An article by

Dr. Martin Berger

Published on

02/01/2023

Updated on

02/01/2023

Reading time

7 min

The payment traffic of financial institutions has always been in a constant state of change. In the past five years in particular, innovations and regulatory requirements have prompted banks to redefine and implement decisive structures in payment transactions.

For financial institutions, this has opened up the potential for optimising existing and also new business areas adjacent to payment traffic. However, new and sometimes far-reaching IT projects have had to be tackled, which have not been made easier by external influences such as the pandemic and the tense economic situation. In the following, the main challenges and innovations are discussed and their influence on the operation of a bank is presented.

Digitalisation through cloud banking

Behind the buzzwords “cloud native”, “API first”, “microservices” and many others are new, essential concepts of cloud computing or digitalisation, which pose challenges for the banking sector. They have to replace their proprietary legacy systems from the late 20th century in order to meet today’s higher customer demands, stricter regulation and increasing competition from FinTechs starting out in the “green field”. This project will also require tech know-how to be built up in the face of declining revenues and rising costs.

Scalability, real-time capability, full automation and flexible composition of workflows in transaction processing cannot be realised for legacy systems without costly refactoring with dwindling expertise, and for new solution providers in cloud banking this is no longer even a USP, but only a pure hygiene factor. Processes and technical procedures of payment traffic are often deeply rooted in the old structures of the legacy systems, which is why a gradual introduction is often more complicated than a big bang migration strategy, which, however, also involves risks that need to be weighed up well. Cloud as an operating environment for core banking and payment systems has already gained a small market share, which will also grow, but for many institutions the use for this is only in the conception or implementation phase. Cloud banking and related topics will therefore continue to occupy the banking sector for some years to come.

Harmonisation of payment traffic through ISO 20022

The worldwide changeover of payment traffic messages to ISO 20022 is forcing banks to adapt their entire payment traffic systems. It is not enough to simply convert the message exchange to the new format. Rather, no information must be lost in the storage of transactions, as it must be available for investigation if necessary. In contrast to the old, unstructured message formats, new fields can now be used in ISO 20022, which, for example, allow more information about the parties involved in a transaction. This makes the identification and prosecution of money laundering and terrorist financing much easier.

The large clearing and settlement systems in America and Asia are on the same path as the Eurosystem, but not in lockstep. With the consolidation of the TARGET system, the changeover for the SEPA banks will be forced in March 2023. The two postponements of this project show that many banks – including systemically important banks – have failed in this major IT project at the first or second attempt. The banks’ ability to implement similarly far-reaching IT projects in the future will certainly become more important, as IT innovation cycles are constantly shortening.

Increasing regulatory requirements

The financial industry has always been subject to high regulatory requirements and is also used to a steady increase in regulations. Interbank payment transactions, for example, are also affected by increasing requirements in terms of reporting obligations in payment transactions. Since 2017, BaFin has begun to provide a framework for the technical and organisational equipment of institutions with the “Bankaufsichtliche Anforderungen an die IT” (BAIT). Here, too, it is to be expected that further tightening will follow.

SEPA Instant Payments

The features of SEPA real-time transfers are absolutely convincing for bank customers: SEPA transfers of up to 100,000 € can be transferred or credited within ten seconds, around the clock, all year round. For generations Z and Alpha, who are growing up with these communication features, this is normal behaviour expected today. The introduction of SEPA real-time credit transfers was discussed and praised on all sides, but with a current transfer share of 13.29 percent according to the European Payments Council (EPC, as of November 2022), it can by no means be called the newly established normal. There are many reasons, the first two of which are probably decisive:

- As a new transfer type, the real-time transfer is still priced with high fees and is therefore only used by customers for particularly urgent payments.

- Optional participation means a challenging IT project for a bank and possibly only the cannibalisation of the business field, for which the normal SEPA credit transfer has been established so far.

- Real-time payments require more liquidity in clearing, as “second-by-second peak debits must also be covered (with conventional credit transfers, net settlement takes place at the end of the day).

- The additional transaction type must be clearly presented to the account holders in the GUI and, if necessary, also explained.

- There is a lack of competitive pressure, as account holders hardly ask for the new transaction type or even threaten to change banks because of it.

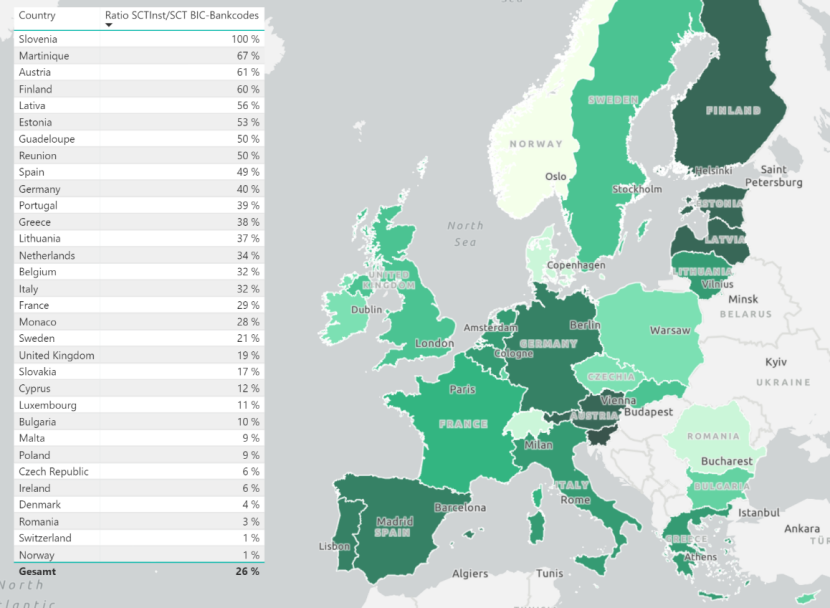

Figure 1: SEPA countries and their percentage of SCT participants also participating in SEPA Instant (generated with Microsoft Power BI on esri map material)

A detailed data analysis of the participating banks conducted by CPG Finance Systems, based on regular participant publications by the European Central Bank and EBA Clearing, shows that as many as 26 per cent (measured by unique BIC bank codes) of SEPA SCT participants can also execute real-time transfers. Figure 1 shows how this penetration will look in the SEPA area in October 2022. From this perspective, it can be interpreted that bank customers still tend to use the standard SEPA credit transfer (presumably due to ignorance or cost reasons), as the percentage of participants is higher at 26 percent than the transactional share of 13.26 percent. The reason for this may also be that financial institutions with a below-average volume share of all SEPA credit transfers are already participating in SEPA Instant today, for example in order to occupy unique selling points here as niche providers.

To address, among other things, the slow implementation of SEPA real-time credit transfers, the EU Commission adopted a new legislative proposal at the end of October 2022 to ensure that SEPA real-time credit transfers can be processed affordably, securely and unhindered throughout the EU. The proposal amends the 2012 Single Euro Payments Area (SEPA) Regulation and sets four key requirements for SEPA real-time credit transfers:

- Make SEPA real-time credit transfers universally available, with an obligation for EU payment service providers that already offer SEPA credit transfers to also offer SEPA instant within a certain timeframe.

- Make SEPA real-time credit transfers affordable, with an obligation for payment service providers to ensure that the price of SEPA real-time credit transfers does not exceed the price of traditional credit transfers.

- Increase trust in SEPA real-time credit transfers by requiring providers to check the match between the IBAN and the beneficiary’s name provided by the payer to alert payers to a possible error or fraud before the payment is made.

- Eliminate friction in the processing of SEPA real-time credit transfers while maintaining the effectiveness of the verification of persons subject to EU sanctions. Establish a process whereby payment service providers check their customers against EU sanctions lists at least daily, rather than checking all transactions individually.

This draft law alone will certainly significantly increase the pressure on banks to deal with SEPA real-time credit transfers and their implementation in a timely manner.

SEPA Request-to-Pay

In June 2020, the EPC manifested the so-called Scheme Rulebook for SEPA Request-to-Pay (SRTP), which came into force in June 2021. This SEPA Request-to-Pay is intended to increase the convenience, security and automation possibilities for all parties involved when paying in-store or online for shoppers, merchants and their financial institutions. It is obvious that with SRTP the EU wants to counter the dominance of non-EU payment providers such as PayPal.

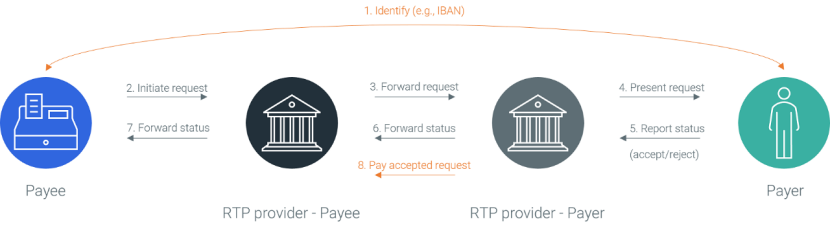

The basic request-response process flow looks like this (Fig. 2):

- Step 1: Identification of the buyer at the merchant, e.g. by IBAN (not defined by the SRTP Rulebook).

- Step 2-4: Transmission of the payment request to the buyer via the merchant’s or buyer’s bank.

- Step 5-7: Transmission of the buyer’s approval or rejection as a response via the same process chain.

- Step 8: In the case of approval, the acquiring bank also triggers a SEPA transaction agreed with the acquirer (not defined by the SRTP Rulebook).

The main features of SRTP are:

- This type of payment request leads directly to a so-called account-to-account SEPA payment between the financial institutions of the buyer and the merchant (e.g. as SCT, SCTInst or SDD) and is not dependent on further intermediaries.

- Request and authorisation for payment takes place directly in the context of the buyer’s familiar banking authorisation, no additional authentication or authorisation steps in other apps or on card readers are required.

- The message exchange is structured according to ISO 20022 and allows, among other things, billing information to be included. The buyer can receive the payment together with the invoice, the merchant and his bank can automate or optimise payment processes and related banking services such as factoring/dunning.

For all four actors involved, there are advantages in terms of convenience, security and automation possibilities, whereby in our opinion the incentives for the buyer bank are certainly the weakest and the implementation costs the highest. However, this player is crucial for a B2C adaptation. If one observes the published announcements on planned implementations, it becomes apparent that first movers are first to be expected in the B2B sector. In November 2022, the EPC lists just two SRTP participants in the SEPA area.

The potential for SRTP is definitely compelling: the banks can counter other payment enablers and become more involved in payment again; the merchants can leverage optimisation potential in process automation; the buyers will join in if payment becomes more convenient and secure for them. However, it remains to be seen how this young initiative will develop in the coming years.

Digital Euro and Central Bank Currencies

In July 2021, the ECB started the investigation phase for a digital Euro and the introduction of the Central Bank digital Currency (CBDC) is more than likely. The exact form of the digital euro is not yet foreseeable in many places, but banks must already build up internal know-how and examine the possible scenarios and their impact on their own business activities. On the one hand, new business areas may emerge, but existing business may also suffer from a CBDC.

Summary

The challenges for financial institutions in interbank payments are manifold and complex, especially due to their interconnectedness. Nevertheless, due to the IS0 20022 harmonisation, the setting of new standards such as SEPA real-time transfers and the increasing use of modern technology architectures in the cloud, the industry as a whole is moving in a direction that equips it for new issues and for a stable but also flexible payment processing of the future. The importance of a good IT strategy and its successful implementation will continue to increase.

This article was published on 19.12.2022 by GI (https://www.geldinstitute.de/).

If you have further questions, please use our contact form.

Share