An article by

Dr. Martin Berger

Published on

12/10/2020

Updated on

09/07/2025

Reading time

2 min

Table of content

SEPA Instant Credit Transfer: Shortly explained

SEPA Instant Payments are available as SEPA Instant Credit Transfers (SCT Inst) for several years now and were developed by the European Payments Council. An EU regulation now requires banks to offer this type of transfer to their customers, and it may not be more expensive than a normal SEPA transfer.

The European Union has pushed ahead with the introduction of SEPA Instant Credit Transfers to make payments within Europe more modern, faster, and more efficient. The goal is to enable citizens and businesses to transfer money across borders within seconds – 24/7 all year long. This is intended not only to strengthen the competitiveness of the European single market but also to promote the digital transformation of the financial sector. At the same time, the EU aims to reduce dependence on non-European payment service providers and secure Europe’s financial sovereignty.

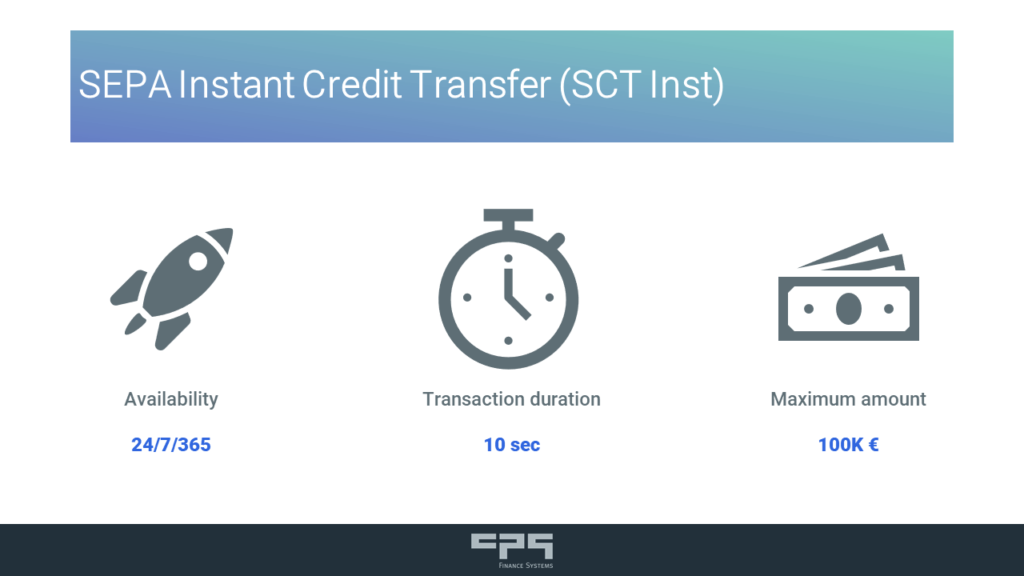

The core characteristics of this ultra-fast SEPA transfer procedure are as follows:

- 10 seconds — the transferred amount should be booked on the recipient’s account within this period. ATTENTION: From October 5, 2025, this period will be reduced to 5 seconds!

- EUR 100,000 — the current maximum limit of the transfer. ATTENTION: From October 5, 2025, this maximum limit will no longer apply!

- 24/7/365 — Availability without downtime.

- In SEPA countries — SCT Instant Payment should be offered in all countries of the SEPA area.

Core characteristics of SEPA instant payments

Clearing of SEPA Instant Credit Transfer

SEPA Instant Payments can currently be processed by financial institutions and payment service providers via two clearing networks:

- The European Central Bank offers the Target Instant Payment Settlement (TIPS) service for this

- The EBA Clearing offers the RT1 service for this

Software solutions for processing SEPA SCT Inst Credit Transfer

Among other things, we offer with CPG.instant a high-performance, tailor-made software solution for processing SCT Inst Credit Transfers, which allow a bank or company to flexibly connect one or more core banking systems or booking systems and to clear SEPA Instant Credit Transfers accordingly via interfaces to TIPS or RT1.

If you have any questions, suggestions or interests about payment transactions for SCT Inst Credit Transfer or about our software products, please do not hesitate to contact us!

Share