payments and Reporting Plus (CBPR+) and Cross-Border Instant Payments Plus (IP+) standards, OCT Inst includes additional fields that are not (yet) available in SCT Inst.

Bottom line

OCT Inst has the potential to change the way payments are made. After the somewhat hesitant introduction of SEPA instant payments, SEPA banks and customers now have yet another reason to become friends with SEPA real-time payments. It remains to be seen whether they will also be used at the point of sale and thus attack the credit card world.

An influence on the online trade will rather not take place. Reason: the scheme (as always with SEPA) does not provide “consumer protection” and continues to leave this field to PayPal & Co.

If you have any questions about the One-Leg Out Instant Credit Transfer please use our contact form.

Share