An article by

Andreas Wegmann

Published on

22/12/2021

Updated on

23/12/2021

Reading time

4 min

Cashless and contactless payment is more than a trend because of the pandemic. A large number of old and new payment methods are offered to POS merchants. There are two major hurdles in retail: the hardware costs and the fees to use. With so-called “Account to Account Payments”, i.e. a payment directly between two accounts, there are by definition no intermediaries. What is the process like at the POS? A new approach is presented in this article.

The customer’s smartphone as a communication center

When you think of cashless payments, you almost always think of the so-called card terminals. In the meantime, the card has often found its way into the smartphone, but the terminal seems to be indispensable. It communicates with the respective payment system and confirms the authorization of the payment to the merchant. It takes days for the retailer to actually have the money in his business account, and fees are of course deducted.

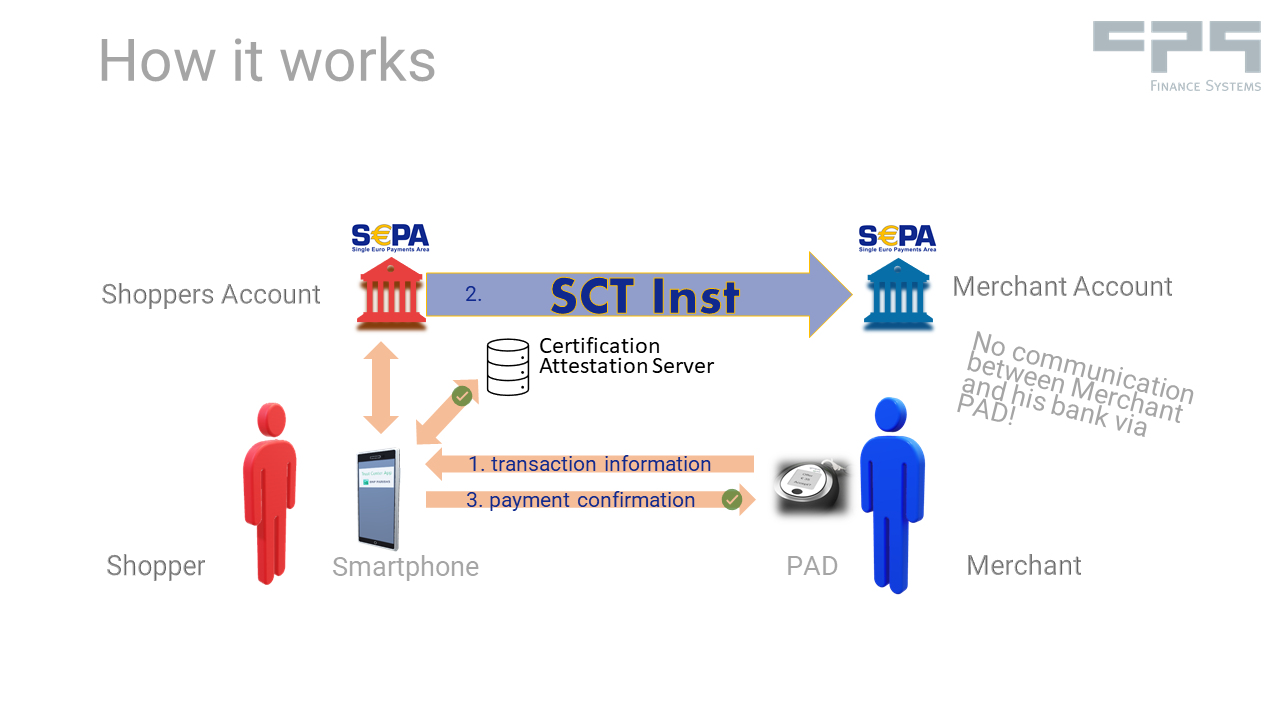

With Account to Account Payments, a card terminal is not necessary if the payment is initiated by the customer on his smartphone. The customer makes a transfer with his banking app on his smartphone.

A mobile app must be loaded so that a smartphone can take over the communication task. When setting up this app, the customer integrates his bank’s online banking using an open banking provider in accordance with PSD2.

Confirmation of receipt of payment at an Account to Account Payment

The dealer can of course only hand over the goods over the counter when he has received his money or can be sure that he will receive it. In the case of Account to Account Payments, this could be done by looking at the online banking system, which is, however, quite cumbersome. In addition, a business owner will hardly give his online banking access to his cashier staff.

The dealer can of course only hand over the goods over the counter when he has received his money or can be sure that he will receive it. In the case of Account to Account Payments, this could be done by looking at the online banking system, which is, however, quite cumbersome. In addition, a business owner will hardly give his online banking access to his cashier staff.

It is much easier if the incoming payment is not checked on the recipient account, but rather the confirmation of the successful transaction from the banking app is used. The prerequisite for this is that this transaction cannot be reversed, i.e. it is final. This confirmation appears where the transaction is initiated: on the buyer’s smartphone.

The payment app on the buyer’s mobile phone sends this information to the retailer’s so-called “Payment Attestation Device” (PAD) in a tamper-proof manner.

SEPA Instant Payments with Account to Account Payments

With SCT Inst there is the ideal basis for account to account payments for POS merchants in the SEPA area. Processing is guaranteed within a few seconds, i.e. the money is then available in the merchant’s account without any deductions and can be used immediately. In addition, the payment is final and free of charge for the merchant (apart from any fees charged by his bank for the posting item).

The upper limit of € 100,000 at SCT Inst offers additional business possibilities. Transactions with large amounts (e.g. in the car trade) can also be carried out quickly, securely and inexpensively.

The new solution for Account to Account Payments

Since the beginning of 2021 there has been a process patented in the EU that enables payment transactions in the manner described above at the point of sale. Instead of a card terminal, the merchant only needs the so-called Payment Attestation Device (PAD) for a one-off amount (> 50 €). With a “tap”, the customer’s smartphone contacts the payment app and receives the amount due. This amount is automatically transferred to the credit transfer form in the banking app. If the customer authorizes the payment and the execution is confirmed by the bank, this information is transmitted to the PAD and displayed there. So the dealer has his money in his account and he can hand over the goods.

Since the beginning of 2021 there has been a process patented in the EU that enables payment transactions in the manner described above at the point of sale. Instead of a card terminal, the merchant only needs the so-called Payment Attestation Device (PAD) for a one-off amount (> 50 €). With a “tap”, the customer’s smartphone contacts the payment app and receives the amount due. This amount is automatically transferred to the credit transfer form in the banking app. If the customer authorizes the payment and the execution is confirmed by the bank, this information is transmitted to the PAD and displayed there. So the dealer has his money in his account and he can hand over the goods.

The security

Even if there is no fee and a high usability, neither merchants nor customers will use a procedure if it is not secure. The question arises less for the customer, as he only uses his own smartphone for the transaction.

Even if there is no fee and a high usability, neither merchants nor customers will use a procedure if it is not secure. The question arises less for the customer, as he only uses his own smartphone for the transaction.

But also the retailer can completely trust the confirmation of the payment by the PAD. The PAD, the customer’s smartphone and the respective transaction are completely fraud-proof thanks to nested certificates. Even if a PAD is stolen, there is no abuse scenario.

If you would like to know more about the procedure described, please use our contact form.

This system is not limited to SEPA account to account payments. More information can be found in our youtube video:

Share