Published on

22/04/2022

Updated on

03/11/2023

Reading time

2 min

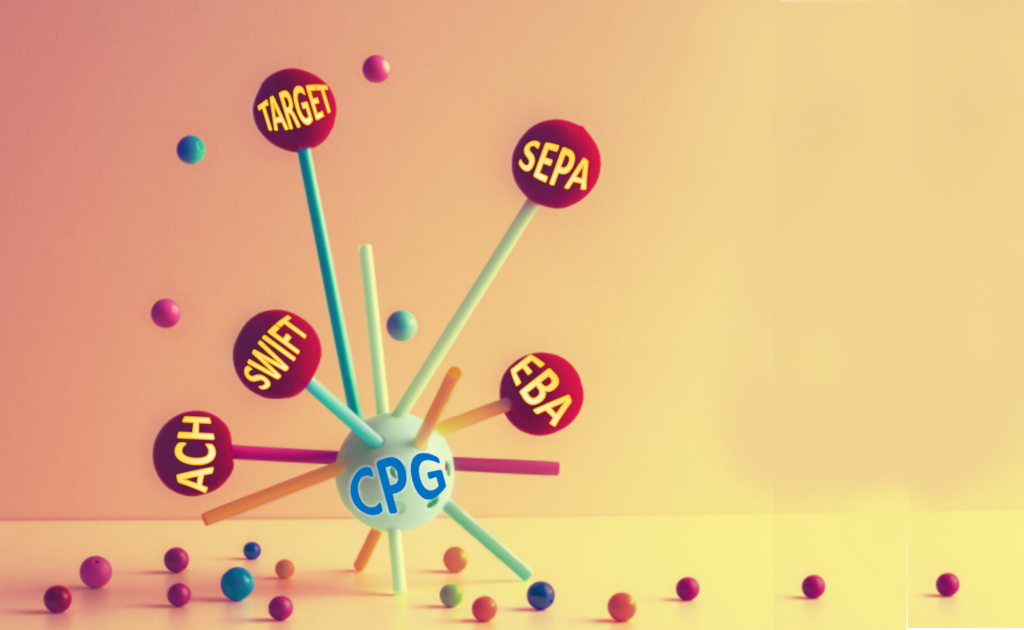

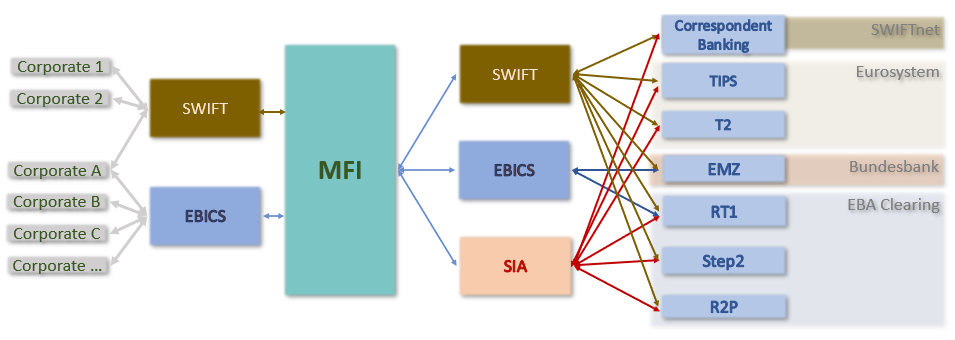

Anyone who works in European cashless payment transactions will be able to classify the terms EBICS and SWIFT. And no, the two things cannot be meaningfully compared. However, SWIFT and EBICS compete in one aspect: the connection to the SEPA Clearer (the clearing system for electronic retail payment transactions of the Deutsche Bundesbank).

Vor- und Nachteile von SWIFT

As explained in an earlier post (see here), SWIFT’s basic task is the transmission of messages between financial institutions. The Eurosystem is important, but by no means everything. Depending on the region and business strategy, a bank can only process its payment transactions using SWIFT. The big advantage here is having only one transfer point for transactions. The bank’s own systems therefore do not have to deal with various external systems. However, this advantage can also be viewed as a major disadvantage: SWIFT becomes the “single point of failure” for payment transactions. Not least because of this, with the consolidation of the TARGET2 system, an alternative communication channel via SIA (Nexi Group) is being established. The Eurosystem should not be 100% dependent on SWIFT and many banks want it that way. The danger of espionage emanating from SWIFT is hardly less relevant (see “Global surveillance disclosures“). Anyone listening to SWIFT can analyze the financial situation of banks, companies and entire countries and also misuse it for their own purposes.

Wozu EBICS?

EBICS was also dealt with in an earlier article (see here). It is “only” an open communication standard with German roots. The aim of the German banks was to create an efficient and cost-effective communication channel for financial transactions. The disclosure of the standard means that anyone can theoretically build their own EBICS server. In reality, this does not make economic sense. There are some providers on the market who compete with each other and ensure prices are in line with the market. Banks usually pay a license price and can then send and receive unlimited messages. With the monopolist SWIFT, every transaction has its price and is therefore an expensive solution for bulk payments. EBICS is not only becoming more widespread in interbank payment transactions, but also in communication between companies and banks. EBICS is necessary for banks with a focus on business customers, even if only in a scaled-down version.

SWIFT oder EBICS – was ist besser?

The question “which is better?” does not arise, since a bank can hardly do without SWIFT. Only a combination of the connection of SIA and EBICS could cover the needs of most financial institutions. EBICS is therefore more of a means of saving costs and avoiding one-sided dependencies. It is easy to calculate whether the use of EBICS is worthwhile – just look at the SWIFT statement. The operation of an EBICS server pays off very fast with higher transaction numbers. Speaking of fast: EBA-Clearing offers an EBICS connection to their RT1 service for SEPA Instant Payments.

Modern payment systems such as CPG.classic offer banks complete flexibility when connecting to the relevant clearing systems. Thanks to flexible payment routes, payment transaction costs can be optimized and system failures bridged. For more information please use our contact form.

Share