An article by

Dr. Martin Berger

Published on

18/02/2022

Updated on

09/11/2023

Reading time

4 min

Table of content

In February 2022 we will once again look at instant payment progress, the current participation of banks in interbank payments for SEPA Instant Payment and current relevant news on the same topic. As background information for more in-depth information, you will find the essential features of SEPA instant credit transfers in our article SEPA Instant Credit Transfer: Transfers up to € 100K in 10 seconds.

Latest news

9th of February 2022: On the edge of fintech & Regulation Conference, Mairead McGuinness, Commissioner for Financial Services, Financial Stability and Capital Markets Union in the EU Commission, confirmed in a tweet that the EU Commission will present a legislative initiative to accelerate the introduction of instant payments in the second half of 2022:

Today I’m confirming the Commission will present a legislative initiative on instant payments in the second half of 2022 💶

We need this to accelerate the roll-out of instant payments in the EU.

Starting the day with a fireside chat at the #FinTech and Regulation Conference. pic.twitter.com/lbxbA7idA4

— Mairead McGuinness (@McGuinnessEU) February 9, 2022

Instant payment progress: Comparison of SCT Inst vs. SCT participation in the SEPA area

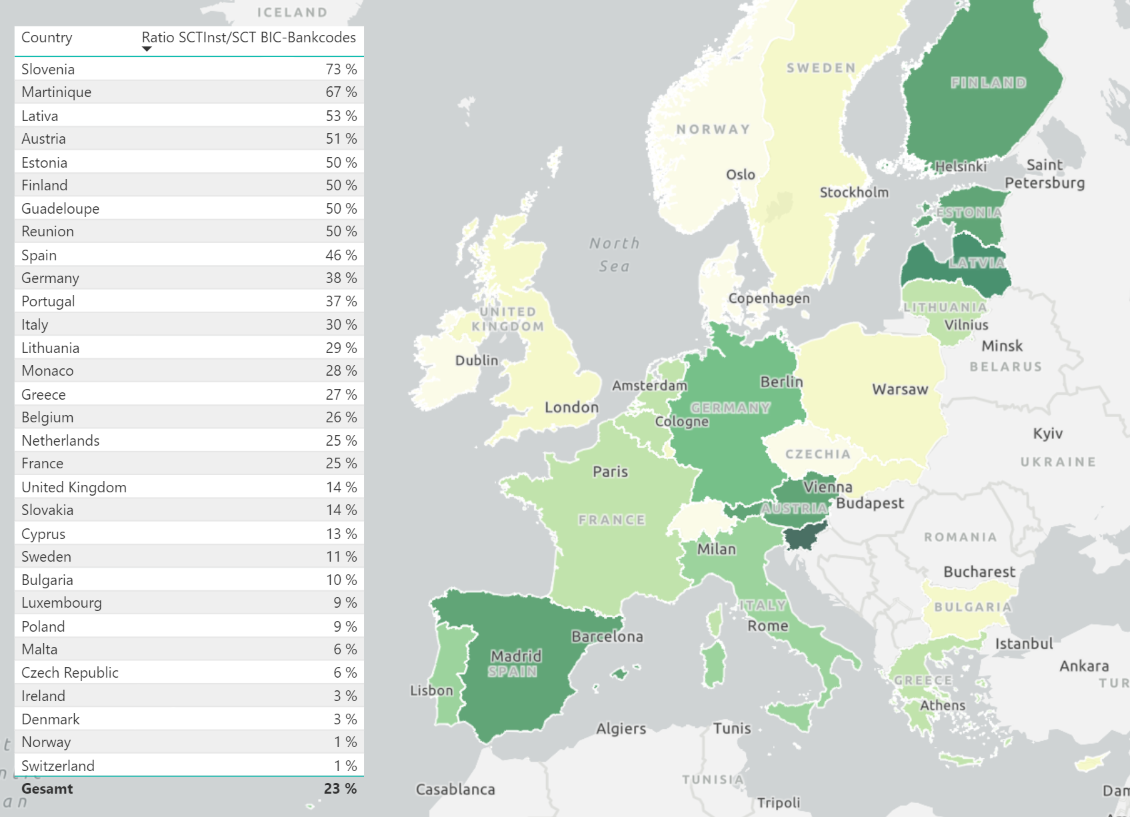

Based on the data from ECB, from EBA Clearing and the Bundesbank’s directory of available payment service providers, the total number of payment service providers participating in SCT in the SEPA countries (measured using their BIC bank codes) is set in relation to the number of those opted for SEPA Instant participation. The following figure shows the comparision:

Comparison of the SCT vs. SCT Instant number of participants (counted according to unique BIC bank codes) per SEPA country in February 2022.

Instant payment progress: Number of BIC bank code participants in TIPS and RT1

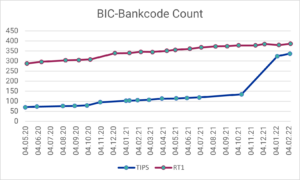

The following figure shows the number of BIC bank codes participating in TIPS and RT1 in the period from May 2020 to February 2022. The significant increase in TIPS participants is probably due to the updated rules for SEPA Instant.

Instant payment progress: Number of BIC bank codes connected to TIPS or RT1 in the period May 2020 – February 2022 (data sources: EZB, EBA Clearing)

Statistics from EBA Clearing

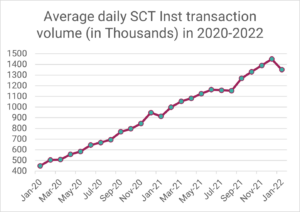

The following figure shows the average daily SEPA Instant transaction volume processed via RT1 from January 2020 to January 2022.

Instant payment progress for R1: Average daily SCT Inst transaction volume in 2020-2022

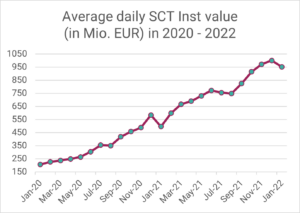

The following figure shows the average daily SEPA Inst volume in EUR million processed via RT1 from January 2020 to January 2022.

Instant payment progress for R1: Average daily SEPA SCT Inst value in EUR million in 2020-2022

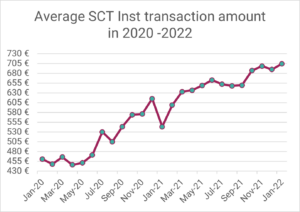

The following figure shows the average transfer amount for instant transfers for the period January 2020 to January 2022:

Instant payment progress for R1: Average transfer amount in EUR in 2020-2022

Are you as a bank interested in software solutions for processing SEPA instant credit transfers?

CPG.instant as a software solution for connecting core banking systems to TIPS or RT1 in interbank payments

Among other things, we offer a high-performance software solution CPG.instant for processing SCT Inst transfers, which allow your bank to flexibly connect one or more core banking systems and clear SEPA instant payments accordingly via interfaces to TIPS or RT1.

If you have any questions or suggestions or you are interested in the topic of payment transactions, instant payment and related software products, please do not hesitate to contact us.

This article is part of a bi-monthly series and appears in our blog category on SEPA instant payments.

External data sources:

- ECB TIPS facts (07.02.2022)

- EBA Clearing RT1 participants (07.02.2022)

- Bundesbank Verzeichnis der erreichbaren Zahlungsdienstleister (14.02.2022)

Share