Published on

10/06/2025

Updated on

10/06/2025

Reading time

4 min

Cashless payment is now spreading even in cash-loving Germany. Numerous companies offer various solutions to win over small businesses as customers who are still sceptical about the effort and costs involved. The lowest end of the technical possibilities is a static QR code at the point of interaction (aka point of sale). Few people realise that a QR POI solution is also possible between SEPA bank accounts without additional providers.

The QR POI Principle

Unlike with card terminals, with a QR POI solution the retailer does not trigger the collection of the transaction amount with a card terminal, but receives the payment without any action on their part. The payer (= customer) only needs to know where to send the payment and that is precisely what the static QR code is for: it contains the recipient data for optical transmission. A merchant (payee) is completely passive, i.e. they do not have to agree or accept. The system simply informs them that payment has been received and they can then hand over the goods. With this simple principle, Alipay and WeChat Pay have popularised cashless payments in China since 2014 and dominate this market.

Merchants and customers must each have an account with these wallet systems and the merchant must also pay a fee for the transactions, but the system does not require cards and the associated card terminals and is therefore significantly more cost-effective.

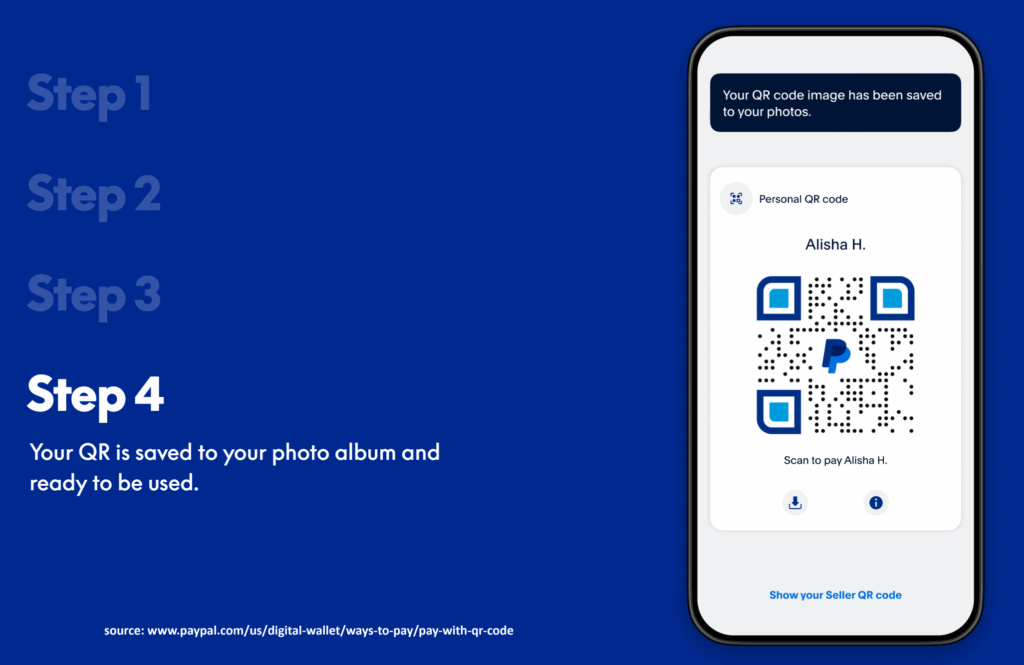

PayPal QR POI

PayPal copied this principle in 2020. Stationary merchants can use a static QR code to receive payments on their PayPal business account without a card terminal. The customer must have a PayPal account and a 2.29% discount and 9 cent transaction costs are charged (as of October 2025). With around 32 million active users in Germany, coverage appears to be reasonable and a further 400 million or so foreign PayPal users are also potential customers.

Waiting for Wero

The European company Wero is also planning to offer a QR POI solution, although this is still at the trial stage. Wero is in the process of expanding its network of participating banks and, according to experts, the discount will be well below the 1% threshold. Wero offers the advantage that the merchant receives the money directly into his bank account. With PayPal, you first have to wait for the payout before you can use a credit balance outside the PayPal world.

With Wero, both parties must also have an account with a bank that has implemented the system. Wero’s biggest weakness at the moment is its limited distribution.

QR POI without additional fees with SEPA Instant Payments

From October 2025, real-time payments will be mandatory for banks in the eurozone. All of the approximately 350 million accounts in the euro countries will then be able to send payments to each other in real time without being charged any additional costs. Unlike Wero or PayPal, there are no additional “rules” or fees because everything is based on the functionality and account model of the house bank account. Incoming credit is available immediately and there is no limit on the amount.

All relevant mobile banking apps can read the EPC-compliant QR code, so almost all Euro account holders are able to pay at the POI in this way.

How do you get an EPC-compliant QR code?

There are various free tools on the Internet that convert your own bank details into a QR code. Once a code has been generated, it can be saved in the smartphone’s image gallery or printed out.

The iOS voice assistant Siri also supports the EPC QR code format from iOS 16. With a little technical skill, the QR code function can be configured as a voice command and is then conveniently available.

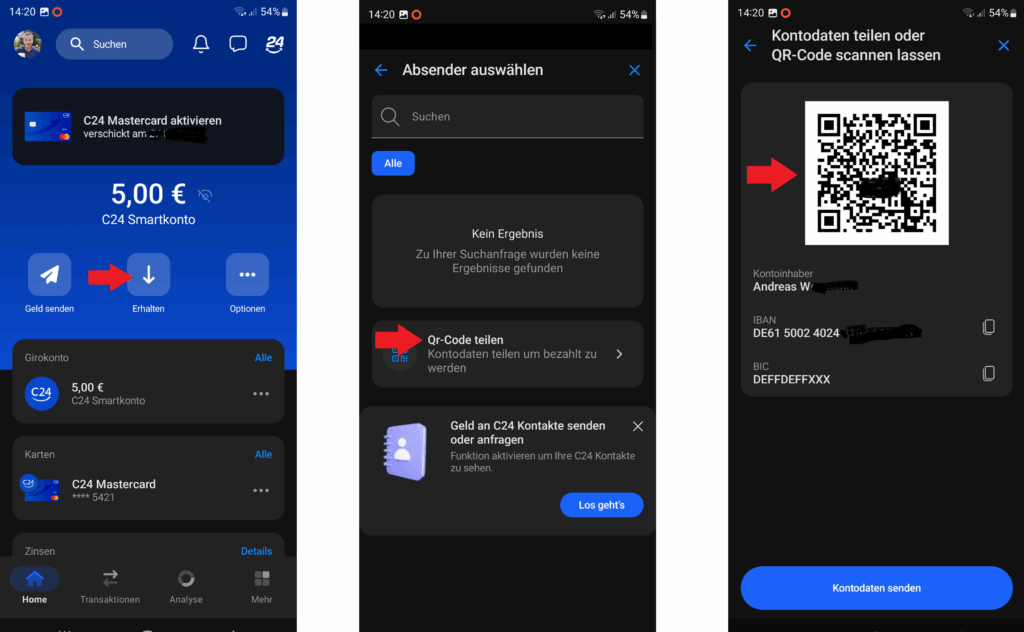

Some banks (such as C24 Bank in the illustration below) offer the option of generating a QR code with your own BIC and IBAN.

Retailers can therefore offer a cashless payment solution quickly, easily and cost-effectively. The merchant’s own bank app informs them when a payment has been received. Many banks offer a notification function in the app so that the banking app does not need to be open.

So there’s nothing better than using your own existing bank details for QR POI!

If you are a company or financial institution interested in SEPA payment solutions, we look forward to hearing from you.

Share