An article by

Andreas Wegmann & AI friends

Published on

28/05/2025

Updated on

28/05/2025

Reading time

2 min

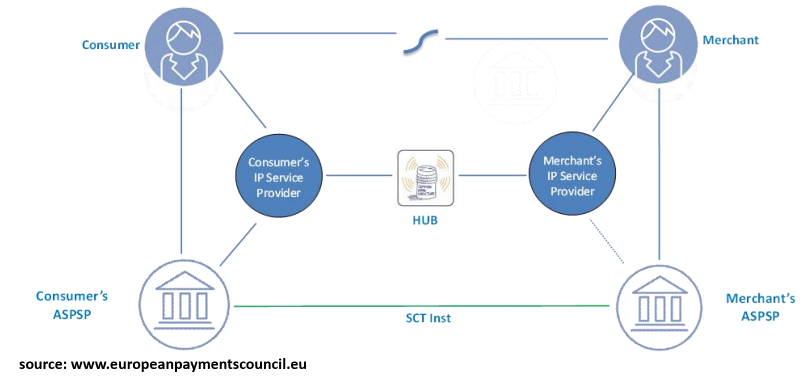

Many people no longer want to carry cash around with them, but in some situations it doesn’t seem to work without “cash” because card terminals are too expensive. From October, banks are obliged to offer their customers SEPA instant payments (SCT Inst) for both sending and receiving. This opens up new possibilities at the point of interaction (POI), as SCT Inst POI does not require an expensive card terminal.

Regulatory basis of SCT Inst POI

The SCT Inst Rulebook is the basis for real-time payments in the EU, but payment service providers are only obliged to make these available to their customers with the EU Commission Regulation (EU) 2023/1113. Although the so-called PSD2 (Second Payment Services Directive, EU Directive 2015/2366) is also relevant in SEPA payment transactions, nothing is regulated with regard to use at the POI.

The fact that the EPC is aiming to use real-time payments at the POI can be seen, among other things, from the initiative of a standardised QR code at the POI. Open banking providers are still being considered for a technical bridge.

Misconception: I don’t pay for paying

Everything that stands between a sending and receiving SEPA payment account costs money: card schemes, wallets, open banking providers or new payment schemes such as Wero all have to generate a return for their shareholders. The fees charged by these companies end up exclusively with the point of acceptance (i.e. the merchant), so that the payer (i.e. the customer) is convinced that it costs them nothing.

This widespread fallacy ignores the fact that the only source of income for a merchant is the customer. Costs for payment systems must always be passed on to the price and are therefore always paid by the customer. From an economic point of view, consumer prices can therefore be reduced if cashless payment becomes cheaper.

The good news: SCT Inst POI is already available today!

SEPA real-time payments will be possible between all approx. 450 million SEPA bank accounts from October 2025 and many of them already are. The modern person is equipped with a smartphone and also has a banking app on it. Almost all banking apps offer the option of processing an EPC-compliant QR code (often called a girocode in Germany).

If a merchant wants to receive a payment, all he has to do is present the girocode. If there is no modern POS system that supports this function, this can also be done via a mobile app:

Example of an app for generating a giro code:

If the “Kontowecker” function is activated in your own banking app (comparable functions are available in all good banking apps), the merchant even receives a push notification.

SCT Inst POI is therefore easy and convenient to use for SEPA account holders with a banking app.

If you are a bank or company interested in SEPA Instant Payments solutions, we look forward to hearing from you.

Share