Published on

29/04/2025

Updated on

29/04/2025

Reading time

4 min

By October 2025, banks in the eurozone will have to make real-time payments (SEPA Instant Payments – SCT Inst) available to their customers and may not charge any additional fees*.

This payment infrastructure can also be used for payments in shops (Point of Sale or Point of Interaction – POI) and this will have a major impact on the market for POI payment systems. Read more in this article.

The feeling of real time when paying at the POI

If you don’t pay much attention to cashless payments, you won’t find anything special about “real time” and 24/7 availability. With every card payment at home and abroad or when paying with wallet solutions such as PayPal, for example, there is an immediate confirmation. It feels like a payment in real time, but it is only a confirmation and not a payment for the point of acceptance (i.e. merchant) to the house bank account. It often takes days before a merchant can actually dispose of the transaction amount.

SCT Inst, on the other hand, is a real movement of bank money in real time between two euro accounts. The recipient can dispose of the amount the next moment and does not have to pay any extra fees.

The current account and its cards

The core of banking services is a current account from which payments can be sent or received. In order to enable its own customers to make cashless payments at POIs, e.g. in a supermarket, the bank must conclude an agreement with a card company. Customers receive a card with which they can make payments at a merchant’s card readers.

The complex systems for tamper-proof processing have to be financed and card organisations are private companies with a profit motive. The cardholder generally has no costs for a transaction, but the merchant receives transaction fees and a so-called discount deducted from the turnover. Ultimately, a merchant has to pass these costs on to its prices and so consumers end up paying for any payment system, even if very few people realise this.

SCT Inst POI – a new payment system?

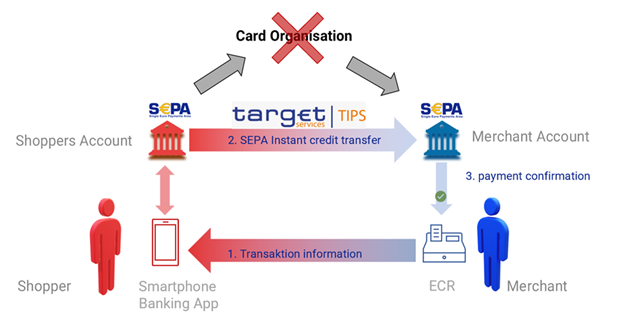

With SCT Inst and mandatory participation for SEPA banks, the EU has not created a genuine POI payment system, but in many cases it can be used as such.

Every consumer and every company can use the new option as a sender and recipient because the only requirement is a SEPA bank account.

The costs for the banks to execute an SCT transaction are incredibly favourable: apart from low annual fees, a single transaction costs EUR 0.001 (for both the recipient and sender bank).

However, beyond payment processing (clearing and settlement), politicians and the ECB have not bothered, so executing a payment is currently not convenient.

With SCT Inst, the payee must provide the payer with their payment details (IBAN, amount) and the payer must then initiate the real-time transfer in their banking app, for example. Nobody wants to type in an IBAN, so from the user’s point of view there is apparently a lack of user-friendliness.

SCT Inst: Solution with gaps or room for innovation?

Fortunately, almost all banking apps can already read the so-called giro code. The EPC specified a QR code format many years ago to enable error-free optical transmission of transfer data.

The giro code is used at the POI to optically transmit the seller’s bank details (IBAN, account holder, payment amount) to the buyer. The buyer scans the Griocode with his (!) banking app and the data is transferred to a bank transfer. No new app or registration is required!

Once the payer has scanned the Griocode and authorised it as a real-time transfer, the incoming payment appears in the recipient’s banking app or online banking after a few seconds.

Many banking apps have a message function for incoming transactions (depending on the bank, this may be called a transaction alert, account alarm, account alert or similar). If this is activated in the banking app, the confirmation of the incoming payment appears as a push message on the smartphone, i.e. the banking app does not have to be opened first.

Payments at POI for SME and Corporates

If employees of a company are to accept cashless payments, they cannot be granted access to the company’s online banking system. The confirmation of the incoming payment must be sent as a push message, e.g. to a cash register system (Electronic Cash Register ECR).

Such an SCT Inst-capable POS system should also be able to execute the cancellation function as a transfer in online banking (return transfer via SCT Inst).

Of course, the confirmations can also be converted into an SMS, WhatsApp or e-mail if the application scenario requires it. Automated telephone calls or fax messages to a dedicated workstation would also be conceivable for public authorities or in the healthcare sector, so that cashless payments can be made with little effort in a less digitalised environment.

SCT Inst can therefore be used as a payment system in many places, is unrivalled in terms of cost and the number of potential users is enormous. Existing gaps, e.g. in the creation of giro codes or the transmission of payment confirmations, are comparatively minor hurdles compared to the technical complexity of a card reader. Nevertheless, SCT Inst will not be able to completely replace cash or cards because not everyone wants to or is able to use smartphones (accessibility!).

If you are a financial services provider looking for a solution for payment with SCT Inst at the POI, we look forward to hearing from you.

Share