An article by

Andreas Wegmann

Published on

03/03/2022

Updated on

03/11/2023

Reading time

3 min

SEPA direct debits (SDD) are generally delivered and settled at different times. This is the design of the SDD scheme and is confusing many people. In addition, the different CSMs in Europe have different time frames for processing. This article explains the interaction of the SDD (CORE) timelines and deadlines, based on the German Bundesbank clearing system for retail payments.

Due Date and Settlement Date

SDD transaction handling requires a good understanding of these two terms:

due date (ReqdColltnDt)

The SDD Schemes allow payers and billers to anticipate the precise date (due date), when their account will be debited or credited, respectively. The due date is assigned by the creditor.

Interbank settlement date (IntrBkSttlmDt) – ISD

Interbank settlement date must be a business day of the SEPA Clearer (SCL). It is possible to set the date up to 14 calendar days in the future. If the date of at least one transaction lies in the past or can not be reached the transaction will be rejected

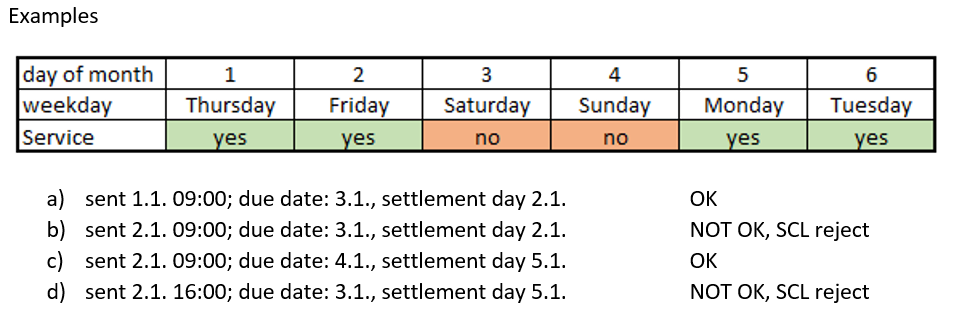

In the SEPA Clearer direct debits are also processed where the SEPA due date (ReqdColltnDt) falls on a Saturday, Sunday or a TARGET holiday. Settlement then takes place on the following TARGET2 banking day. It is important to know that due date and ISD may not differ more than -1 day.

Transaction b) is rejected by the SEPA Clearer because ISD is not one day in advance.

Transaction d) is rejected because due date differs more than one day to ISD.

Many banks in Germany don´t have a complex SDD scheduling. The easy way is to change the due date to the ISD and send it at least two SEPA Clearer workingdays in advance.

SDD Timelines for R-Transactions

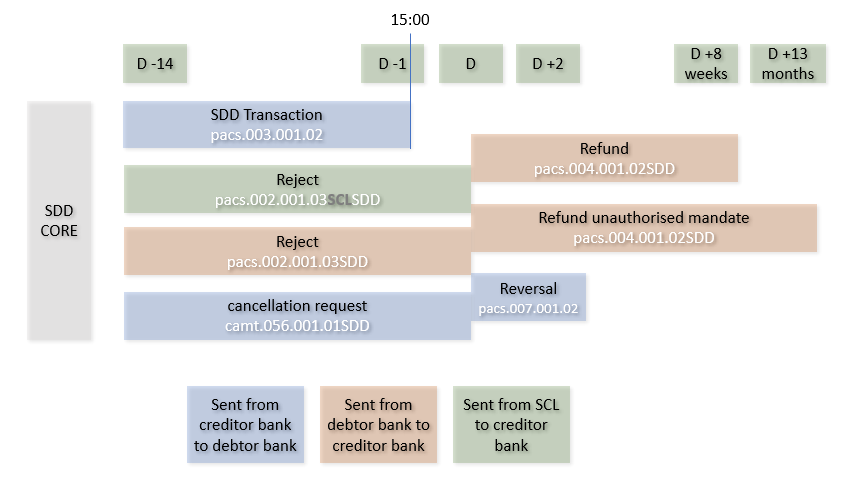

The SEPA Clearer will not send a positive confirmation for a SDD transaction but R-transactions may occour. There are different time windows for these kind of transactions:

pacs.003.001.02 – SDD

original message SEPA direct debit

pacs.002.001.03SCL – rejection (not part of the EPC specifications)

Rejection from the SEPA-Clearer; a payment system should not receive those kinds of messages when a proper validation for pacs.003 is in place.

pacs.002.001.03 – rejection

Rejection prior to settlement by the debtor bank to the creditor bank via the SEPA-Clearer (e.g. account does not exist).

pacs.004.001.02 – return/refund

Return after settlement by the debtor bank. If the debtor initiates the refund of a SDD (e.g. he believes the transaction is unjustified), the debtor bank sends this refund back in the form of a return. The debtor bank will not examine the complaint in any way. At SCL, the amount will be returned to the debtor bank.

The debtor bank can impose compensation in this message (CompstnAmt). The compensation is also deducted from the SCL account of the creditor bank.

camt.056.001.01 – cancellation request (not part of the EPC specifications)

Recall/cancellation of SEPA direct debits prior to settlement by the creditor bank. There will be no positive answer to this request. A negative answer will be a pacs.004. That means the SDD could not be stopped before settlement but will be refunded.

pacs.007.001.02 – reversal

Reimbursement of the countervalue of the direct debit by the creditor bank (e.g. double processing) or the creditor (e.g. undo deal) after settlement.

Modern payment systems such as CPG.classic can handle the whole processing cycles with the SEPA Clearer. If you need more information please use our contact form.

Share