An article by

Andreas Wegmann

Published on

23/10/2023

Updated on

23/10/2023

Reading time

2 min

CESOP stands for Central Electronic System of Payment Information and is a new system that will be introduced in the European Union from 2024. CESOP is intended to help better combat VAT fraud, especially in the area of cross-border e-commerce.

How does CESOP work?

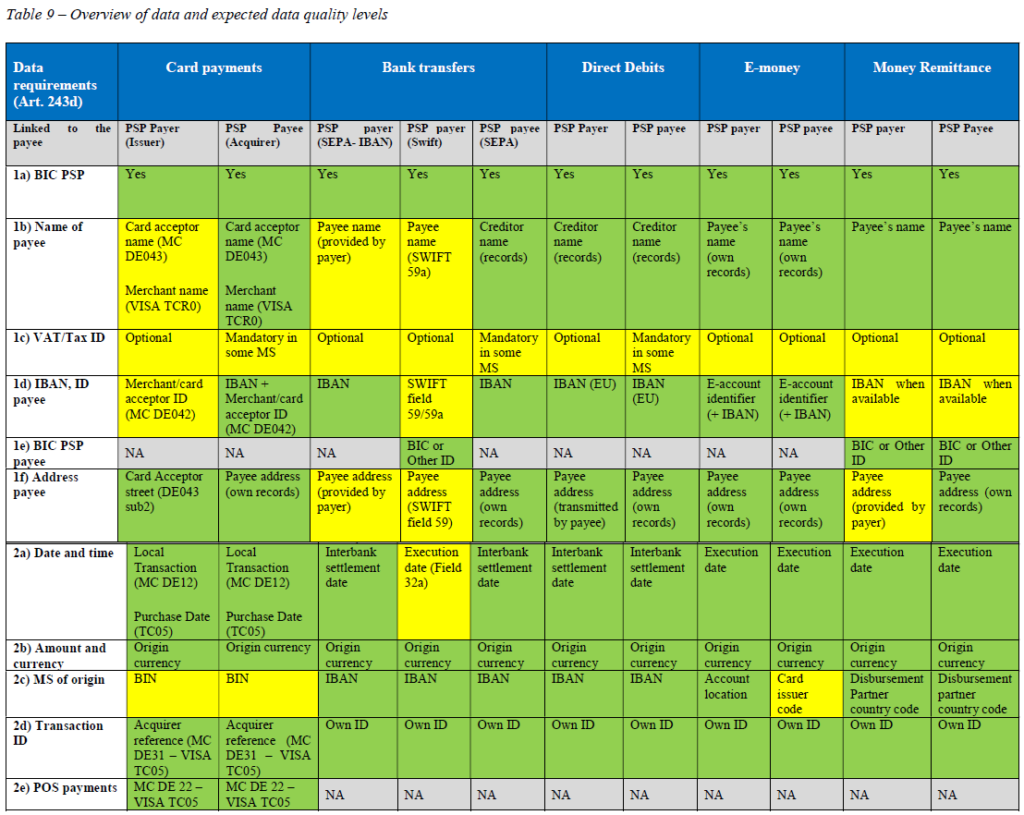

CESOP is based on the collection and transmission of payment information by payment service providers (PSPs) involved in cross-border payments. The CSPs include banks, electronic money institutions and other regulated payment institutions. The PSP must record and transmit the following data to the competent national authorities:

- the identification number of the PSP

- the identification number of the payer

- the identification number of the payee

- the date and time of the payment

- the amount and currency of the payment

- the purpose of the payment

- the type of payment (e.g. credit card, bank transfer, etc.)

Source: EU Commission

The national authorities then forward this data to a central electronic system managed by the European Commission. This system enables the exchange of information between Member States and facilitates the control and verification of cross-border transactions.

Which are the reportable transactions?

CESOP reportable transactions are all cross-border payments (within and outside the EU) provided by payment service providers as defined in the Payment Service Directive (PSD2) if they make more than 25 payments to the same payee in a calendar quarter. A payment is also considered cross-border if the payee is resident in the country but uses a payment service provider abroad (with a foreign BIC).

As a rule of thumb, the payee’s bank is required to report and a payment is therefore not reported twice.

A special requirement are payments made to non-EU countries, e.g. the UK or the USA: here, the payment service provider must report the recipient, even though the recipient is not its own customer.

The reverse case of incoming payments from non-EU countries, on the other hand, does not have to be reported, as there can be no VAT fraud for the EU in this case.

As mentioned in a previous post on CESOP, the payment service provider needs to perform its analysis across different payment types.

Why is CESOP important?

CESOP aims to help reduce VAT fraud, which damages public finances and fair competition in the EU. In particular, CESOP aims to combat so-called carousel fraud, where goods or services are traded several times between different countries without the corresponding VAT being paid.

CESOP also aims to improve cooperation between Member States and reduce the administrative burden on the PSPs. By harmonising reporting obligations, CESOP aims to promote a single internal market for payment services and increase legal certainty for all parties involved.

Helpful links:

Share