Published on

23/05/2025

Updated on

23/05/2025

Reading time

3 min

The One-Leg Out Instant Credit Transfer (OCT Inst) is a relatively new part of the European Central Bank’s market infrastructure. Put simply, this clearing system allows banks outside the EU to connect to real-time euro payment transactions. In addition to the business model for the banks, there is also an economic benefit: The countries involved promote their trade relations because cost-effective payment transactions in real time enable more efficient business.

Real-time transactions with currency exchange

OCT Inst and SCT Inst (SEPA Instant Credit Transfer) are technically largely comparable. While participation in SCT Inst is reserved for EU countries (incidentally, Denmark is now also connected to TIPS as a non-euro country), OCT Inst is intended to open the door to payment transactions for other countries. The account in the “leg-out” (i.e. the non-EU party) can have any currency.

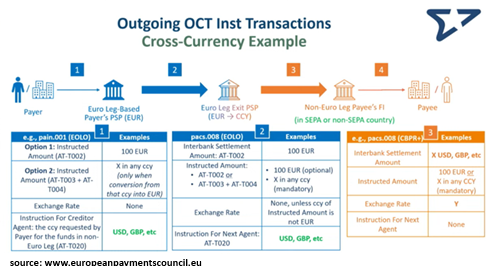

This currency exchange naturally harbours opportunities for profit, but also risks of loss, especially because real-time settlement and 24/7 availability must be guaranteed. In the event of extraordinary events, the calculation for currency trading can change abruptly. The risk for the currency exchange is usually borne by the so-called “Exit PSP” or the “Entry PSP”, i.e. banks that carry out the conversion in the standard case in the transaction chain. The exchange rates and any additional fees must be communicated transparently to the sending and receiving parties. The sender should also be able to decide whether it wants to send a fixed amount in its own currency or whether the recipient should receive a specified amount in the target currency (a limit of €100,000 per transaction applies). Processing is therefore anything but trivial.

Hurdle No.1 for the OCT Inst Participants: Time

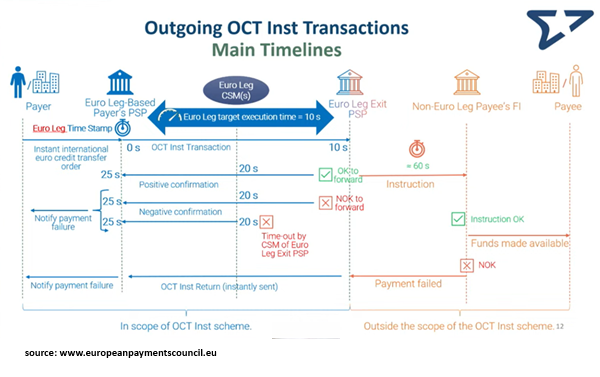

Especially in currency trading, people like to take their time: it is worth exchanging currencies in large amounts because better prices can be achieved and your own margin increases as a result. With OCT Inst, there is no such time because it is a real-time system. Of course, the course of time outside the system boundaries cannot be controlled, but the exit or entry PSP undertakes to ensure that the downstream PSPs also adhere to the time frame. As soon as a transaction is sent from the “leg-in” PSP, a maximum of 20+60=80 seconds may elapse before the recipient bank credits the amount.

Information from the EPC webinar on 20 May 2025

The current activities on the OCT Inst platform were reported on in a 90-minute webinar:

- More than 60 Spanish banks are connected to QCT Inst directly or via Iberpay to improve payment transactions with Brazil. These participants required little effort for their connection, as only a few additions to the SCT Inst connection were necessary.

- There is great interest internationally in becoming a leg-out participant in OCT Inst, but the conditions (real-time system, 24/7, ISO 20022 message format) are usually not yet in place. This also applies to the USA, as a representative of The Clearing House explained.

- Overall, the speakers in the webinar are satisfied with the development of the platform to date and there is a consensus on the great growth opportunities for banks and the economy through OCT Inst.

If you are a financial institution looking for a technical connection to OCT Inst, we look forward to hearing from you.

Share