An article by

Andreas Wegmann

Published on

12/11/2020

Updated on

12/11/2020

Reading time

3 min

Table of content

Request to Pay at the POS: How does it work?

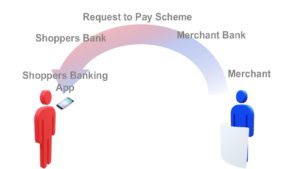

The basic properties of R2P have already been explained here. The consideration here relates to use at the point of sale (shops, restaurants, gas stations, etc.), where R2P opens up enormous potential for cost savings and better convenience.

The process is quite easy:

- Buyer gives his IBAN to the merchant (e.g. via NFC transfer from the mobile phone, manual entry, scan of the bank card or using SEPA proxy lookup)

- Merchant initiates an R2P transaction to his bank (merchant bank)

- The buyer receives the request via his bank on his banking app and confirms it

- the pending payment transaction (SCT Inst) is authorized by the buyer

- the merchant has immediate receipt of the money on his house bank account (not just a confirmation!)

Request to Pay at the POS: When and how can I use it?

The first version of the rule book for Request to Pay will be available in November 2020. Implementation at your own bank, i.e. the dealer’s bank and the buyer’s bank, is decisive for use as a seller or buyer. Since banks are not obliged to offer the R2P function, a change of bank may be necessary. Retail payments in Germany are dominated by the German griocard and cash.

In retail, especially in the food retail sector, the duration of a transaction is very crucial for use. The handling of a R2P transaction might be too time-consuming in a traditional POS check out. With innovative store concepts such as Amazon Go it will be different because the R2P will happen at the moment of registration before entering the store.

Request to Pay at the POS with an invoice?

The message format of R2P provides space for invoice data. A complete integration, however, requires that this information is also transmitted in the subsequent payment process. Furthermore, the payer’s bank must then also process the information, i.e. display it in the account statement. In the case of purchases with many individual items and possibly different VAT rates, this will hardly be feasible. It is more obvious to include a reference number with the message, via which the invoice can then be made available elsewhere.

What are the advantages?

At first glance, you might think that R2P at the POS is just another payment method. In fact, there is one fundamental difference: Authentication and authorization take place in the buyer’s banking app! The buyer does not have to download a new app on his mobile phone or register anywhere.

With POS payments, this brings customers closer to their own bank, in a “familiar environment”. There is no need to deal with cards or their PIN. The approval of the transaction takes place exactly as the account holder is used to from his bank.

Even the retailer does not have to purchase any new equipment or conclude contracts with providers or acquirers, as long as his house bank is R2P capable. The cash register system is connected to the retail bank’s R2P service and supplements (or replaces) the card terminal there. Since there is no need for an intermediary between the retailer and his bank, the money is received directly on the retailer’s house bank account – available immediately. Above all, the retailer saves the card fees (0.2% for girocard, up to 3% for credit cards) and also the costs for a card terminal (€ 20-30 / month).

The entire infrastructure for card payment (card, network operation, card terminal) is therefore becoming obsolete for buyers and retailers.

There is also another important advantage for dealers and customers: amounts of up to € 100,000 can be processed. This means that cars or other expensive goods can now also be sold cashless at the POS without risk.

What does this cost?

The processing fee for the sending bank (merchant bank) is currently 0.0025 €/transaction. The associated payment procedure (usually a SEPA Instant Payments) is in the same range for clearing. The fees for interbank payments are usually quantity dependent, i.e. there may be deviations downwards here.

Much more decisive is the question of what the banks will charge their customers for a Request to Pay transaction. There is of course no specification for this on the part of the scheme, but a market price should be formed. As with card payments, it is to be expected that the buyer will not bear any costs, but that the merchant will be charged a transaction fee.

Share