An article by

Andreas Wegmann

Published on

08/02/2024

Updated on

09/02/2024

Reading time

3 min

The SEPA banks must regularly provide all kinds of statistical data to their respective national banks. The ECB turns this into a publicly accessible portal that also contains data on cashless payment transactions. Unfortunately, it takes some getting used to. Fortunately, the ECB also publishes additional reports so that the average person can also gain insights from them. The Bundesbank in turn publishes these reports in the most widely spoken language in the EU: German.

The EU’s major clearing systems

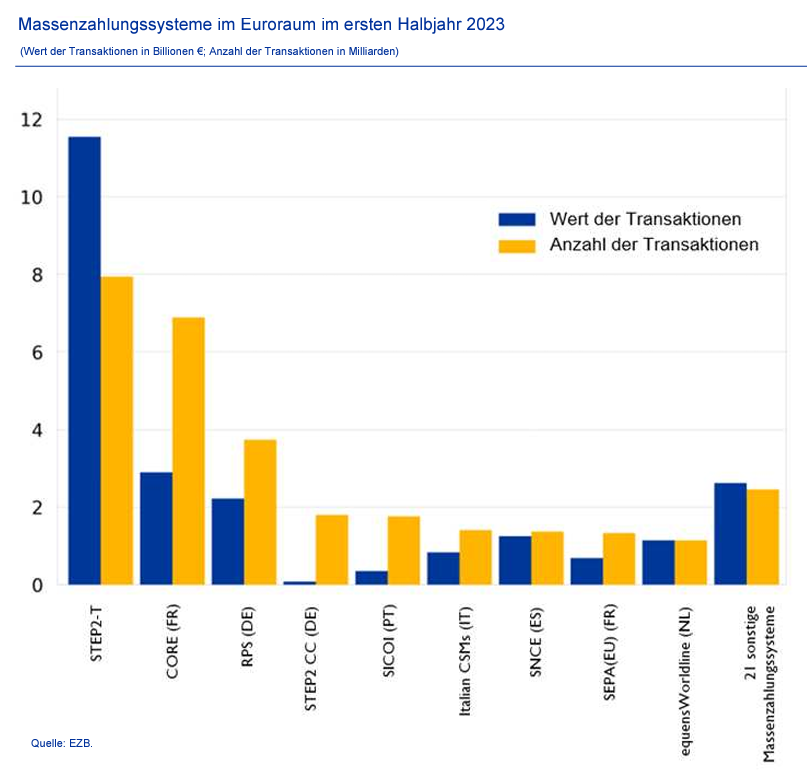

While the total number of transactions has risen by over 10%, their value has fallen by 4.5% compared to the same period last year. This is an indication of a weakening economy coupled with increasing acceptance of cashless payments. On average, a cashless transaction in the first half of 2023 had a value of €1,662. The statistics are collected across all Euro clearing systems in the EU, which serve different purposes and therefore also have different average transaction values. The data from the SEPA clearer of the Deutsche Bundesbank can be found under “RPS (DE)” (Retail Payment System) in the illustration. The predominantly German transactions also include “STEP2 CC (DE)“. This EBA clearing service has mainly German members who process their card payments there.

Dip in direct debit

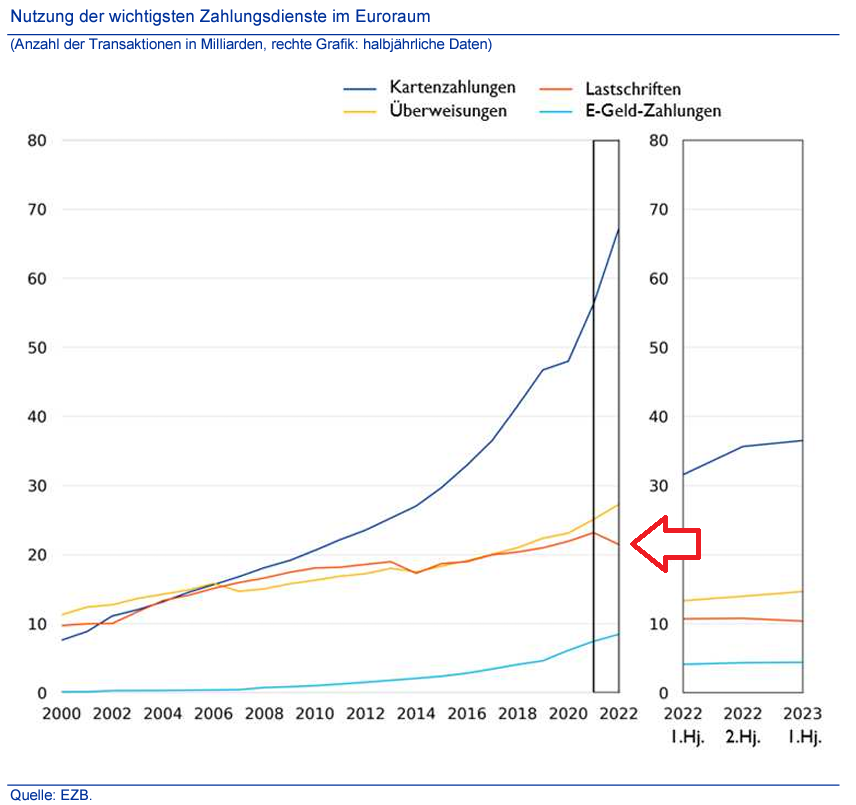

When looking at the development of the different payment methods, a significant decline (3.1%) against the trend in direct debit transactions is noticeable.

The total value of direct debits rose by an incredible 27.1% in the same period! The average transaction value therefore increased by more than €100 to €461 per direct debit.

Unfortunately, we can only speculate about the cause, as the exact origin of the transactions is not reported. For example, anyone who uses Google Pay on their smartphone, backed with a PayPal account and in turn has their PayPal account topped up by direct debit from their SEPA bank account produces a transaction in the above statistics.

A look at the individual SEPA countries shows a rather even decline and not a significant deviation in a single country. With a share of 33.5% of cashless payment transactions, SEPA SDD continues to be the most widespread in Germany. Usage is typically focussed on continuing obligations, e.g. payments for rent, utilities or subscriptions. This may be one of the reasons for the decline: consumers are reducing their spending on subscriptions in the face of a weaker economy. At the same time, some companies may have switched direct debit customers to other payment methods in the event of payment problems.

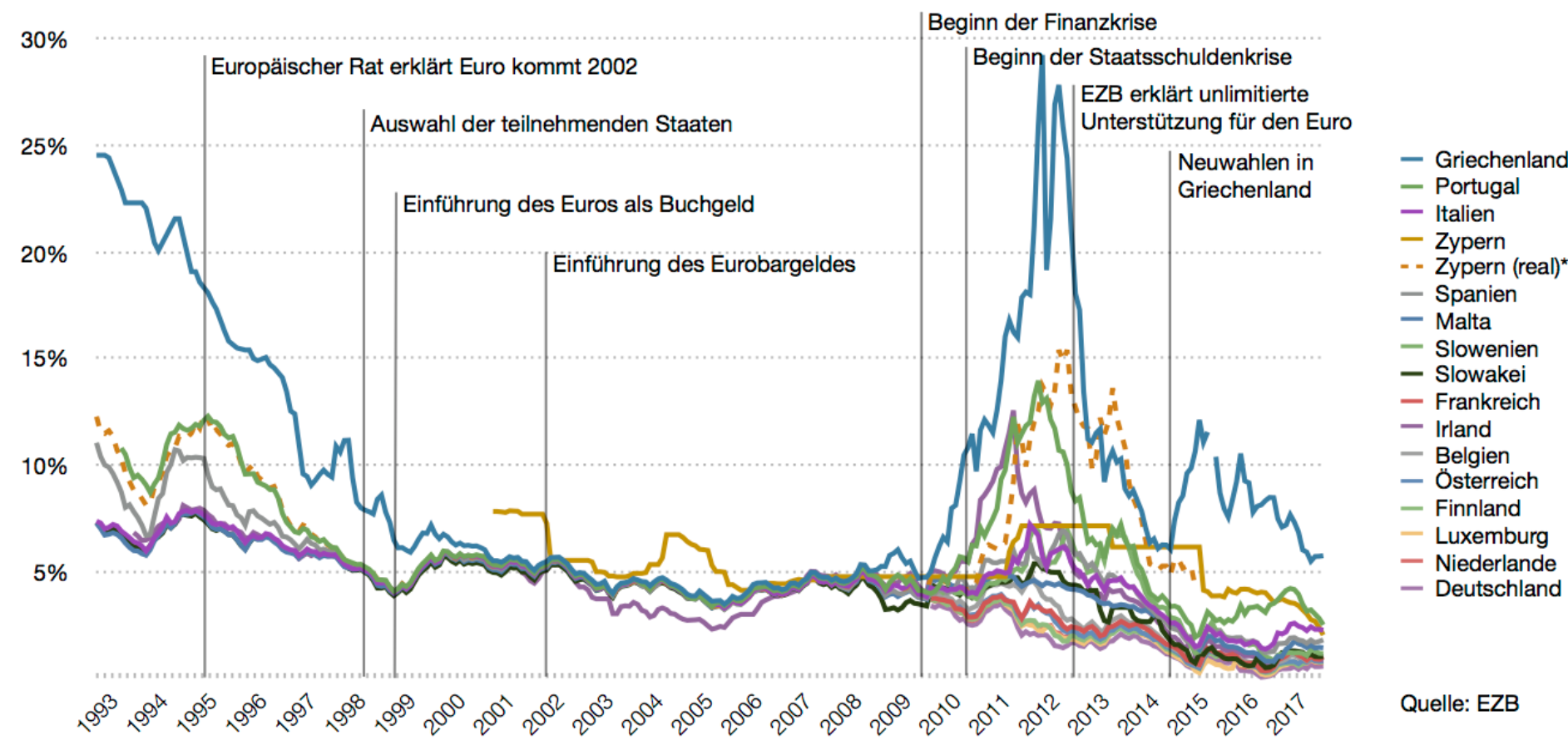

Zinskonvergenz und -divergenz: Renditen 10-jähriger Staatsanleihen von Mitgliedern der Eurozone

The dip in 2013 would be an indication of this: at that time, the economic trend was significantly dampened by the euro crisis. It remains to be seen whether the “dent” will “bulge out” again when the economic outlook improves.

If you have any questions about SEPA direct debits or are looking for a solution for processing them, we look forward to hearing from you.

Share