An article by

Andreas Wegmann

Published on

04/11/2020

Updated on

26/11/2020

Reading time

4 min

Table of content

Request to Pay shifts authentication and authorization to the buyer’s e-banking application even in an online purchase. The online business gave birth to a large variety of companies (e.g. PayPal, Klarna) which found smart ways for authentication and authorization. Even a credit card scheme is a an appendage with separate rules and high fees. The bank account is exploit by these payment methods and the only functions as a “stupid money container”. With Request to Pay, banks can regain lost ground.

Request to Pay in E-Commerce: How Does It Work?

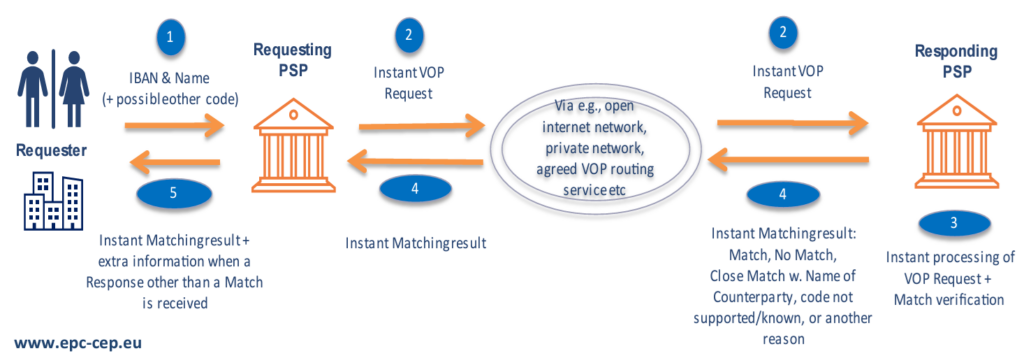

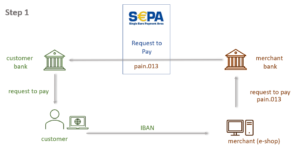

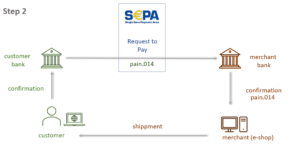

When checking out in the online shop, the buyer simply enters his IBAN number – done! Thanks to the cross-sum check, rotated numbers are recognized, so the entry is comparable to that of a credit card number, but without the expiry date and card verification number. The dealer’s system forwards an R2P transaction to its own main bank account. The transaction is transferred to the buyer’s bank via the SEPA service and displayed in his familiar e-banking application. The buyer then makes the payment like a normal transfer, i.e. it is a familiar process in a familiar environment.

Depending on the industry, the retailer can specify deadlines and the associated SEPA payment procedure (see basics). In combination with a SEPA Instant Payment, the merchant can dispose the money at the same time. This means that R2P is as secure for the retailer as payment in advance but much faster: 10 seconds.

In addition, the transaction limit of € 100,000 is very, very high in comparison.

Another possibillity is the immedate recognition of the claim, but deferred payment e.g. upon receipt of the goods. If R2P is connected to a SEPA direct debit (SDD), subscriptions or installment purchase are possible too.

Request to Pay with SEPA Proxy Lookup and E-Billing

Another way to make the process even more convienient for the shopper is the SEPA Proxy Lookup Service (SPL). If the buyer has stored his e-mail adress or telephone number in SPL (in his banking app) he does not need to enter it during the check out again. The merchant can “lookup” the IBAN via his bank in SPL and initiate the R2P transaction.

An R2P message has free fields for invoice data. There are certainly limits to this when making purchases with many items, but there are far more options than the familiar fields in the purpose of a SEPA payment method or a credit card.

Request to Pay in e-commerce: when and how can I use it?

The implementation of R2P at the respective house bank is decisive for the use for buyers and sellers. Banks are currently not obliged to implement R2P, so a shift to another bank might be necessary.

Apart from your own bank, no other service provider is required. A complex integration in accordance with PCI DSS as with credit cards is not necessary. An IBAN is of course to be handled responsibly in the sense of the GDPR, but not stricter than the other data of the buyer. Consequently is the technical implementation of R2P very easy for an online shop.

Advantages over other payment methods for online business

The main difference to the other payment methods in online trading is the directness. Neither buyers nor sellers need an intermediary because both parties act exclusively with their respective bank. So there are no additional costs, no new processes or contractual commitments.

This directness results in legal certainty for the seller too. If a buyer recognizes an R2P claim, this is done in the e-banking application at his bank. The acknowledgment of the claim is linked to the payment, i.e. mix-ups are impossible. E-banking offers must meet the PSD2 requirements, i.e. This means that the recognition of the claim already has the same level of security as the payment itself.

If SCT Inst is connected to R2P as a payment method, the merchant has his money directly available in his account, i.e. he does not have to wait for the settlement of an acquirer or collector. The account reconciliation for such payouts is also omitted.

R2P cannot be beaten in terms of convenience and security either, as the parties only act in their familiar banking application.

Request to Pay in e-commerce: what does it cost?

A request to pay transaction costs the sending bank a direct fee (currently € 0.0025) at the Bundesbank. For the related SEPA payment method, an amount in the same range will be charged again. The fees for interbank payments are usually Quantity-dependent, i.e. there may be deviations downwards here.

The more decisive question is how much fees the banks charge their respective customers for an R2P transaction. There is of course no specification for this in the R2P scheme, but a market price should be formed in the competition between banks. As with the other payment methods, it can be expected that the buyer will bear no (or low) costs. The merchant’s bank is expected to charge a higher transaction fee.

Share