An article by

Andreas Wegmann

Published on

11/05/2022

Updated on

11/05/2022

Reading time

3 min

Table of content

The EPC Scheme Rulebook for SEPA Request to Pay (SRTP) has been available since June 2020 after many years of discussion in advance. There is now a second edition and the interbank infrastructure for processing is also in operation. The topic is much discussed because companies and retailers hope for lower fees in payment transactions and more options for automation (e.g. billing data). The European dependence on US credit cards and US wallet solutions is also threatening from a political point of view. Are the Europeans launching a payment solution liberation with SRTP?

What is SEPA Request to Pay and what isn’t?

Many posts give the impression that SEPA Request to Pay is a payment method. In fact, SRTP is “only” the recognition of a transaction whose associated (SEPA) payment is made afterwards. SRTP is therefore an addition to the existing SEPA payment methods and can only be used in combination with them.

In combination with a SEPA Instant Payment transaction, SRTP actually has the potential to replace a credit card payment, but unfortunately that’s not all.

Well done or just well meant?

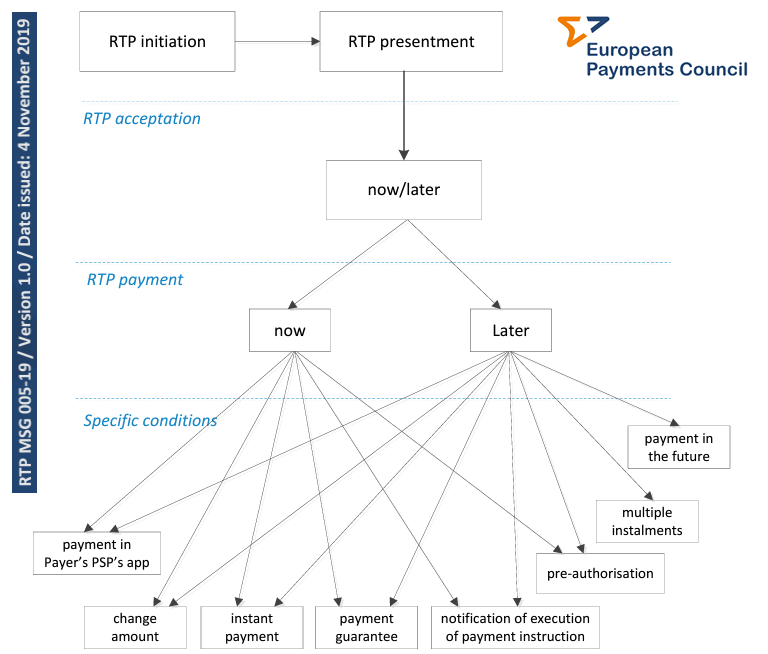

Understandably, the creators of the SEPA Request to Pay “Scheme” have tried to provide a multifunctional and flexible framework so that all conceivable business cases can be covered. In version 1.0 of the Rules Book there was a graph of this:

A request can therefore be defined for an immediate or later payment. The amount may change, payment in installments may be possible, or a guarantee or pre-authorization for a payment may be requested. Of course, this variety of possibilities pleases retailers and companies, because every conceivable business case for online shops and retail stores is covered.

This colorful bouquet of possibilities is difficult to convey to an inexperienced customer (= payer) and can hardly be implemented in a banking app. Many core banking systems cannot easily e.g. map delayed payment guarantees. In retail banking, SEPA Request to Pay is a nightmare for banks.

Safe shopping for Portuguese people in Finland?

The German advertising claim of 2010: “Sichererer” (this is a modification of the German word for “secure”) from PayPal was motivated by a truism in payments business: whoever has the customer gets the merchant. No payment method has ever prevailed without offering the customer a tangible advantage. With SEPA Request to Pay, the “payer” is only an actor, but not a customer. The scheme therefore also leaves out any consideration of disputes, so that a payer will prefer to use a credit card or PayPal if he does not trust the seller 100%. Especially in cross-border online business, there is a need for a fair dispute handling and a quick sorting out of black sheeps.

Who makes money from SEPA Request to Pay?

The SRTP Rule Book also leaves the question of the business case to the participating banks. The corporate customer department of a bank can usually still imagine profits from the transactions. The IT service providers required for the implementation sense very concrete business from lengthy projects. It is from this camp that the voices come that urge banks to implement SRTP quickly, because otherwise market shares are said to be lost.

In the private customer departments, no SRTP-related migration of customers has yet been identified and they are more likely to enjoy the income from the card business (interchange fee). The (card) dove in the hand is better here than the (SRTP) sparrow on the roof.

Which path will SRTP take?

The Eurosystem is definitely a success story and an elementary part of the EU – at least from the point of view of the citizens. Banks are mourning lost earnings from (EU) currency business and cross-border (EU) payments. As a company, they must strive for economic success and, if possible, influence political decisions for this purpose.

Whether the financial world intentionally wants to prevent the political initiative for SEPA Request to Pay according to the motto “If you can’t convince them, confuse them” (Harry S. Truman) is speculation. Superficially, the banks are drivers of SRTP in the form of the EPC. What is certain, however, is that no bank can make large investments unless there is a clear advantage for its own shareholders.

It also seems inconceivable that EU citizens use a less advantageous payment method due to EU patriotism. SRTP solves a problem that nobody has.

Least implausible for a SRTP success seems to be the possibility that politicians will “decree” its use, as has happened with SEPA as a whole.

What speaks against a forced marriage between the SRTP authorization in each SEPA transaction? Answer: a reasonably transparent payment transaction processing.

Unfortunately, SRTP will probably not be a cause for concern among credit card and wallet solution providers for the foreseeable future.

Share