An article by

Andreas Wegmann

Published on

02/12/2020

Updated on

08/12/2020

Reading time

3 min

Corporate or purchasing cards are an essential part of the credit card world. Companies can simplify the billing of business expenses and at the same time allow more convenient procurement. Of course, the “plastic” medium of these company cards will be replaced by the mobile phone. The opportunity should be used to switch from the expensive credit card scheme to SEPA Request to Pay.

SEPA Request to Pay instead of a company credit card

The motivation for introducing corporate credit cards is always to automate billing and reconciliation. The purchasing card in the USA was also created for this reason. The principle experienced its breakthrough with its introduction in the Pentagon. Internal studies had shown that the cost of the approval process for the procurement of office supplies exceeded the value of the material. The employees were given a purchasing card with their own budget and they could then procure the necessary pencils themselves. The cards are limited in use to the sectors typical for business expenses. Each point of acceptance (merchant) is classified using a code (Merchant Category Code – MCC) and this code is part of the transaction data. With the MCC, categories of card transactions can be recognized and thus booked more easily,

If a company wants to issue corporate credit cards, it has to work with an issuing bank. The regulations of the credit card world must be adhered to, i.e. the identification of the cardholder, the process for payment, billing and payout are specified. A separate subsystem is created for the company card handling in the company.

The merchant fees are highest with this type of card and therefore they are not so popular with merchants.

With Request to Pay, a company can fulfill the same function via a SEPA service with its main bank.

SEPA Request to Pay – How Does It Work for Expenses?

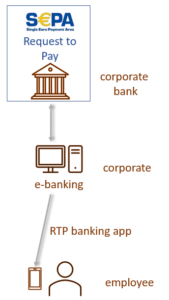

Banks with a focus on corporate banking will enable the administration of sub-accounts for employees in their e-banking application. An associated banking app can then be issued to employees via the e-banking system. The credit limit

and other operating conditions are controlled by the company directly. The employee can now make business expenses with his (company) mobile phone and e.g. shop or refuel at the point of sale or in online shops.

The transactions are made directly in the banking application of the company

and all e-billing (including an MCC) are included.

Benefits for corporates

- Cooperation with the main bank instead of a credit card subsystem

- no reconciliation with receipt data (due to e-invoicing)

- direct control and flexible application options

- high security against fraud

SEPA Request to Pay in corporate banking at banks

Many banks offer their corporate customers directly or with partners corporate credit cards. As a rule, the banks then also participate in the income generated (interchange fee), but have little control over this part of the business relationship.

The expenses of company credit cards are usually settled with a delay of several weeks and thus they also have a credit function for the company. This part of the corporate financing is withdrawn from the main bank.

With RTP, banks have the opportunity to regain control and work more closely with their corporate customers. This is particularly true if no company credit card program could be developed or it is not lucrative.

Share