An article by

Dr. Martin Berger

Published on

24/06/2021

Updated on

21/04/2024

Reading time

6 min

Table of content

A current version of this article can be found here!

Instant SEPA Payments: the status summarized in June 2021

Using public data from the ECB and EBA Clearing, we analyze the status of the participation in Instant SEPA Payments (SCT Inst) by banks and financial institutions (identified by their BIC or BIC bank code), especially from an interbank perspective. The following article illuminates the following status in June 2021:

- Around 24% of all BIC bank codes in the SEPA area are now also connected to SCT Inst.

- Since April 2021, 47 new financial institutions have been registered as SCT Inst participants.

- The linear increase in SCT Inst transaction volume or SCT Inst amount volume based on data from EBA Clearing continues until June 2021.

- The number of TIPS and RT1 participants (measured in BIC bank codes) continues to grow slowly but steadily.

Instant SEPA: the essentials

We explain Instant SEPA Payments in a nutshell in the article SEPA Instant Credit Transfer: Transfers up to € 100K in 10 seconds.

Which data do we evaluate?

Here we evaluate the current status of participation in Instant SEPA Payments with public data from the European Central Bank (ECB) and EBA Clearing (EBA stands for Euro Banking Association) from May 2020 to June 2021. Both institutions regularly publish participant information for Instant SEPA Payments. We specifically analyze which banks participate in SEPA Credit Transfer Instant using which bank identifier code (BIC) or which BIC bank code.

Why the reference exactly to these sources? The ECB and EBA Clearing both offer clearing and settlement mechanisms (CSM) for Instant SEPA Payments and therefore report regularly on their participating institutes. The ECB offers the Target Instant Payment Settlement (TIPS) service for instant payments, while EBA Clearing offers the service called RT1.

Instant SEPA Payments: Comparison of SCT Inst vs. SCT availability in the SEPA area

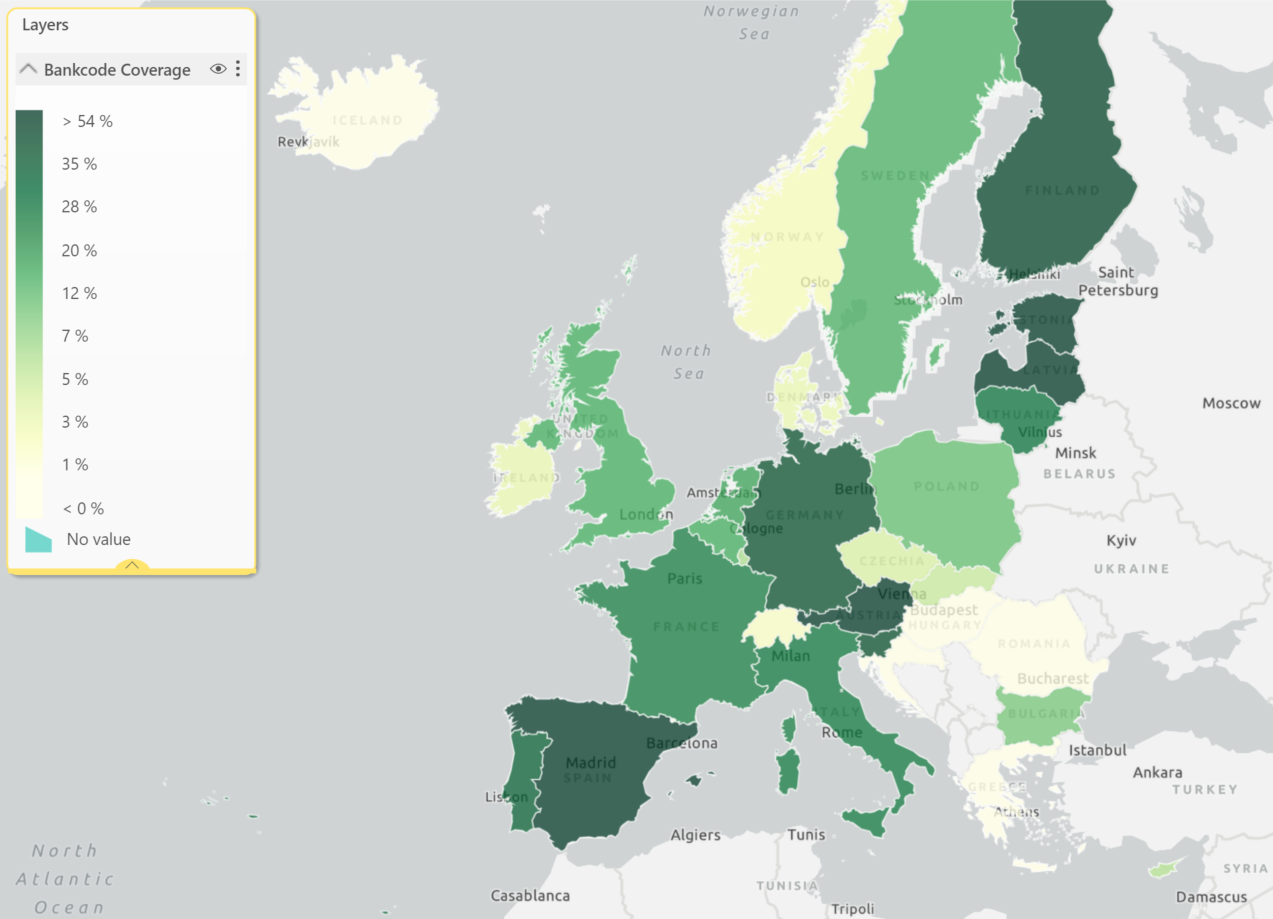

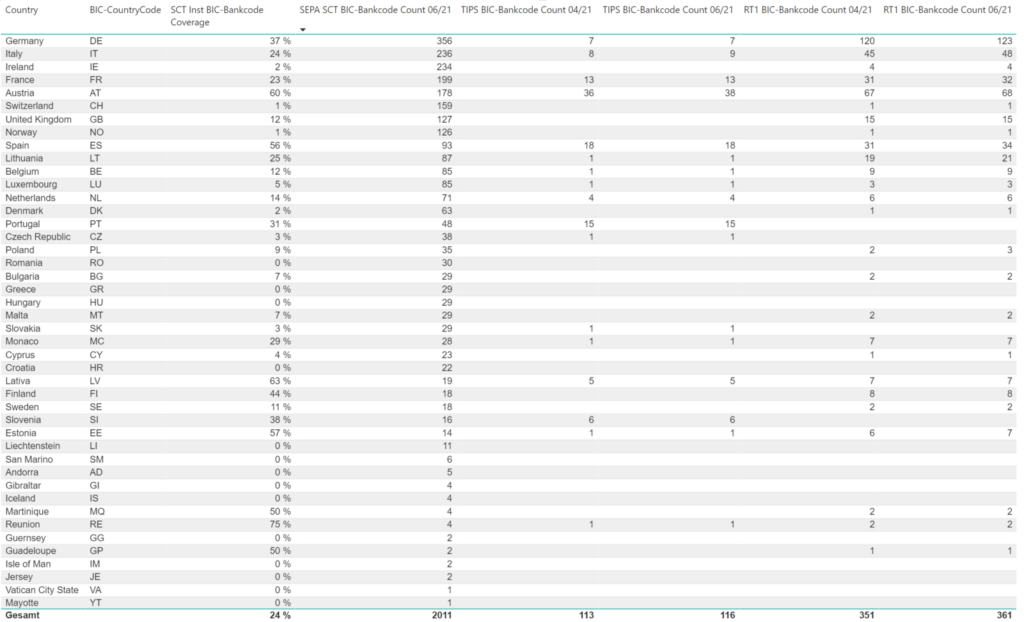

This map of the SEPA area shows the percentage comparison of the number of SCT Instant participating BIC bank codes to the classic SCT participating BIC bank codes.

Based on the data from ECB from June 1st, 2021, from EBA Clearing from June 8th, 2021 and the Bundesbank’s directory of available payment service providers as of June 14th, 2021, the percentage of SCT-participating payment service providers (measured using their BIC bank codes) is analyzed which have also opted for SCT Instant participation in the SEPA countries. The data on which the map is based are listed in the following table:

Percentage comparison of SCT Inst vs. SCT participation of the listed BIC bank codes per SEPA country, their participation in TIPS or RT1 in comparison between April and June 2021.

Instant SEPA Payments: Statistics from ECB and EBA Clearing

Statistics from ECB

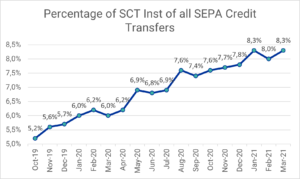

The following graphic illustrates the percentage of Instant SEPA transfers compared to all SEPA transfers that were processed in the months of October 2019 to March 2021. A sustained upward trend can still be seen.

Instant SEPA Payments: Percentage of SCT Inst transfers of all SCT transfers (data source: ECB)

Statistics from EBA Clearing

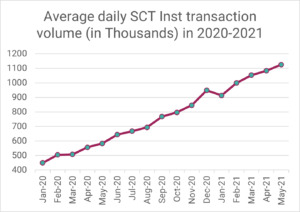

The following figure shows the average daily Instant SEPA Payments transaction volume processed via RT1 from January 2020 to May 2021. An almost linear increasing trend can still be seen here.

SEPA Instant via R1: Average daily SCT Inst transaction volume in 2020-2021 (data source: EBA Clearing)

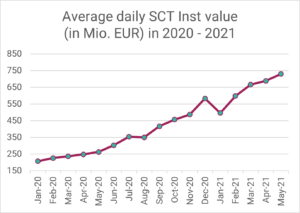

The following figure shows the average daily SEPA Inst volume in EUR million processed via RT1 from January 2020 to May 2021. As expected, a similarly increasing trend can be seen here as well.

SEPA Instant via R1: Average daily SEPA SCT Inst volume in EUR million in 2020-2021 (data source: EBA Clearing)

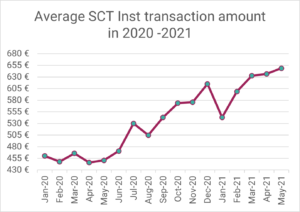

The following figure shows the average transfer amount for Instant SEPA transfers for the period January 2020 to May 2021:

SEPA Instant via R1: Average transfer amount in 2020-2021 (data source: EBA Clearing)

Number of BIC bank code participants in TIPS or RT1

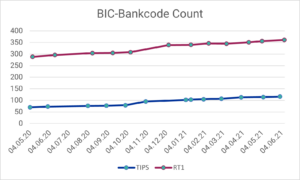

The following figure shows the number of BIC bank codes participating in TIPS or RT1 in the period from May 2020 to June 2021. A slowly increasing trend can still be seen here, even if the increase in the SCT Inst transaction volume (see above) is still evident Adoption of SCT Inst can explain transactions within the participating banks, rather than through more SCT Inst participants per se.

Instant SEPA Payments: Number of BIC bank codes connected to TIPS or RT1 in the period May 2020 – June 2021 (data sources: EZB, EBA Clearing)

New participating banks since April 2021

New TIPS participants since April 2021 are:

| Number | Institute | Type | Country |

|---|---|---|---|

| 1 | RAIFFEISEN LANDESBANK SUEDTIROL AG | TIPS Participant | IT |

| 2 | DEUTSCHE BANK AG | Reachable Party | AT |

| 3 | Raiffeisenbank Althofen – Guttaring, reg.Gen.m.b.H. | Reachable Party | AT |

| 4 | Raiffeisenbank Arnoldstein-Fuernitz eG | Reachable Party | AT |

| 5 | Raiffeisen-Bezirksbank Spittal/Drau, reg.Gen.m.b.H. | Reachable Party | AT |

| 6 | Raiffeisenbank Brueckl-Eberstein-Klein St. Paul-Waisenberg, reg.Gen.m.b.H. | Reachable Party | AT |

| 7 | Raiffeisenbank Bleiburg reg.Gen.m.b.H. | Reachable Party | AT |

| 8 | Raiffeisenbank Eberndorf reg.Gen.m.b.H. | Reachable Party | AT |

| 9 | Raiffeisenbank Lavamuend, reg.Gen.m.b.H. | Reachable Party | AT |

| 10 | Raiffeisenbank Grafenstein-Magdalensberg und Umgebung, reg.Gen.m.b.H. | Reachable Party | AT |

| 11 | Raiffeisenbank Oberdrautal-Weissensee, reg.Gen.m.b.H. | Reachable Party | AT |

| 12 | Raiffeisenbank Huettenberg – Wieting, reg.Gen.m.b.H. | Reachable Party | AT |

| 13 | Raiffeisenbank Koetschach – Mauthen, reg.Gen.m.b.H. | Reachable Party | AT |

| 14 | Raiffeisenbank Landskron – Gegendtal, reg.Gen.m.b.H. | Reachable Party | AT |

| 15 | Raiffeisen Regionalbank Laengsee-Hochosterwitz eGen | Reachable Party | AT |

| 16 | Raiffeisenbank Region Woerthersee eG | Reachable Party | AT |

| 17 | Raiffeisenbank Moosburg-Tigring, reg.Gen.m.b.H. | Reachable Party | AT |

| 18 | Raiffeisen Bank Lurnfeld-Moelltal eGen | Reachable Party | AT |

| 19 | Raiffeisenbank Drautal reg.Gen.m.b.H. | Reachable Party | AT |

| 20 | Raiffeisenbank Nockberge eGen | Reachable Party | AT |

| 21 | Raiffeisenbank Lieser-Maltatal eG | Reachable Party | AT |

| 22 | Raiffeisen-Bezirksbank St. Veit a.d. Glan-Feldkirchen, reg.Gen.m.b.H. | Reachable Party | AT |

| 23 | Raiffeisenbank Millstaettersee eG | Reachable Party | AT |

| 24 | Raiffeisenbank Mittleres Lavanttal eGen | Reachable Party | AT |

| 25 | Raiffeisenbank Rosental, reg.Gen.m.b.H. | Reachable Party | AT |

| 26 | Raiffeisenbank Oberes Lavanttal reg.Gen.m.b.H. | Reachable Party | AT |

| 27 | Raiffeisen Bank Villach reg.Gen.m.b.H. | Reachable Party | AT |

| 28 | Raiffeisenbank St. Paul im Lavanttal eGen | Reachable Party | AT |

| 29 | Raiffeisenbank Friesach-Metnitztal, reg.Gen.m.b.H. | Reachable Party | AT |

| 30 | Raiffeisenbank Ossiacher See, reg.Gen.m.b.H. | Reachable Party | AT |

| 31 | Raiffeisenbank Gurktal, reg.Gen.m.b.H. | Reachable Party | AT |

| 32 | Raiffeisenbank Hermagor, reg.Gen.m.b.H. | Reachable Party | AT |

| 33 | Raiffeisenbank Voelkermarkt, reg.Gen.m.b.H. | Reachable Party | AT |

| 34 | Raiffeisenbank Wernberg, reg.Gen.m.b.H. | Reachable Party | AT |

| 35 | Raiffeisenbank Oberes Moelltal-Oberdrauburg eGen | Reachable Party | AT |

| 36 | Raiffeisenlandesbank Kaernten – Rechenzentrum und Revisionsverband, reg.Gen.m.b.H. | Reachable Party | AT |

New RT1 participants since April 2021 are:

- flatexDEGIRO Bank AG (Germany and Austria)

- AFONE PAIEMENT (Germany, France and Italy)

- inHouse Pay AS (Estonia)

- UNICAJA BANCO, S.A. (Spain)

- CiviBank, Banca di Cividale S.c.p.a. (Italy)

- Banca Passadore & C. S.p.A (Italy)

- UAB NEO Finance (Lithuania)

- SIMPLEX PAYMENT SERVICES UAB (Lithuania)

Weitere Informationen zu Instant SEPA Payments

This article is part of a series on Instant SEPA Payments and builds on these articles:

- SEPA Credit Transfer Instant: Analysis of the adoption in April 2021

- Instant Payment System: News and insights from February 2021

- SEPA Instant Payments: News and insights from December 2020

- Instant Payment: News and insights from October 2020

- SCT Instant Payment: participation analysis within SEPA area (August 2020)

- SEPA Instant Credit Transfer Register of Participants: a data analysis (June 2020)

In the following analyzes, we will observe the monthly changes and further deepen the evaluation of the spread of Instant SEPA Payments in the SEPA area.

Contact

Among other things, we offer a high-performance software solution CPG.instant for processing SCT Inst transfers. If you have any questions, suggestions or are interested in the topic of payment transactions, Instant SEPA Payments and software products, please contact us:

- Telefonisch: +49 (0) 89 6809700

- E-Mail: infocpg@cpg.de

Share