An article by

Andreas Wegmann

Published on

04/11/2022

Updated on

03/11/2023

Reading time

3 min

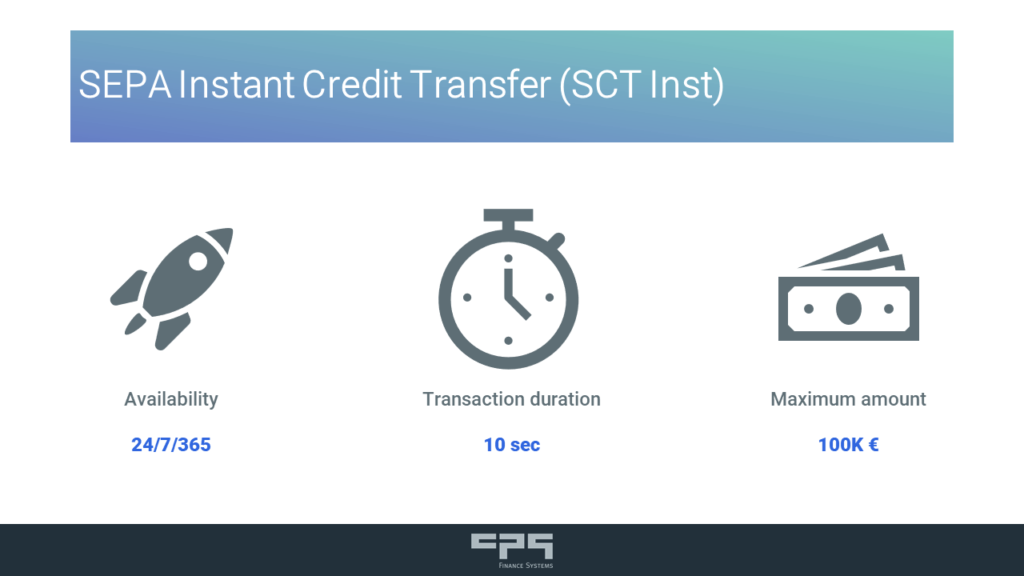

SEPA Instant Payments (SCT Inst – real-time payments) will become mandatory for SEPA banks. “Real-time payments are a matter of course nowadays and should not cost anything either.” Anyone who thinks this way has not dealt with the payment transactions of banks. This article gives an insight.

Are real time payments a step forward?

For many people, the EU’s commitment to SCT Inst for European banks is long overdue. “If a sum of money takes hours or days to be transferred from one account to another, it’s because the banks’ IT systems are outdated.” That’s what many people think, or something like it, but it’s only partly true. Of course, banks are not wasteful with their IT budgets, but in payments there is another aspect that is overlooked: liquidity.

A bank does not have unlimited funds at its disposal, but has to obtain them from the owners, from customers (as deposits) or even from the National Bank. All this is not for free, but there are capital costs. The higher the interest rates, the higher the costs.

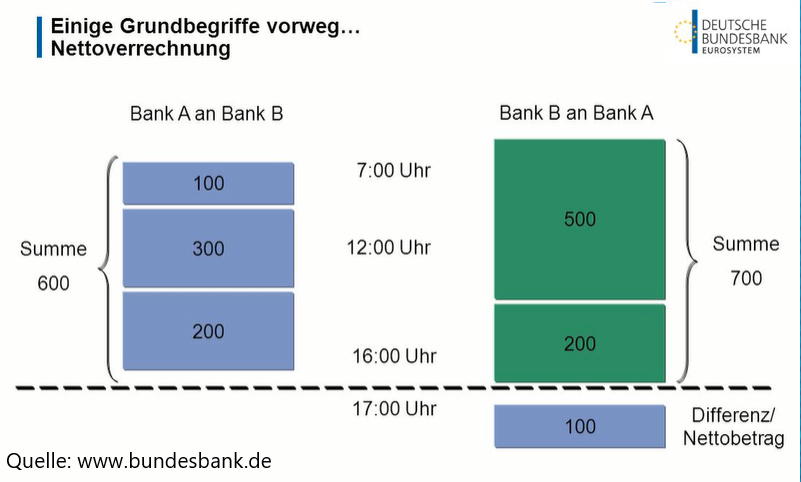

To minimise these costs, modern clearing and settlement systems work on the principle of net settlement. The incoming and outgoing payments of each participant are cyclically offset against each other, so that at the end of the day each participant only has to make up its difference.

Net settlement is not possible for SCT Inst. The liquidity requirement is higher for the participants.

Liquidity management with SCT Inst

When clearing with net settlement systems, the participant only needs to look at the history of the daily balances to make a plan. Gross settlement with SCT Inst (clearing either by TIPS or RT1), on the other hand, forces a much more precise analysis. If, for example, there are corporate customers who instruct many payments at the end of the month, there are large peaks in demand that need to be covered.

In addition, real-time payments suddenly require a 24x7x365 way of working. While, for example, the system for retail payments of the Bundesbank (SEPA Clearer) virtually only settles during office hours, SCT Inst transactions must be possible around the clock according to the conditions of participation. Since an emergency team must be on standby, the personnel costs increase.

Incidentally, the Bundesbank’s SEPA Clearer is also exemplary in terms of costs: a bulk file with up to 100,000 transactions costs only €0.0025. The costs of a SEPA Instant Payment transaction are around 1 cent per transaction (depending on the volume).

A horror scenario is now an extraordinary event on a weekend that causes unusually high credit transfers by customers. If the clearing system for the participant has no credit balance, his payments will not be executed. With the SEPA clearer, a participant would have until the end of the day (weekdays) to provide liquidity, but with SEPA instant payments there is no such time. As a result, the bank may not be considered solvent by its customers and the problem increases.

SCT Inst therefore causes higher direct and indirect costs for banks, which ultimately have to be passed on to the customers. A particular disadvantage arises for small banks, as they can spread the effort over fewer shoulders. This EU regulation will also play into the hands of the big banks.

Share