An article by

Andreas Wegmann

Published on

25/10/2022

Updated on

03/11/2023

Reading time

2 min

The banks of the Euro area will get a payments clearing system and securities trading on 20 March 2023. This new market infrastructure of the European Central Bank replaces the previous TARGET2 system. This article gives a simplified overview of the most important innovations and terms of “T2/T2S”.

What changes when switching from TARGET2 to T2/T2S?

Many experts had expected that after TARGET and TARGET2, TARGET3 would now be the new name for the ECB’s renewed market infrastructure. However, the new system is much more than the old TARGET2, because it not only processes large-value payments, but also integrates the real-time payment system (TIPS) and securities settlement (T2S). Consequently, the migration project is called T2/T2S consolidation. Here are the main changes for participants:

- SWIFT’s monopoly for access to the T2/T2S system is broken,

- the account structure is changed and

- transactions are processed in ISO 20022 format.

Ancillary systems of individual national banks such as the SEPA Clearer (retail payments) of the Deutsche Bundesbank are not affected by changes with regard to their control. However, liquidity for such ancillary systems is supplied from T2.

Structure and components of the new TARGET system

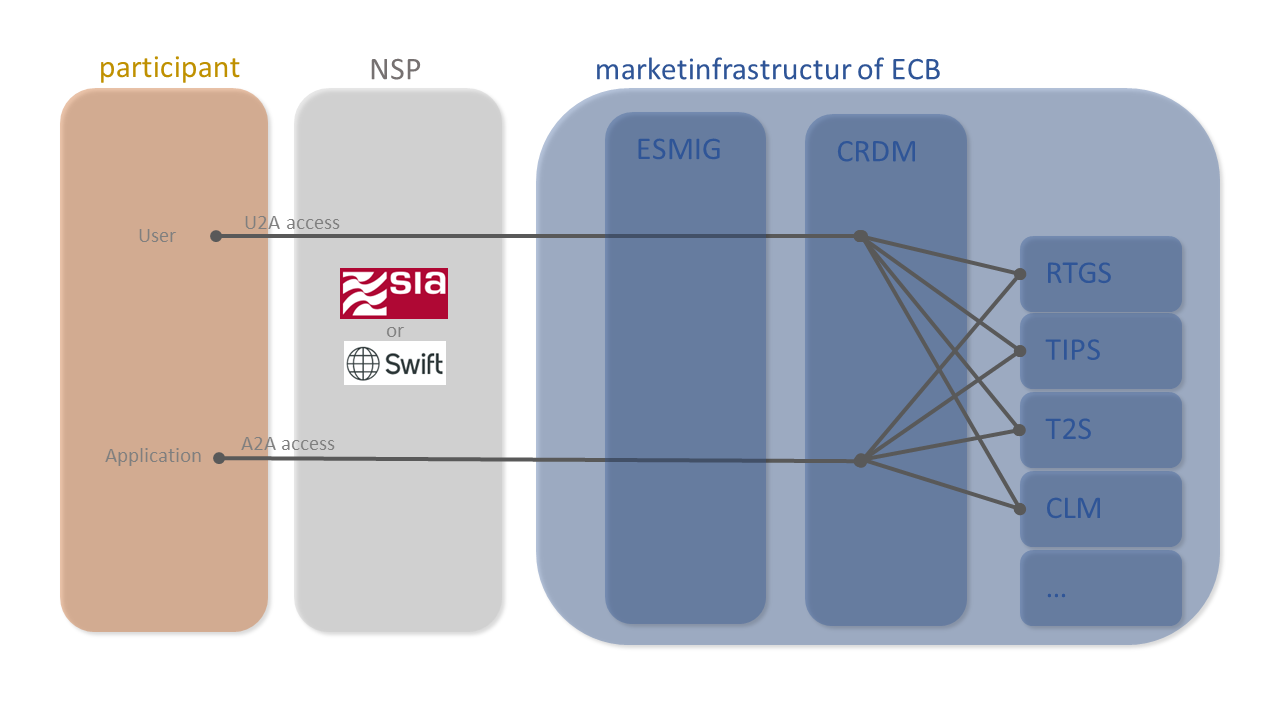

The T2/T2S participants, vulgo “banks”, must conclude a contract with a Network Service Provider (NSP). Currently, two companies are certified for this: SWIFT and SIA (Nexi Group). The NSP is responsible for secure communication with the TARGET system.

In principle, access can be made by a user, i.e. the activities can be carried out manually in a user interface. More efficient and automatable are accesses with a software system (application) such as CPG.classic. Accordingly, a distinction is made between U2A and A2A accesses.

The main components of the system are:

- ESMIG – Eurosystem Single Market Infrastructure Gateway

ESMIG is the “gateway” through which all U and A actions must pass. It checks whether the participant is generally authorised to access the system. The schema validation of the XML messages is also carried out here. - CRDM – Common Reference Data Management

This module contains the master data administration for T2, T2S and TIPS. Each participant can, for example, configure reports, carry out user administration and make a variety of other settings here. For every action in the system, the CRDM checks whether the user has the corresponding authorisation. - RTGS – Real Time Gross Settlement

The same-day transmission of large amounts is carried out in RTGS. This module thus replaces the TARGET2 platform, which will be decommissioned during the migration. - T2S – TARGET2 Securities

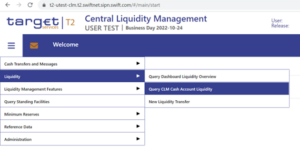

Eurosystem participants can carry out securities transactions in central bank money using this service. - CLM – Central Liquidity Management

As written above, the participants can centrally manage the liquidity for the individual services. The central bank functions are also located here (management of the minimum reserve, credit line, etc.). This module is therefore essential for every participant.

Share