An article by

Andreas Wegmann

Published on

30/10/2020

Updated on

18/11/2020

Reading time

3 min

Table of content

The SEPA service described here can be an important component in the interaction with SEPA Request to Pay and is therefore briefly explained at this point.

SEPA Proxy Lookup (SPL) – who is behind it?

At companies such as PayPal or Klarna, the user can log in with their telephone number or email address, because everyone can easily remember this. In the case of banks, login names are usually required, which you have to define for this one purpose and which are therefore easier to forget.

The Association of European Banks (EPC) would like to strengthen the competitiveness of the banks by making the initiation of a financial transaction as easy as possible and the account holder no longer using intermediaries.

SEPA proxy lookup – how does it work?

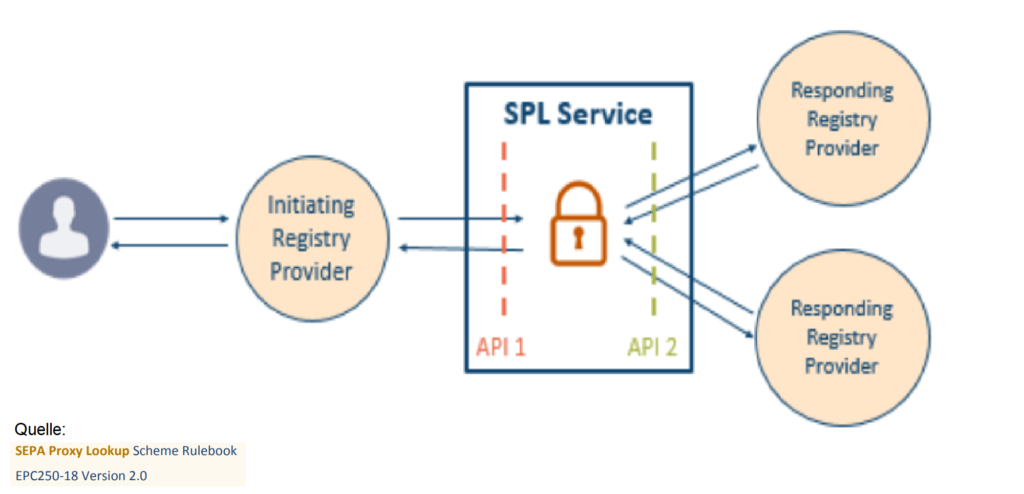

As the name “proxy” suggests, SPL regulates a “mediation” between a bank account (IBAN) and a telephone number or e-mail address. Since this is an official SEPA service (scheme), the corresponding technical standards and rules that are specified in the SPL scheme rulebook apply.

Of course, the data cannot be accessed at will, rather the parties involved (provider = SEPA banks) are subject to the requirements of the rulebook.

SEPA proxy lookup – what advantages do I have as a bank customer?

SPL should be seen as a supplement to other SEPA services. Whenever a bank customer has to enter their IBAN, they can simply enter their telephone number or email address instead. In the simplest case, e.g. an energy supplier can determine the bank details of a customer via their e-mail address and SPL instead of asking for the IBAN in a form. The company avoids disruptions e.g. transposed digits and the customer has an easier registration process.

Another application is conceivable in the area of online “fake profiles”. E.g. the seriousness of a person often has to be checked on auction, social media or real estate portals. The check should be carried out as quickly, easily and cheaply as possible, without causing data management issue (GDPR). Anyone who has stored their telephone number with SEPA Proxy Lookup must inevitably have gone through the identification check of a bank.

With a SEPA proxy lookup request, a provider can verify his bank telephone number and name quickly, easily and inexpensively.

Very interesting use cases for SPL arise in the interaction with SEPA Request to Pay for payments in retail stores or e-commerce shops. These payments are then authorized in the banking app of the customers own bank. The customer does not have to use non-bank apps or cards (accounts) to carry out payment transactions, but his bank account is again his only “financial center”.

SEPA proxy lookup – an opportunity for banks?

With SPL, bank customers can more easily have access to their account because their own telephone number or email address is easier to remember than an IBAN. The benefit unfolds together with Request to Pay for payment transactions, because other payment schemes (credit cards) or third-party providers (PayPal) are replaced.

Initially, there is no income from the already regulated interchange fees, but at the same time the bond with the account holder is strengthened again.

A business model for banks arises above all on the corporate customer side (merchants), who have high cost savings with a SEPA payment transaction compared to credit card transactions, PayPal etc..

Share