An article by

Andreas Wegmann

Published on

01/06/2023

Updated on

05/11/2023

Reading time

3 min

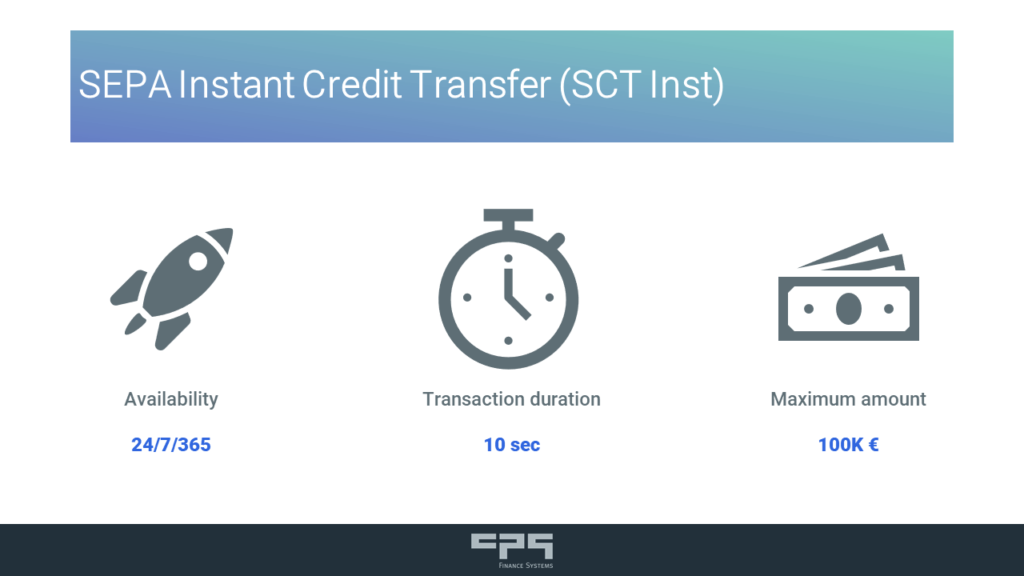

The new One-Leg Out Instant Credit Transfer (SEPA OLO or OCT Inst) clearing service will significantly change the ECB’s market infrastructure. Until now, only Euro payments were possible in the TARGET system, but as early as November 2023, the currency barrier will fall. With SEPA OLO, a party (i.e. “one-leg”), whether sender or receiver, is not in the euro zone (i.e. “out”). In the future, a SEPA account holder should be able to settle his foreign payment transactions just as quickly and easily as is possible in the Euro zone with SEPA Instant Payments. Whether and how quickly the new service will be used is currently difficult to assess. This article sheds light on a few aspects.

Instant payments for cross currency transactions?

When banks make currency transactions, they like to take their time. The reason is not old, slow computers or sleepy employees, but waiting for the right moment to buy or sell. The profit in foreign exchange trading is not achieved by fast settlement, but by skillful action on spot and futures markets.

Real-time transactions naturally stand in the way of such a strategy, and it has therefore surprised many market participants that the EPC has geared the new One-Leg out Clearing towards this. In its market survey, the EPC has recognized the need for this: not only companies, but also banks want real-time payments for cross-currency transactions.

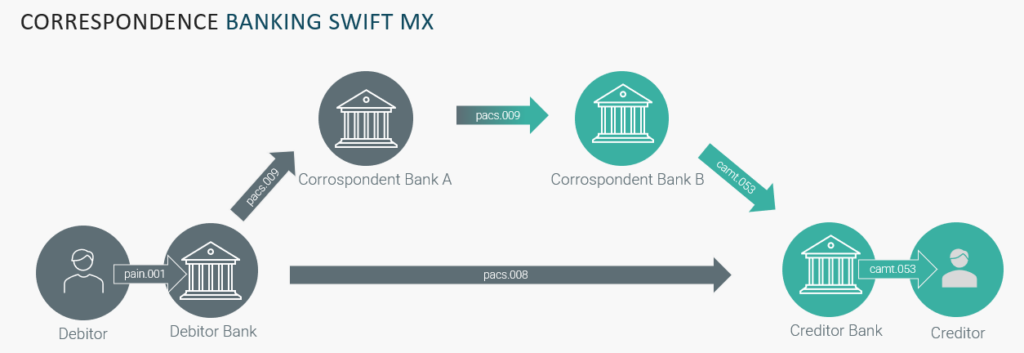

SWIFT’s correspondent banking business

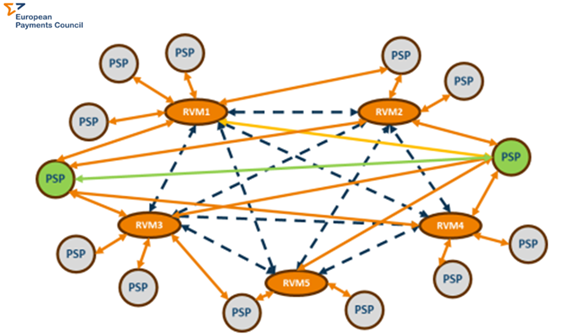

As is well known, fiat money cannot leave the country, i.e. if a SEPA bank wants to handle US$, for example, the transactions must be backed by the U.S. central bank. It is only worthwhile for a few large banks to maintain their own foreign subsidiaries for this purpose. Smaller banks have to rely on so-called nostro accounts at other banks.

There are about 200 banks worldwide that operate this business more or less intensively and SWIFT is usually used for communication. How fast the correspondent bank processes the payment is not specified in this system. Banks with large business volumes have both a cost advantage in maintaining the network of partner banks and more experience in optimization. Corporate customers that rely on fast cross-currency transactions for their liquidity management complain of a banking oligopoly.

Fintechs, Neobanks and Specialized Banks

Of course, many companies have already discovered the growing need for cross-border cross-currency transactions and have specialized in them. Solutions for private or business customers are offered on the basis of their own branches or partner banks, but other banks are often among the target customers as well.

Of course, many companies have already discovered the growing need for cross-border cross-currency transactions and have specialized in them. Solutions for private or business customers are offered on the basis of their own branches or partner banks, but other banks are often among the target customers as well.

With its foundation in 1852, Western Union is probably the oldest representative in this segment. Wise (formerly Transferwise), Remitly or Thunes are the more modern players in this industry. Finally, Ripple also belongs to this category, although the basis of clearing here is its own cryptocurrency.

What does SEPA OLO mean for Europe?

SEPA OLO will undoubtedly mean advantages for companies in the euro area in foreign payment transactions.

SEPA OLO will undoubtedly mean advantages for companies in the euro area in foreign payment transactions.

Example wage payments for factories in the non-euro area:

- today, money is transferred abroad, converted in the process, and then domestic transfers are made from there using a local account.

- In the future, all wages worldwide can be instructed from (Euro) headquarters – in Euros, in real time, 24/7/365 and without a foreign bank account.

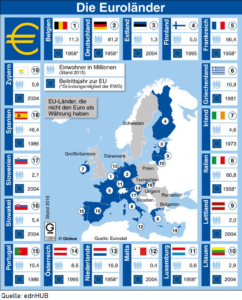

EU countries that are not participating in SEPA and whose economies are therefore struggling with the currency hurdle will be looking to connect their real-time capable clearing systems to SEPA OLO clearing. The same is certainly true for countries with high trade volumes with the EU and the economies of the “two legs” will benefit equally.

The EPC’s specifications in the SEPA Rulebook do not impose any restriction on participants or currencies, so perhaps every tradable currency in the world will sooner or later be accessible in the TARGET system.

The importance of a currency increases with its trading volume and therefore the Euro as a currency will undoubtedly benefit from SEPA OLO. Whether the existing players in foreign exchange trading will become part of the new infrastructure or whether other financial service providers will be the winners remains to be seen.

Share