An article by

Andreas Wegmann

Published on

05/02/2026

Updated on

05/02/2026

Reading time

2 min

Expansion of the SEPA area (May 2026)

The EPC Board has decided to admit Serbia to the SEPA area, but this does not mean that Serbia is joining the monetary union! The Serbian dinar remains the legal tender for all domestic transactions, taxes and salaries within Serbia. Joining SEPA primarily serves as a tool to reduce the high fees for international transfers (especially for remittances from migrant workers in the EU) and to link the economy more closely to the EU single market.

The EPC Board has decided to admit Serbia to the SEPA area, but this does not mean that Serbia is joining the monetary union! The Serbian dinar remains the legal tender for all domestic transactions, taxes and salaries within Serbia. Joining SEPA primarily serves as a tool to reduce the high fees for international transfers (especially for remittances from migrant workers in the EU) and to link the economy more closely to the EU single market.

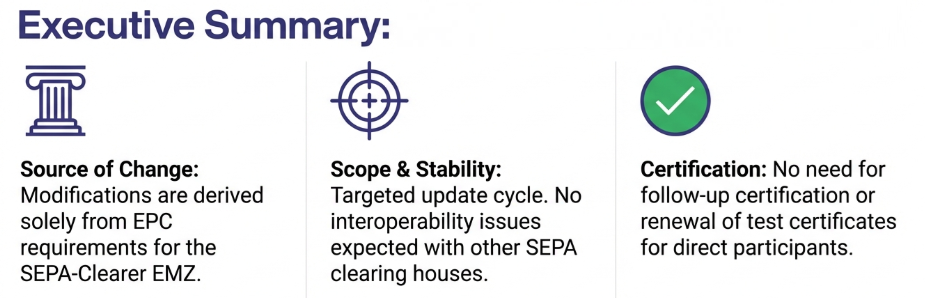

The operational connection (Operational Readiness Date) is planned for May 2026. No new version of the EPC Rulebooks is planned for implementation, as the existing documents already contain the relevant requirements.

SEPA institutions must adapt the SEPA country list, IBAN validation table, sanctions and embargo checks in good time, as well as customer terms and conditions, price and service lists and product descriptions.

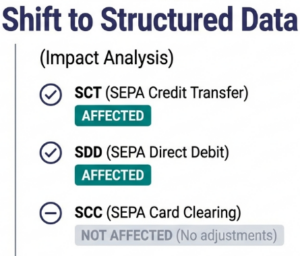

Prohibition of unstructured address data at the SEPA clearer

The most significant technical change will come into effect on 16 November 2026: from this business day onwards, unstructured address details for payers and payees will no longer be permitted in payment transactions.

The most significant technical change will come into effect on 16 November 2026: from this business day onwards, unstructured address details for payers and payees will no longer be permitted in payment transactions.Transactions will be checked by the SEPA clearer and, if necessary, rejected with error code XT33. This requirement applies to SEPA credit transfers (SCT) and direct debits (SDD).

Transitional arrangement: For R messages (e.g. returns) relating to original transactions prior to the cut-off date (15 November 2026), there will be a 13-month phase during which unstructured data will continue to be accepted.

Unchanged

Share